State of Retention 2025

The best insights for voluntary and involuntary churn behavior at scale.

Here for the insights? Sign up for the solutions.

That includes:

- 15 million subscriptions

- 3 million cancellation sessions

- 6 million failed payments

- $250m of revenue recovered by Churnkey

You'll get insights around:

- Why customers cancel

- How customers feel when they leave

- Why card payments fail

- And what you can do about all of it

Table of Contents

A

Introduction

- The two types of churn

- 2024 churn trends

B

Cancellation trends

- Three million cancellation sessions

- Retention offer effectiveness

C

Failed payment trends

- Why payments fail

- How to deal with failed payments

- How payments are recovered

- How failed payments differ across the world

D

Conclusions

- How much does improving retention and lowering churn even matter?

Introduction

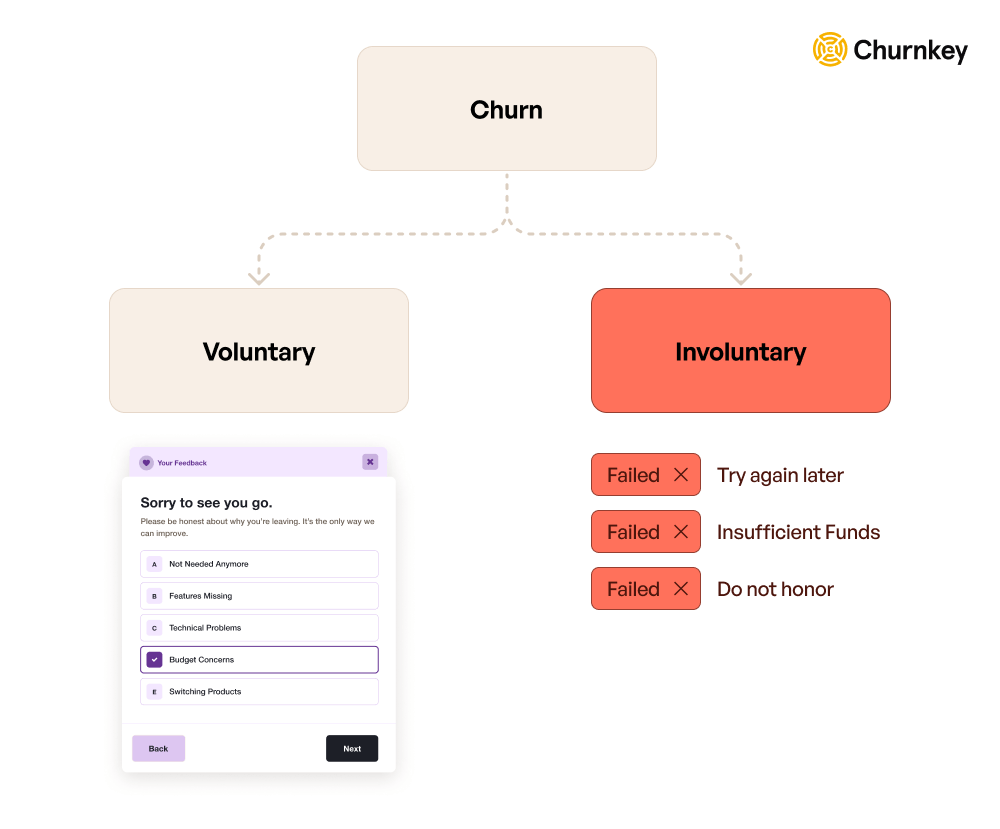

The two types of churn

Let's start with a primer on the basics. Churn has two parts: involuntary and voluntary. While voluntary churn gets more attention—since it's comprised of painful subscription cancellations— involuntary churn is often overlooked because it's more low key and fails quietly in the background.

When a subscription is cancelled because the payment failed, this is considered involuntary churn. Involuntary churn can easily comprise 40% of your churn, if not more, depending on the nature of your business.

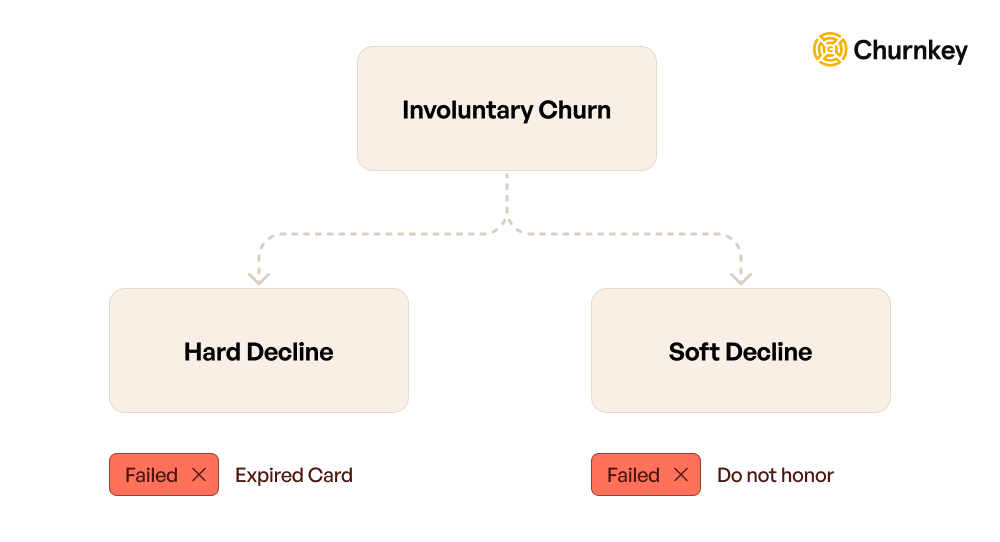

Within involuntary churn, there's more nuance: soft and hard credit card declines.

- Soft declines are temporary issues (e.g., insufficient funds, credit limit exceeded) that can be resolved primarily with card retries, requesting a backup card, in-app payment collection walls, and dunning recovery campaigns across email and SMS.

- Hard declines are permanent issues (e.g., stolen cards, business closures) that require customer intervention via recovery (or dunning) campaigns and in-app payment collection walls. Automated card retries are not allowed for hard card declines, and card issuers will penalize businesses who attempt to retry hard declines.

Declines in general can be notoriously difficult to understand, since banks use antiquated numerical codes further grouped into umbrella labels. Check out our comprehensive guides on Decline Codes for more detail.

How did churn trend in 2024?

For over a thousand companies spread across the globe, voluntary churn (orange line) generally hovered around 7%, while involuntary churn (red line) centered around 1%. Overall churn hovered near 10% throughout the year, increasing to higher levels in the waning months of 2024.

But churn rates are deceiving. Even a seemingly low monthly churn rate of 5% results in losing nearly half (46%) of one's customers annually.

Monthly churn rates above 10% lead to annual churn rates over 70%, which would be catastrophic for most businesses.

Why? At these rates, you're effectively replacing your entire customer base each year.

Monthly Churn Rate vs. Annual Churn Rate

Insight

Once you've got customers hooked, many people stop there. But it's a mistake. Keeping paying customers long-term usually requires active defence against churn. And this matters. It's far cheaper to keep existing customers than to acquire new ones."

Aakash Gupta, author of Product Growth and ex-VP of Product at Apollo.io, from his Ultimate Retention Guide

Cancellation trends

What you can learn from three million cancellation sessions

After analyzing nearly three million cancellation sessions, hundreds of thousands of customer-centric offers, and saving nearly two million subscriptions from cancellation, we noticed a number of clear trends from the past year.

What we discovered can help you build better products, uncover opportunities for improved pricing, and refine your ideal customer if your churn looks like it's out of control.

Why customers cancel

To our surprise, our data shows that customers seem to be generally satisfied with the product to which they're subscribed. Cancellations are driven primarily by practical factors like budget and usage frequency.

But upon further investigation, that's not the entire picture.

Budget limitations

Budget limitations remained the leading cause of voluntary churn at 33%. But after analyzing millions of freeform follow-up questions, so-called "budget limitations" can frequently be used as a repository for product frustration, disillusionment, or bad experiences. Targeting price has historically been the easiest ways for customers to express dissatisfaction, since it's the easiest topic to surface.

If your cancellation survey is flooded with budget concerns, it might be worth experimenting with your pricing and feature mix. Budget limitations also indicate a perceived value mismatch and can signal issues with product/market fit.

Infrequent usage

Infrequent usage remains the second-highest cancellation reason. We see 3% more users citing infrequent usage as a reason for churn in 2024 compared to last year. These typically occur in businesses with seasonality, low switching costs, or an on-and-off use case. Offering pauses, discounts, and "lite" versions of your plans are effective mitigation strategies.

Unmet expectations

Cancellations due to unmet expectations point to potential misalignment between your product's promise and its delivery.

This can stem from:

- Overpromised features: Users expect capabilities that don't align with the product.

- Underutilized features: Customers may not fully understand the product due to poor onboarding or lack of feature visibility.

Alternative solutions

While slightly declining as a cited cancellation reason, "alternative solutions" still remained slightly higher than 4%, flagging competition as a persistent churn vector. Churn to competitors suggests gaps in differentiation. Analyzing competitors' offerings and improving your unique value proposition relative to theirs can make you overperform in this area.

How customers react to various voluntary retention methods

Discounts

Discounts accounted for 53% of all acceptance offers and are the most widely-accepted offer among customers. Our customers leverage a variety of discount strategies:

- one-time discounts

- coupon for a fixed period, such as "20% off for 3 months"

- or, in rare cases, lifetime discounts

Insight

What does this mean for discount offers?

If customers say they're facing budget constraints, it might be tempting to race to zero on price if your margins support it. But for many businesses, this isn't a sustainable tactic and, in the long run, can cheapen your product. We recommend rolling out reasonably-sized one-time discounts first, then gradually increasing in generosity if offer acceptance is low. Ultimately, we believe you should think of discounts as a journey to achieving price equilibrium between your product and what people are ultimately wiling to pay.

Strategic discounting is another key tactic. Tailoring offers based on customer segments—such as early vs. late churners or trialing vs. active customers—can reduce revenue churn.

Strategic discounting can help you achieve stronger pricing alignment. By tailoring offers to unique customer segments, you can tie price sensitivity and elasticity to discrete aspects of your customer base. Track how these segments respond to various discounts and research the feedback they're leaving. It may help you come up with new feature-pricing mixes that improve both adoption and retention.

Pauses

Pauses are also quite popular, with a 19% acceptance rate across all cancellation sessions. Offering customers the option to pause their subscription—rather than cancelling outright—is a fantastic opportunity to retain a customer.

Most businesses have an off-season when customers tend to cancel their subscriptions to save money. For example, event management software may see lower demand during the off-wedding season.

If a product has an on-and-off use case, such as a photo asset library, customers might cancel and renew whenever they have a project to complete.

Companies with lower AOVs—serving B2C customers—or with lower switching costs would also benefit from offering a pause option instead of a direct cancellation or discount offers.

From our research, a significant number of customers prefer to pause/unpause to avoid the hassle of re-entering card details. When asked to cancel without a pause option, some may never return and instead switch to a competitor because they feel like they're being put through unnecessary hassle.

Resources

How To Encourage SaaS Customers To Pause Their Subscriptions (Instead of Cancelling) - If you have a lot of 'one-time use' cancellations, offer the ability to pause the subscription. Churnkey's blog offers a lot more detail on the pausing tactic.

How to Improve Voluntary Churn by Elena Verna, Head of Growth & Data at Dropbox and PLG Advisor.

Pauses can be structured in different ways.

You can set a maximum duration—one month, three months, or more—that customers are allowed to pause. Longer pauses increase the risk of customers forgetting about their subscription, leading to disputes. They also leave revenue on the table. From our data, we found that the longer the pause duration, the higher the probability for customers raising disputes or cancelling immediately after they're charged again.

A productive approach is to set a good default pause length (e.g., one month) while giving customers the option to extend it if needed. Letting customers choose the pause duration gives them control while keeping them in the ecosystem. The shorter the pause duration, the faster you'll get to see the revenue.

Ultimately, subscription pauses are a win-win for both the customer and the company since they offer flexibility, and it's no surprise that pauses are so prominent in our dataset.

Plan changes

Customers accepted new plans nearly 7% of the time, a fascinating exercise in flexible pricing. Pricing flexibility has many facets. Based on your product usage patterns, you might surface lighter versions of your product. Hidden or exclusive plans surfaced during cancellation, such as "lite", weekly, or daily options, can provide an alternative to full cancellation while preserving usage and account data for your customer.

Other

Under "Other," we've grouped trial extensions, customer redirection to Support, and custom offers like team seat handoffs. Some of our highest-performing Cancel Flows are these more "niche" offers that speak directly to the makeup of one's subscriber base and are targeted very tightly with well-defined segmentation.

Like this? We can tell you when we release new research projects.

Failed payment trends

Why payments fail

Payments largely fail for transactions both parties want completed because of:

- Insufficient funds, which represented nearly half of all declines

- Risk management reasons, making up 25-30% of all declines

- Card-related issues, like expirations, lost cards, or stolen cards, which made up 10-15% of all declines

How to deal with failed payments

Failed payments can be recovered in two ways:

1 Payment Retries

Sometimes, you can simply retry the transaction (e.g., if you encounter a "do not honor" failure code).

We discovered that retries are especially useful when encountering "insufficient funds" codes, albeit with some finesse: moving the transaction attempt to dates or times when cards are more likely to be recharged helps a number of payments go through.

Be aware of retry limits‐Mastercard, for example allows 35 attempts, while Visa allows 15 attempts within 30 days. Exceeding these limits can lead to fines as high as $15,000.

Even so, payment retries are very effective. From our data, we've seen recovery rates as high as 89% using our unique approach to card retries.

2 Customer Intervention

Hard declines, such as expired or cancelled cards, require customers to update their payment information.

To maximize recoveries in this situation, leverage:

- Frictionless dunning campaigns: Use email and SMS reminders to prompt users to enter cards without having to login

- Inline card updates: Alert customers to update their payment details directly in-app with easy-to-use card forms

- Advanced segmentation: Tailor dunning messages based on customer attributes (e.g., plan type, subscription age) for better targeting

- Flexible payment options: Offer partial payments or temporary discounts to retain customers

- Payment walls: Restrict access to features to gently nudge users into updating their cards

How payments were recovered

In 2024, our data showed that 70% of all involuntary churn we detected was recovered (one of the highest recovery rates in the industry).

Among only dunning emails and SMS campaigns, the average recovery rate was 42%, showing the power of having intelligent retry technology in your corner.

Mode of Recovery

Note:Billing Contact API had about a 10% uplift in email recoveries by targeting billing contacts.

Related Product

Dan Layfield, author at Subscription Index, previously at CodeAcademy and UberEats: "Setting up correct payment processing is one of the most important things you can do as a subscription product. I have probably written about this more than anything else. The longer your product is around, the more important this is. In my experience, [...] using a vendor like Churnkey's Precision Retries helps optimize retires for soft decline and customer outreach for the hard declines."

Failed payments behaved differently across the world

Insufficient Funds

Highest in Australia (81.4%) and Poland (80.1%) and lowest in both Singapore (29.3%) and Indonesia (25.0%). The global average of the "insufficient funds" decine code was around 60%. Remember: this is typically a "soft" decline that can be retried automatically within certain limits without requiring customer intervention.

Higher rates of this code may indicate:

- The presence of more aggressive retry strategies by merchants in these regions

- A higher proportion of debit card usage vs. credit cards

- Greater usage of prepaid cards or cards with fixed spending limits

- Macroeconomic factors such as high consumer debt, high unemployment, or low disposable income

High Risk Level

Highest in Singapore (23.6%) and the United States (20.8%). This is a "hard" decline requiring customer intervention.

Higher rates of "High Risk Level" might indicate:

- More sophisticated fraud detection systems in these markets

- Different risk appetite of issuing banks in these regions

Do Not Honor

Highest in India (24.7%), Philippines (24.2%), and Indonesia (13.7%). Lowest in Netherlands (4.7%) and Australia (4.6%).

This is typically a generic decline code used when:

- Banks don't want to disclose the specific reason behind a decline

- Temporary network disruptions that cause unknown acceptance failures

- Higher rates in developing markets might indicate less granular decline code implementation

Transaction Not Allowed

Highest in India (62.2%) and Indonesia (34.1%).

Higher rates might indicate:

- Regulatory restrictions such as Reserve Bank of India's subscription policies

- Cross-border transaction limits

Like this? We can tell you when we release new research projects.

The ultimate question: how much does improving retention and lowering churn even matter?

Levelling up your retention capabilities isn't distracting to your core subscription business. On the contrary: it's a new language you'll need to speak on an increasing basis.

We're sure you've heard (or asked) some version of "what's going on with churn?"

We're seeing that there's more scrutiny than ever on the specifics of churn. That means that soon—if you're not already—you'll be asked "why did [customer A] cancel?" or "what does 'Do Not Honor' mean, and why are we losing so much money because of it?"

Thing is, you can be ahead of this. Take what you've seen in this report as a baseline for your own business. There's a revenue growth opportunity hiding in plain sight for subscription companies like yours. Because growing your business isn't just about acquiring new customers—it's about retaining them, too.

But nobody wants to hunt down delinquent payments that are less than a hundred dollars a month per customer. Nobody wants to interview every person behind every cancellation, looking for trends in the data. It's just too expensive.

But when you think that this kind of churn is inevitable, you lose tens, hundreds, even millions of dollars per year in revenue. Recovering even a small fraction of it would make you a hero with your CFO, CEO, and Board.

Or, if you're a solo founder, it might mean the difference between the apartment of your dreams and the house of your dreams.

Truth Bomb

Depressingly, your monthly churn stat also tells you how quickly you'll churn through your customers if you do nothing. For example, with an 8% monthly churn, you'll lose almost two-thirds of your customers each year 😵💫. Even with a 4% monthly churn, you're rebuilding a third of your customers base year after year."

Lenny Rachitsky, author of Lenny's Newsletter

Losing one to two-thirds of your customers each year is a staggering hill to climb. This means you or your marketing teams would need to acquire even more customers to grow. Your customer success/sales teams would have to upsell existing customers to see a healthy net churn.

We built Churnkey to cut churn, improve retention, and do it all in a customer-centric, user-friendly way, having experienced how churn halts growth at our previous company. Over the past four years, we've helped companies save roughly 20-40% of the revenue that they would have otherwise lost to churn.

Truth Bomb

"I spent years of my career acquiring, activating, and converting free customers into paying customers. But working in a high-volume subscription business, my teams missed a huge opportunity to have more impact, and drive more revenue - by reducing churn."

Andrew Capland, author at DeliveringValue, Growth Advisor, and Coach

If that sounds interesting, we're here to help.

Regardless of whether we meet IRL or have a chat, we hope this report gave you a useful roadmap to retention in your own organization. Because who knows what 2025 will hold?

Thanks for reading this far. We're honored, and hope it helps you with whatever you're working on these days.

Khushi Lunkad

PLG and Marketing, Churnkey

Mert Ozgun

AI Engineer, Churnkey

Scott Hurff

Co-founder and Chief Product Officer, Churnkey