Hard vs Soft Declines: Definition, Calculator, Strategies

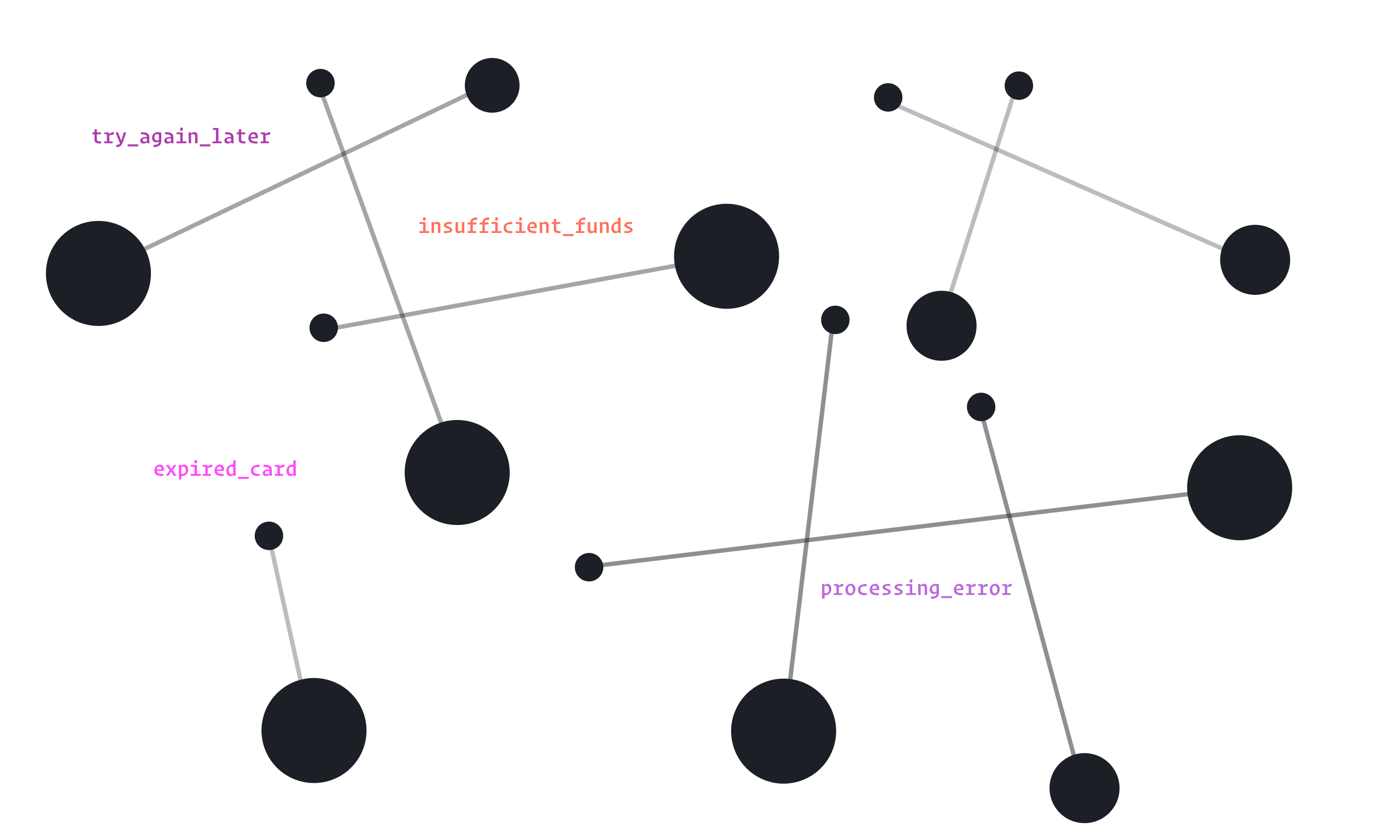

Soft declines are temporary issues (e.g., insufficient funds, credit limit exceeded) that can be resolved with precision retries and dunning campaigns. Hard declines are permanent issues (e.g., stolen cards, account closures) and require customer intervention via dunning campaigns.

You know that churn has two parts — involuntary and voluntary churn.

When a payment fails due to involuntary churn, it fails due to soft and hard declines.

(Image inspired by Leah Tharin)

Soft declines vs hard declines

A soft decline occurs when the payment method is valid, but the transaction fails due to reasons like insufficient funds or billing address changes. A hard decline occurs when the payment method is no longer valid and the transaction fails due to reasons like expired cards or closed accounts.

A soft decline is a temporary problem, and it is possible to resolve without customer intervention. A hard decline is permanent and requires customer intervention.

A soft decline is fully actionable while a hard decline is only partly actionable. If a payment fails due to a fraudulent transaction, it's a hard decline. There's not much that you can do to save that revenue.

There are various methods to manage soft and hard declines. Soft declines can be managed by retrying payments, rotating processors, removing restrictions, checking fraud classifications, and ensuring correct payment settings. Hard declines are managed by optimizing payment methods, using account update programs, and proactive user updates.

Soft declines can also be reduced with Churnkey's precision retries, without requiring any customer intervention. And both soft and hard declines can be recovered with Churnkey's dunning product.

Visualize Your Churn Metrics in 1-Click for Free

Get a free, visual analysis of your churn metrics and understand how your retention compares to other companies. With our free product, you can visualize:

- Gross and new churn rates by date.

- Involuntary and voluntary churn rates.

- Revenue vs logo churn.

- Retention cohort analysis.

- New vs. old churn.

- Churn cake charts.

Test yourself with a quiz

Hard decline meaning and decline codes

Hard declines are transactions that are rejected by the payment processor or issuing bank and cannot be retried.

They require the customer to use a different payment method or card to complete the transaction. There are lots of reasons when hard declines will occur.

Lost/Stolen Card Decline Code

The card has been reported as stolen or lost and should not be used for transactions. It's also referred to as "Pick-up card".

Decline codes look like this (varies depending on your payment provider):

lost_card, pickup_card, restricted_card, stolen_card, updated cardholder available (2022), call issuer. pick up card (2047), card reported as lost or stolen (2053)

If your payment provider's data is messy and hard to interpret, Churnkey's support team can help. We'll help map your involuntary churn data to the correct decline codes, pinpointing the root causes of your biggest leaks. Simply book a demo and experience a true white-glove experience.

Fraudulent Activity Decline Code

Fraudulent card code indicates that the card has been flagged for suspicious or fraudulent activity. Payment Service Providers and banks decide what's fraudulent. You can also set your risk settings that can trigger (here's a link to Stripe).

These decline codes look like this in Stripe, Braintree, or other payment providers:

fraudulent, bank_decline, fraud suspected, security violation, transaction refused due to paypal risk model, risky, dscore, dreject, risk blocked transaction, gateway reject - blacklist transaction cannot be processed, mismatch - shipping to billing shipping country does not match billing country

For the extra curious: Why these fraudulent cards exist and why they buy from you?

Fraudulent cards can happen due to several reasons (🥵)

- Data breaches: Hackers gain access to credit card information through breaches in security systems of companies.

- Phishing scams: Fraudsters trick people into providing their credit card details through deceptive emails or websites.

- Skimming devices: Devices installed on ATMs or point-of-sale terminals capture card information during legitimate transactions.

- Lost or stolen cards: Physical cards are lost or stolen and then used fraudulently.

- Synthetic identity fraud: Fraudsters create fake identities using real and fabricated information to obtain credit cards.

Fraudsters may purchase your product for several reasons, even if they don't need it:

- Testing stolen cards: Fraudsters may use your products to test if stolen credit card information is valid and can be used for transactions.

- Money laundering: Purchasing digital products can be a way to launder money, converting stolen funds into legitimate-looking transactions.

- Reselling access: Fraudsters might resell access to the SaaS product at a lower price, making a profit from the stolen card information. If you search on twitter for something like "Canva sell", you'll see how many people resell accounts.

- Gaining access to sensitive data: Some products may provide access to valuable data or tools that can be exploited for further fraudulent activities.

These things happen, unfortunately.

Invalid Card Number/Account Decline Code

This decline code means that the card number entered is incorrect or does not match any existing card numbers in the payment processor's database.

These are examples of codes associated with the "Invalid" decline reason:

card_not_supported, currency_not_supported, duplicate_transaction, incorrect_number, incorrect_zip, invalid_account, invalid_amount (if it exceeds the allowed amount), invalid_expiry_year, invalid_number, processing_error, reenter_transaction

[Source]

Expired Card Decline Code

The "Expired Card" decline code means that the card being used has passed its expiration date and is no longer valid for transactions. Cards can expire due to several reasons:

- Card is past its expiry date

- Banks issue new security features and expires the old card

- Change in address can lead to the issuance of a new card and early expiration of the old one.

- Some virtual cards are designed for single-use or limited-use transactions, expiring after a certain number of uses or a specific time period.

Closed Bank Accounts Decline Code

This one's pretty simple. The bank account is no longer active. Maybe the user closed it, or the bank closed their account. ACH and direct subscriptions will fail and its a hard decline.

Soft decline meaning and decline codes

A soft decline occurs when a payment method is valid, but the payment fails anyway. Around 80-90% of all declines fall into this category (according to checkout.com).

These can happen due to several reasons:

Insufficient Funds

The account linked to the payment method does not have enough money to cover the transaction.

If a payment error occurs due to insufficient funds, here are some strategies you can employ:

- Retry Payment: Test the frequency and cadence of retrying the payment. Different users and cards may require different retry strategies. Churnkey's precision retries retries outperform traditional retries by nearly 400%. Setting up requires very little engineering lift since it happens behind-the-scenes. Our team will guide you to set up the right retry strategy and cadence.

- Notify the User: Send notifications via email or in-app messages to inform the user about the failed payment and prompt them to add funds or use a different payment method. Churnkey's dunning product and failed payment wall can take care of this for you.

- Alternative Payment Methods: Encourage users to switch to alternative payment methods like PayPal or ACH, which may have fewer issues with insufficient funds.

- Remove Restrictions: Consider removing certain verifications, like zip codes, that might trigger failed payments, especially if you have an established history with the customer.

- Credit Card Processor Rotation: Rotate through different credit card processors to increase the chances of a successful payment.

Billing Address Change

The billing address provided does not match the one on file with the payment method.

Temporary Holds

Banks place temporary holds on cards to prevent fraud and ensure funds are available for pending transactions. These holds allow time for verification and processing, protecting both the bank and the customer from potential financial issues.

Do Not Honor

The "Do Not Honor" decline code means that the bank is refusing to authorize the transaction. This is a soft decline where the payment method is valid, but the bank does not approve the transaction for unspecified reasons.

Common reasons why banks issue a "Do Not Honor" decline code include:

- Suspicious Activity: The bank may suspect fraudulent activity on the account.

- Security Concerns: There may be security concerns or unusual spending patterns.

- Account Restrictions: The account may have restrictions or limits that prevent the transaction from being approved.

- Insufficient Funds: Although not explicitly stated, it could be related to insufficient funds or other account issues.

Technical Issue

A technical problem occurred during the transaction process. The only solution is to retry the payment or ask the customer to update the payment.

Strategies to mitigate hard declines

- Optimizing payment methods: Switch to alternative payment methods like PayPal or ACH to minimize errors related to credit card expirations.

- Account update programs: Implement programs that automatically update payment information when users switch credit cards due to expiration or other factors. Payment systems like Churnkey, Stripe or Braintree often have these features built-in.

- Proactive user updates: Encourage users to update their payment details before cards expire through in-product notifications, emails, and SMS. For already churned users, check out Churnkey's reactivations product. This will ensure you speak to customers in a personalized and they can update their cards in an intuitive way.

- Blocker modules: Use blocker modules to restrict access to specific features or parts of the product until the customer updates their payment information. You can even segment

- Simplified notification processes: Ensure that notifications for updating payment information are straightforward and require minimal steps to complete.

- Offer users reasons to come back: You can offer an extended trial, a discount, a hidden pricing plan and a host of other things to bring them back.

- Track metrics that matter: Campaign underperforming? Look for the data, form hypothesis and implement them in Churnkey.

Strategies to mitigate soft declines

- Optimize retry frequency and cadence: Adjust the frequency and timing of retrying credit cards based on user and card type. Churnkey's precision retries product is an easy yet impactful way to get started.

- Rotate credit card processors: Use different processors to increase the chances of a successful payment. This might be harder to pull off.

- Remove restrictions and verifications: Eliminate certain checks like zip codes to reduce failed payments, accepting some fraud risk. You can adjust settings by talking to your payment provider.

- Check fraud classification: Ensure transactions aren't mistakenly flagged as fraudulent.

- Correct payment notifications and settings: Ensure recurring flags and transactions are properly set up for subscription products. Churnkey's dunning platform is a complete solution to reactive at-risk users.

Hard and soft declines can be problematic if untreated

High rates of declines can pose several significant problems for a business.

- Revenue loss: Hard declines result in immediate revenue loss as payments fail and services are interrupted.

- Customer churn: Customers may churn if their payment methods are not updated promptly. It will cap your growth ceiling. When churn goes up, retention will go down.

- Increased recovery costs: Efforts to recover churned customers due to hard declines can be costly and resource-intensive. To move faster, you can implement Churnkey. We've kept the implementation as lightweight as possible.

- Customer friction: The process of updating payment information can be cumbersome for customers.

- Negative impact on metrics: High hard decline rates can negatively affect key business metrics such as MRR and LTV. You'll see a declining or a flat retention curve.

Soft decline management systems

Churnkey's failed payment and reactivations suite can recover up to 89% of failed payments that occur due to soft declines. Incorporate Churnkey's precision retries, dunning emails, and reactivation campaigns to recover revenue lost to churn. Our retention automation suite tackles both involuntary and voluntary churn.

Thanks for reading!