With hard card declines on the rise, where do you turn?

Churnkey's personalized email, SMS, and in-app payment recovery solutions maximize revenue recovery while respecting your customers' experience.

- Recover up to 89% of failed payments

- See immediate ROI on day one

- Always fixed fees, never a take rate

“ No founder wants to think about failed payments or has the time to deal with them. Churnkey stepped up and did it for us — setting us up quickly and optimizing everything — so we could focus on what we love to do: ship fast and grow faster. ”

![]() Grant Cooper/Co-founder of Cometly

Grant Cooper/Co-founder of Cometly

When payment retries come up against hard declines, it's time for a new strategy to win back hard-won customers.

But it's tough to spin this one up on your own, harder even to optimize it across multiple channels. Email, SMS, in-app messaging, and more require a monetization team you don't have.

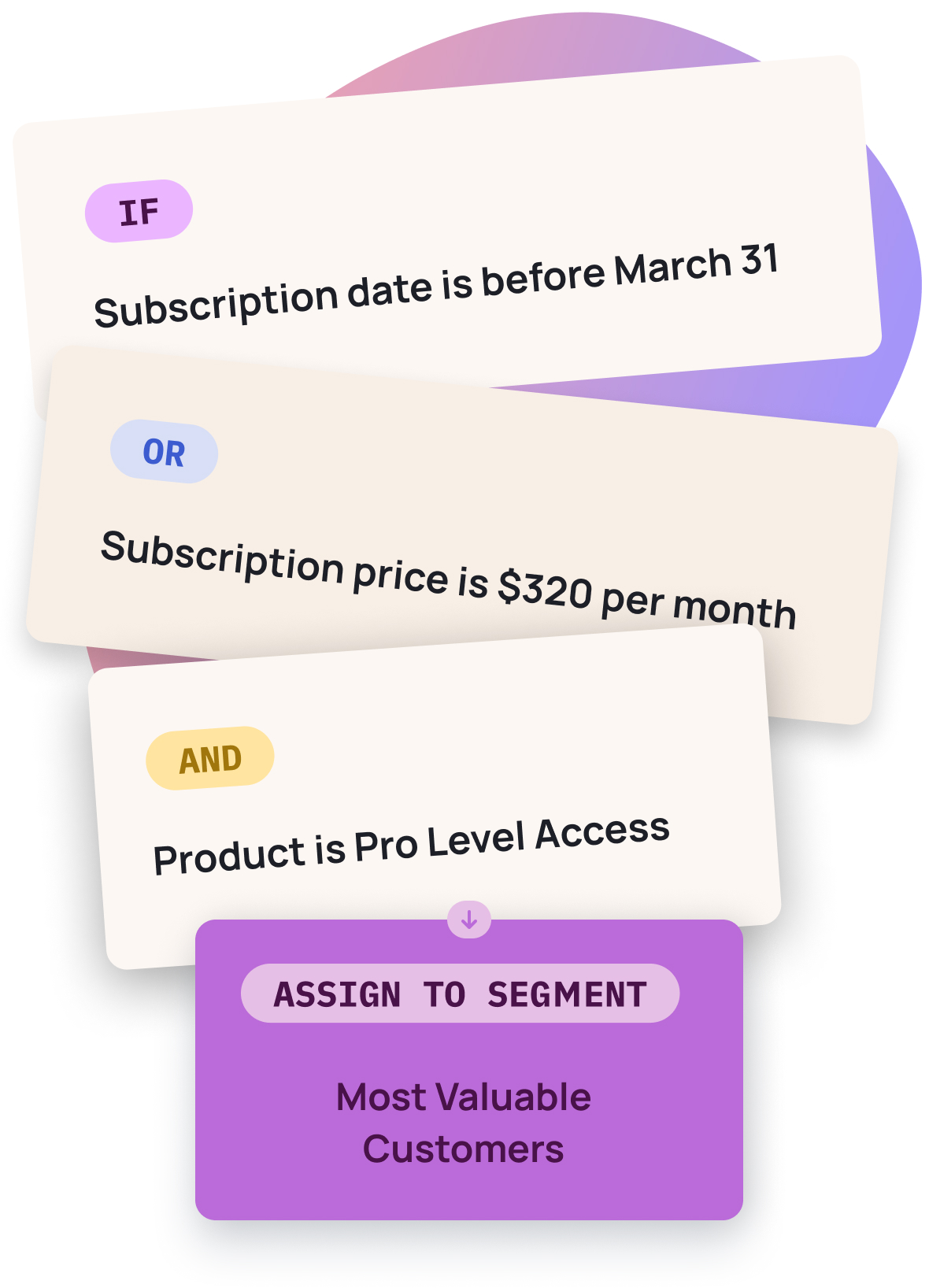

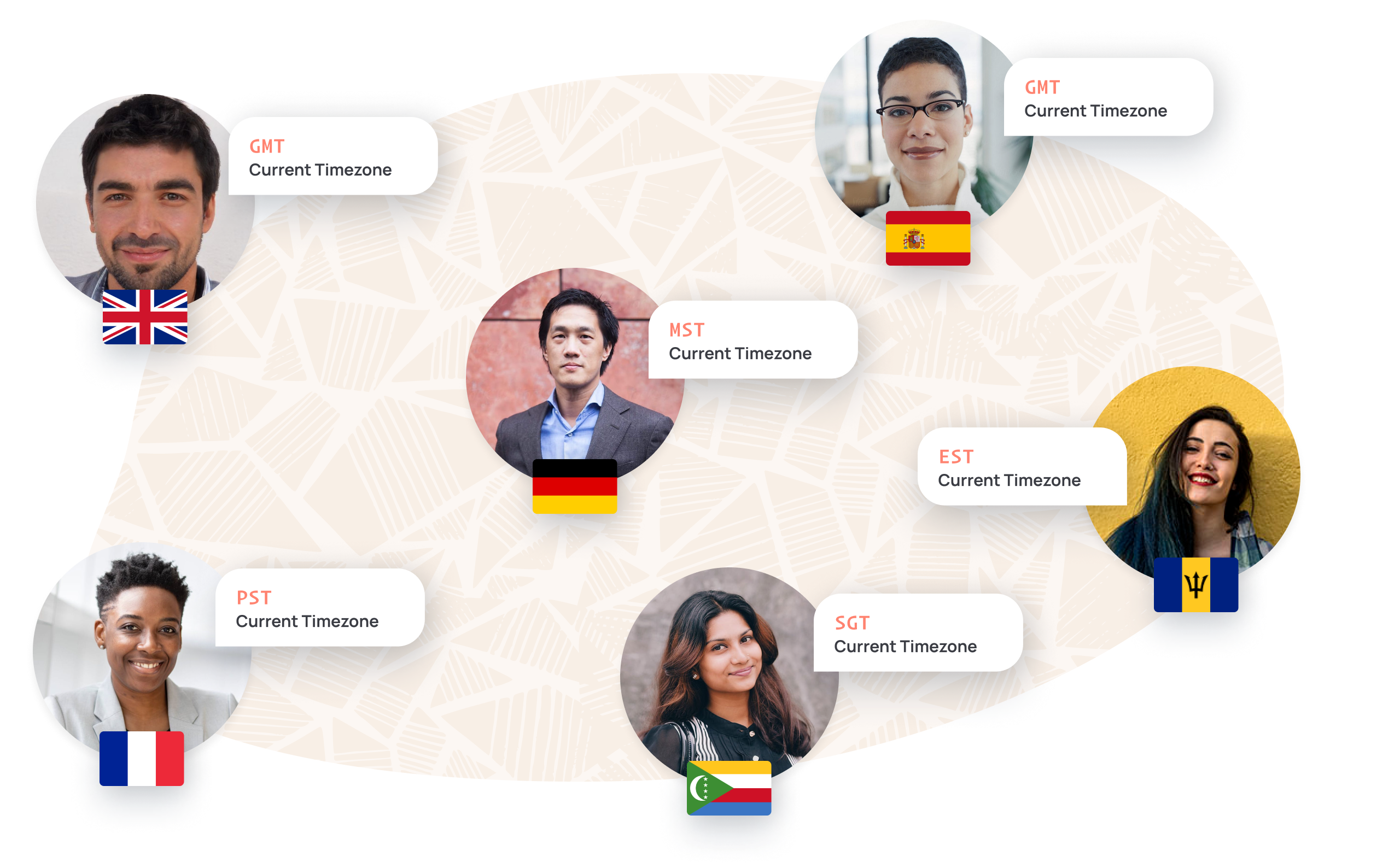

Because every one of your customers is unique: they speak different languages, live in different time zones, subscribe to different plans, and use different payment methods. In an industry first, Churnkey makes it easy to segment payment recovery campaigns—so every message is personal, relevant, and timely.

Payment Recovery Suite

It's all part of our Payment Recovery suite...

Precision Retries

Optimized retry schedules and tactics enhanced by machine learning and adapted for your business' bespoke needs. Works effectively with banks without customer intervention.

Omnichannel Campaigns

When retries can't solve a failed payment, Churnkey's omnichannel infrastructure gets to work across every possible channel, segmented in every possible way.

Payment Recovery Wall

When retries and campaigns aren't enough, deploy in-app messaging to prevent usage in past-due accounts. Completely configurable, intelligent, and tasteful.

Email Campaigns

Deploy verified, personalized, and segmented email campaigns at scale

Whether you'd like Churnkey to build your campaigns for you, or if you'd like to segment, personalize, localize, and control message timing, our modern email campaign infrastructure has you covered.

- Send from your verified domain — Signing your domain, verifying sender addresses, and creating white-labeled subdomains increase deliverability, trust, and conversions. We make this a breeze.

- Pipe in key customer data — by leveraging your business' bespoke customer attributes, create highly-targeted dunning segments that take into account plan, type, duration, and so much more.

- Control design and messaging — match your dunning emails to your brand guidelines with ease. Push campaign copy changes with one click. Preview campaign scenarios for any invoice or customer ID.

SMS Campaigns

See 3-4x more recoveries than email by leveraging SMS

SMS is a natural extension of our messaging ecosystem. Simply toggle on SMS as a channel, customize the copy if you'd like, and Churnkey will take care of the rest.

- Send from a local number —have a customer base that lives within certain area codes? No problem. We can provision local numbers to increase trust and response rates.

- Peace of mind —since SMS has a 98% open rate (versus ~20% for email), you want to ensure every detail is correct. Preview any message inline, or send yourself on-demand testing campaigns.

- One-tap links —every SMS comes with a pre-signed URL that uses your verified subdomain. The result? Increased trust plus guaranteed conversion rates on our mobile-optimized checkout flow.

In-App Messaging

Our Payment Wall intelligently restricts access to cancelled customers

Improve recovery rates by 12-17% with a tasteful in-app payment reminder. Fully configurable to be as flexible as you need it to be.

- Simple to deploy within your app —block feature access across your entire experience, or just display on specific views. Completely up to you.

- Collect new card data inline —no unnecessary pageloads or click-outs. Customers can update their card right away so they can get back to using your product.

- Control design and behavior —match the Payment Wall to your brand, copywriting style, and more. Decide how aggressive or lenient you'd like to be with our "soft" restriction toggles.

Billing Contacts API

Route recovery campaigns to the right person on the team

If your product supports multiple seats or roles, payment recovery campaigns can get tricky. Who's the right person to contact? Should you loop in multiple people? How does that even work? With our Billing Contacts API, we'll solve this for you.

- Identify key roles —push your customer data to us via API and indicate which accounts are owners, billing admins, or whatever indicator of authority you track.

- Launch focused recovery campaigns —now, with better targeting, you can speak directly to the contacts responsible for handling billing for their team.

- See greater results —you'll experience marked increases in recovery performance among your team-based accounts.

“ Over the last 45 days, I've been able to lower churn by over 40% thanks to Churnkey's cancellation survey and win-back offers. As a super busy CEO, I love how simple Churnkey makes it to integrate, manage, and track. ”

![]() Austin Bouley/CEO of Impeccable Investor

Austin Bouley/CEO of Impeccable Investor

Everything your team could be using right now...

- Personalization for every customer

- Unlimited cancel flows

- Unlimited customer segments

- Custom attributes for advanced targeting

- A/B testing engine

- Subscription pauses

- Discounts, delays, plan changes, other offers

- Automatically extend free trials

- Anti-gamification measures

- Custom branding

- No-code editor

- Multi-language support

- Custom CSS support

- Unlimited team members

- Dynamic flow branching

- Block functionality for paused accounts

Personalized Cancel Flows

- Personalized for every customer

- Unlimited email recovery campaigns

- SMS recovery campaigns available

- Unlimited customers

- Pre-written and optimized campaigns

- One-click payment processor setup

- Collect partial invoices

- Discount future payments

- No-code setup and editing

- Custom branding

- Hosted payment update flows

- Customer-facing billing history

- Customer-facing cancellation notifications

- Precision Retries outperform the industry

- Block functionality for past-due accounts

- Multi-language support

Payment Recovery

- Personalization for every customer

- Unlimited reactivation campaigns

- Unlimited reactivation segments

- Enhanced timing logic

- Custom attributes for advanced targeting

- Email infrastructure optimized for max deliverability

- Use cancel reason, customer health, & more...

- One-click reactivation experiences

- Personalization for every customer

- Custom branding

- Hosted payment update flows

- No-code setup, creation, and editing

- Fallbacks for every edge case

- Multi-language support

Reactivation Campaigns

- Identify customers most prone to churn

- Dynamic customer base risk scoring

- Predict monthly revenue before it happens

- Analyze customer sentiment over time

- Unlock segmentation via health scores

- Bring your own value metrics to enrich your ML model

- Customer tables sorted by low, medium, high risk

- Bespoke model trained on your billing data

Customer Health

- Track Boosted Revenue, key metrics over time

- Trended, benchmarked cancellation reasons

- Understand offer performance over time

- Insight AI for qualitative feedback analysis

- One-click payment processor setup

- Cancel flow journey breakdown

- Session recordings for every customer

- Activity feed of every flow session

- Real-time activity feed of customer status

- Recovery success over time

- Intelligent retry tracking

- Trial conversion tracking

Metrics Suite

- Personalized setup call

- Cancel flows built for you

- Recovery campaigns created for you

- Testing sandbox

- Concierge migration from any other providers

- Responsive email and live chat support

Setup Services

- Support for Stripe, Paddle, Braintree, Chargebee, other integrations with key billing providers

- Native Stripe App

- Robust real-time webhook infrastructure

- Slack app for real-time alerts

- Dynamic email reports

- Churnkey API for integration with any external apps such as Hubspot, Segment, Klaviyo, Salesforce, more

Integrations

Scale your retention

Churnkey meets top industry standards for data security and compliance

Let us show you how Churnkey outsmarts legacy churn software.

We'll take you on a quick, friendly, no-pressure walkthrough of what we do. And you'll see why so many companies are graduating to Churnkey's churn management software to boost revenue, recover failed payments, make customers happier.