6 Customer Retention Metrics Required for SaaS Growth

Customer retention focuses on reducing churn and capitalizing on the customers you already have, rather than spending money trying to pull in new customers.

A strong focus on customer acquisition is not enough to thrive as a modern subscription business. Customer retention is vital for SaaS company survival — especially since studies have shown that 80% of your future profits will come from 20% of your existing customers.

Keep reading to learn more about customer retention metrics, how you measure them, and how you can make sense of the data with Churnkey.

What is customer retention?

In short, customer retention is one of the best strategies for keeping your business’ revenue high. Why? Because customer retention focuses on reducing churn and capitalizing on the customers you already have, rather than spending money trying to pull in new customers.

If you have high customer retention, it not only increases your company’s revenue—it also demonstrates that you’re providing value. By contrast, it doesn’t matter if you only have great customer acquisition strategies. If you can’t deliver value to those customers once they’re through the door, then all of that acquisition is worthless.

That’s why customer retention analysis is so important. Let’s talk about how to measure your customer retention and exactly what metrics you need to take into consideration when you’re examining your data.

How to measure customer retention

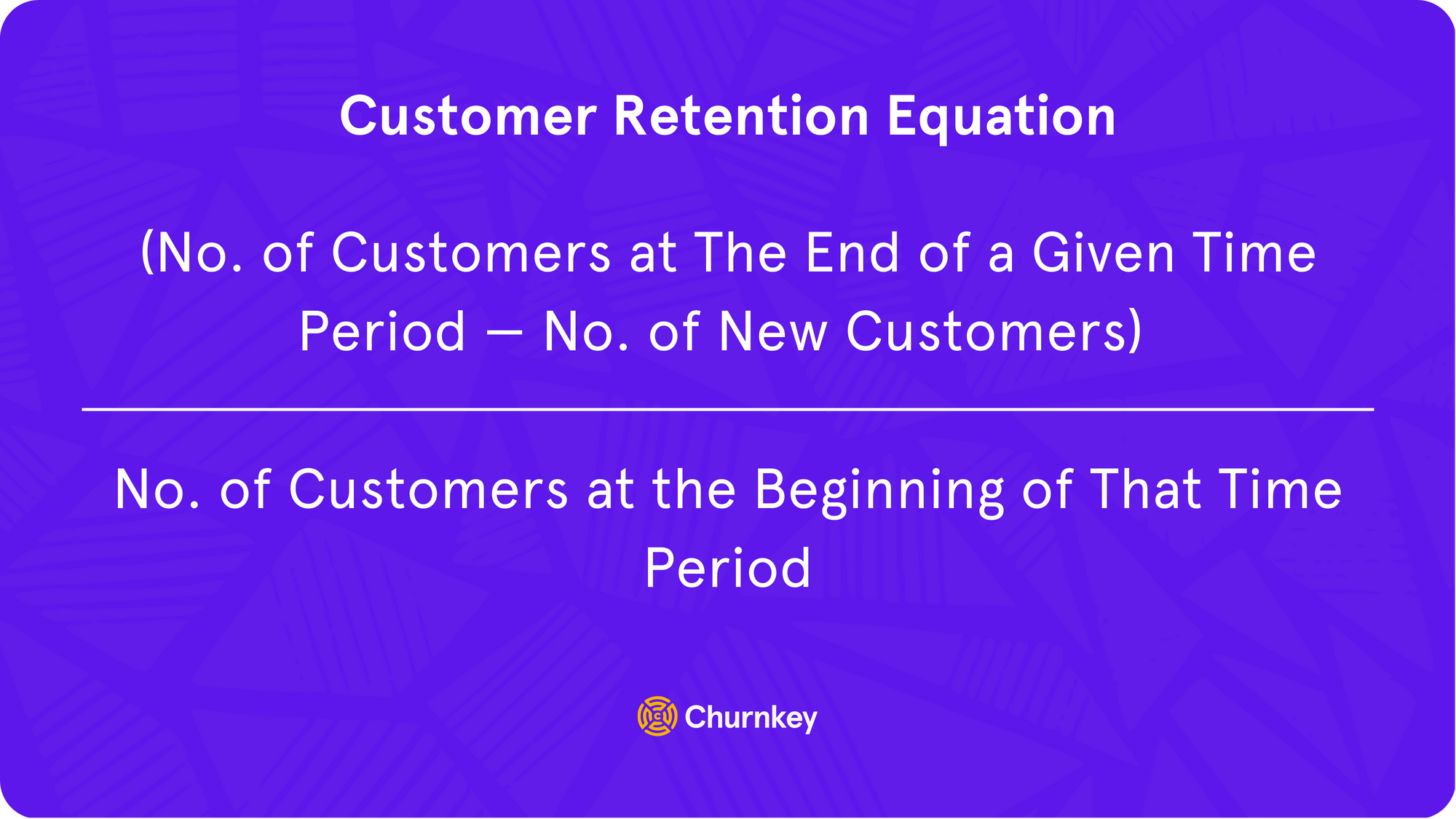

Your customer retention rate is the percentage of your customers who use and resubscribe to your service over time. There are a few different ways to measure your customer retention rate, but the easiest method is to use this retention formula:

(Number of customers at the end of a given time period – number of new customers) / Number of customers at the beginning of that time period

Here’s an example: say your SaaS company had 200 customers at the start of this quarter and 230 at the end. You also had 50 new customers that signed on after the start of this quarter. In this situation, the formula would look like this:

(230–50) / 200 = 0.90 or 90%

Instead of manually calculating, you can use our free, simple retention rate calculator.

Customer retention metrics required for SaaS growth

Now that we know how to measure your customer retention, let’s talk metrics. If you want to break down your customer retention into data you can analyze, here’s a list of the metrics that will help you zero in on every aspect of customer retention so you can start to reduce your SaaS business’s churn.

1. Revenue or MRR Churn

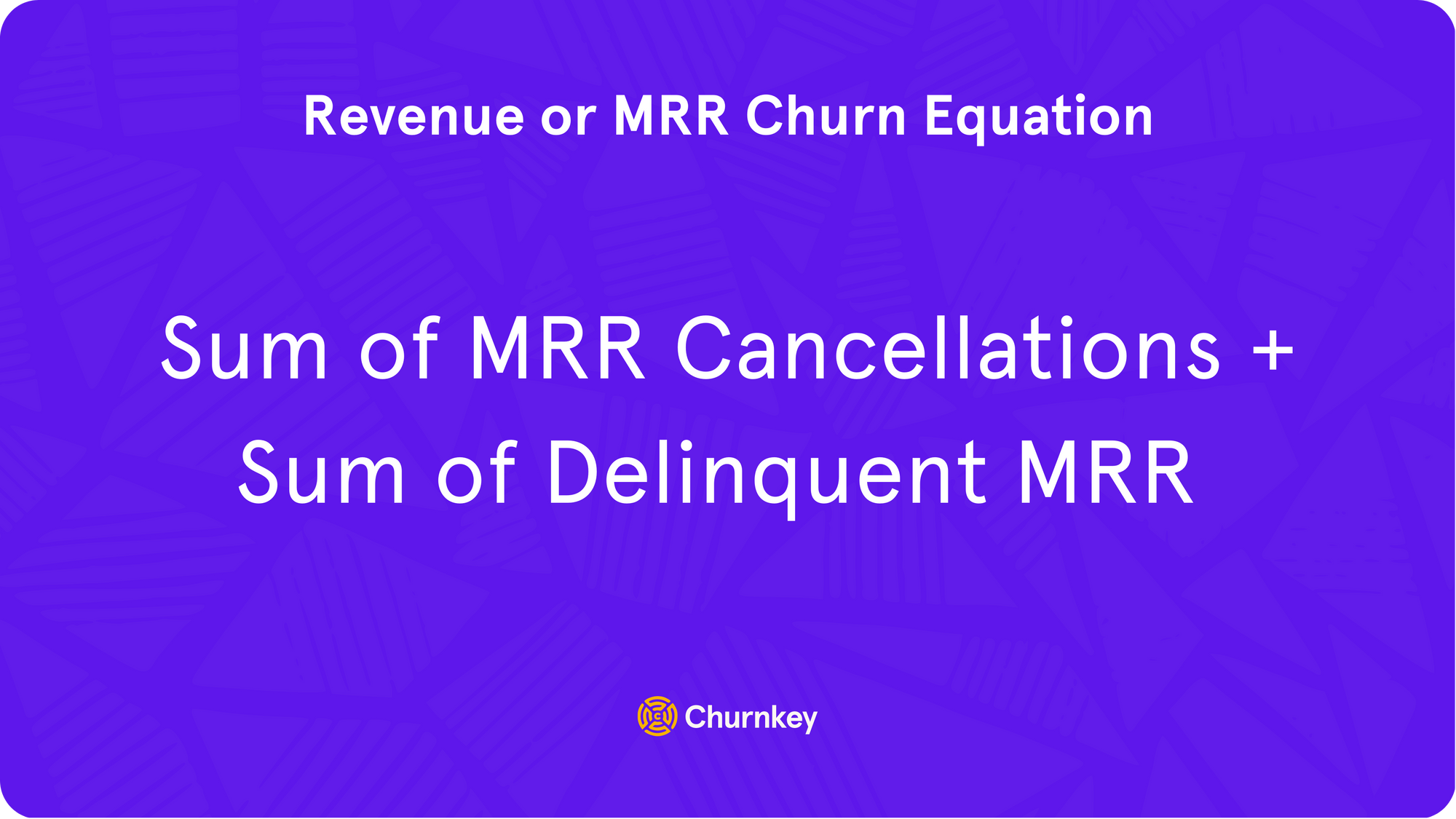

When it comes to SaaS growth, one of the most important things to examine is how many subscriptions you lose each payment period. MRR (monthly recurring revenue) churn is one of the biggest threats to SaaS companies and the most important to analyze, since it’s the measure of the overall erosion of your recurring revenue. Tracking and understanding your MRR churn allows you to create a better product, market it more effectively to your target audience, and enhance your SaaS growth.

MRR Churn Equation: MRR churn = Sum of MRR Cancellations + Sum of Delinquent MRR

How to reduce revenue or MRR churn

- Fix your cancellation problem. Voluntary churn comprises, on average, around 80% of all revenue and MRR churn.

- Understand why they cancel with cancellation insights surveys. Uncovering cancellation reasons is the first step to addressing them. Ask your customers in a non-invasive way why they’ve decided to cancel.

- Ensure your product is fulfilling its promise. Technical problems, a misalignment of product-market fit, or

- Offer targeted incentives to stay with personalized cancel flows. Sometimes customers churn due to seasonality, a poor experience due to bugs, lackluster customer service, or other reasons that might seem out of your control. The thing is, they’re not. You can save 4 out of 10 of customers who cancel with user-friendly, customer-centric flows that empathize with their unique situations.

- Test your pricing. Is your pricing confusing? Misaligned with the market? Use cancellation reasons and cancel flows to find a new pricing equilibrium with your customers.

- Fix your failed or delinquent payments problem.

- The other side of churn comes from involuntary payment failures. Dunning campaigns can recover over 80% of your failed payments.

- Because when you lose revenue from people who actively want to pay you, your business shrinks along with your reputation.

- But it's not a problem you created. Banks, credit card companies, and their opaque policies can cause 20-40% of your churn.

- You can get started with our dunning product for free and start recovering failed payments immediately.

2. Customer lifetime value (LTV)

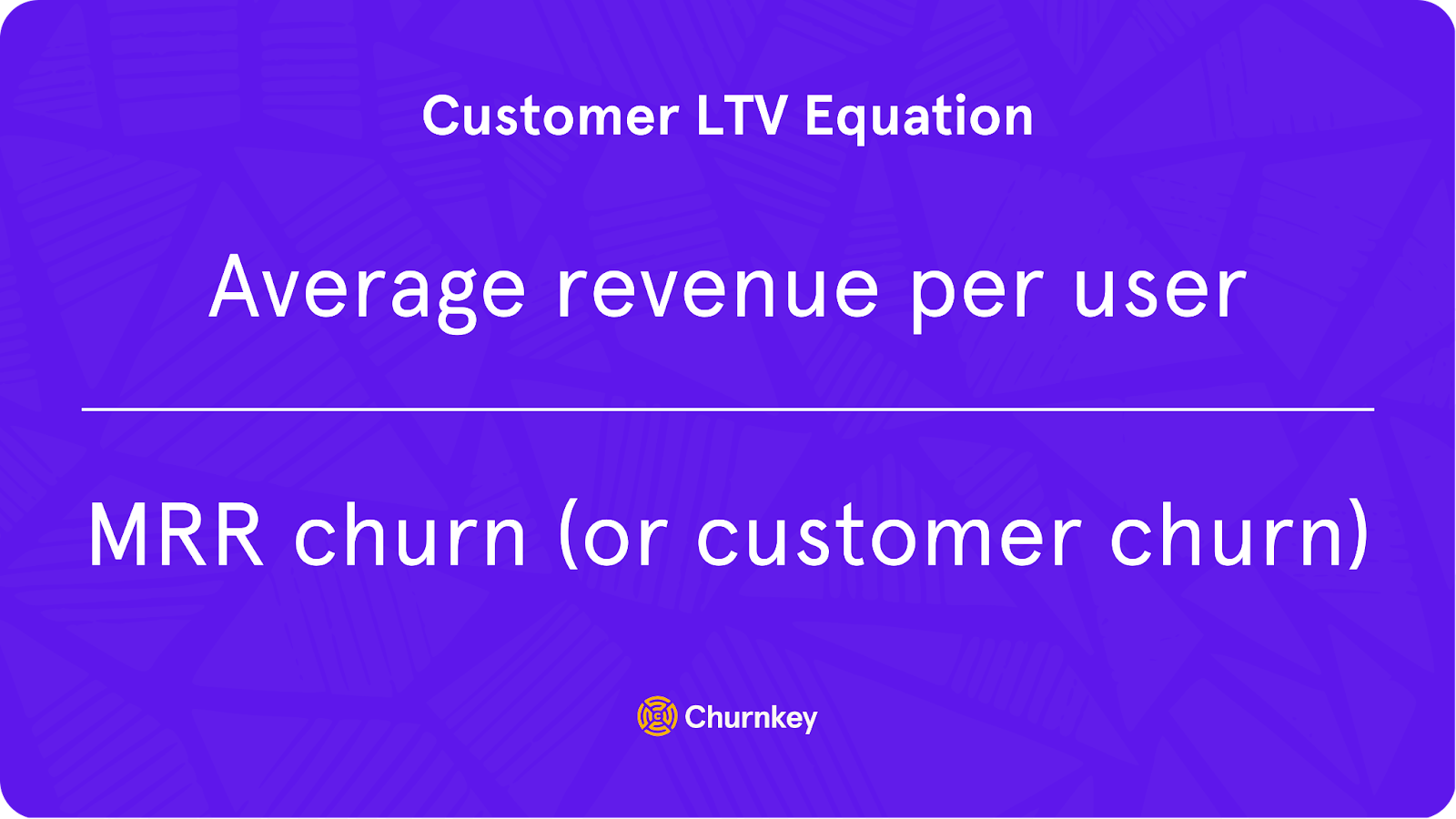

Customer LTV will show you how much your customers are really worth — meaning how much they’ll spend over the course of their time with your business. To calculate LTV, you need to measure how much your customers generate in revenue minus their overall revenue churn.

Customer LTV Equation: Average revenue per user (ARPU) / MRR churn (or customer churn)

How to improve customer LTV

- Improve your product, service, and overall experience. Real talk: you need to differentiate your product and make it stand out. Fulfilling your product’s promise, exceeding expectations, and creating memorable customer experiences are the most sustainable ways to extend customer LTV.

- Ask your biggest fans to refer you. Happy customers represent your ideal personas. These customers tend to recommend similar personas that will be good fits. Incentivize referrals with personal benefits like a gift card.

- Cross-sell and up-sell. Customer needs evolve. So should your product. Create new experiences that entrench your presence in customer workflows and improve the value of your product ecosystem. Research frameworks like product-led growth and study products like Slack and Airtable to scale product expansion.

3. User churn

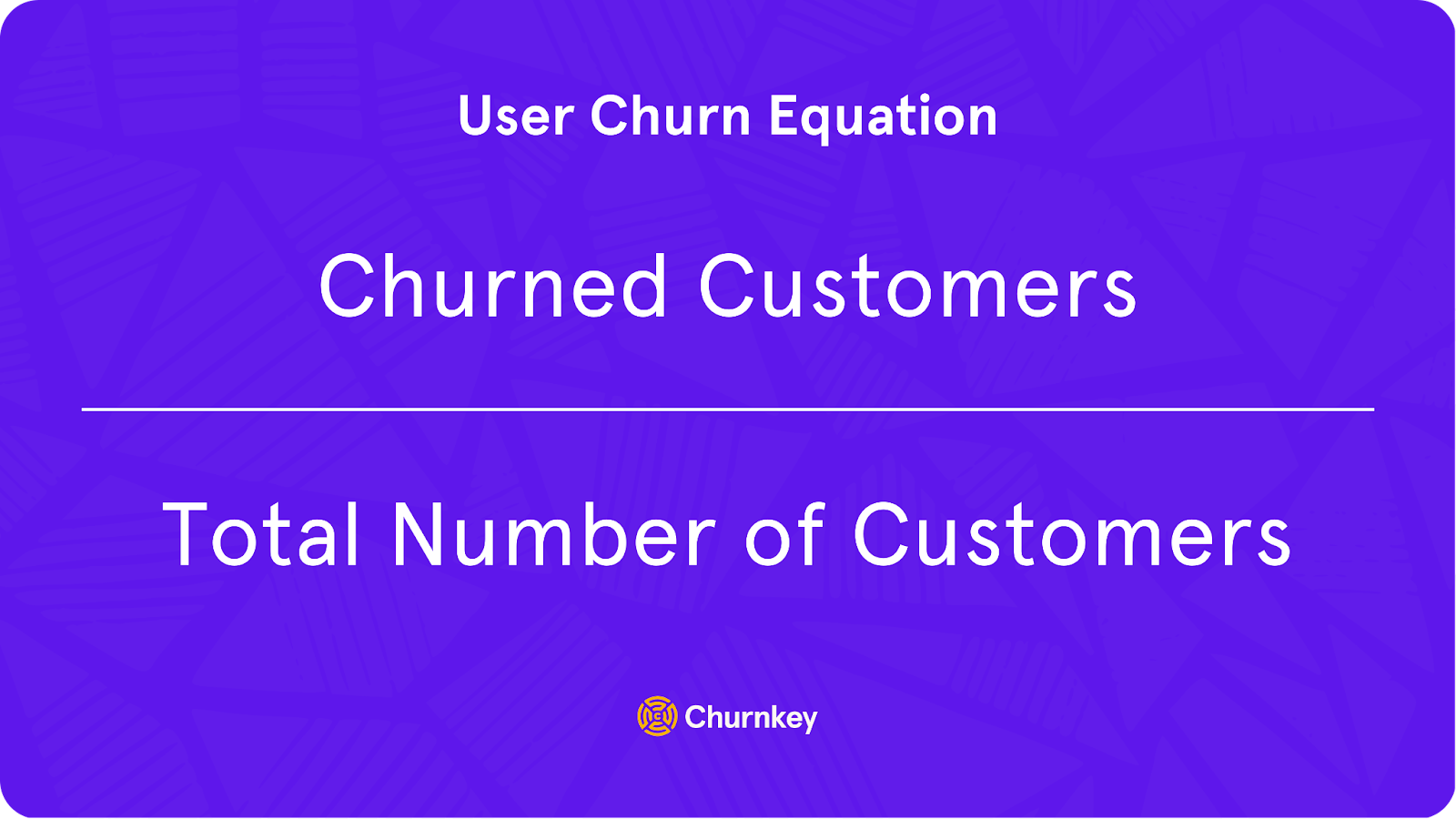

Unlike MRR churn, which is focused on your monthly recurring revenue, user churn is focused simply on the number of users you have. User churn is how many overall users left your company during a period of time. This metric is a good baseline for your company’s overall health and can help you determine how well-priced each of your service tiers are.

User Churn Equation: Number of churned customers / Total number of customers (for whatever time period)

How to reduce user churn

- Re-evaluate your customer journey. There are some useful techniques here for mapping the path from awareness to activation to retention.

- Prevent involuntary churn from happening. 20-40% of the time, customers don’t want to cancel, but credit card companies and failed payments get in the way without their knowledge. Prevent cancellations from delinquent payments by using a proactive dunning solution.

- Make sure customers can figure out your product, and that they’re utilizing it to the fullest potential. Find ways to personalize your customer experience at scale and direct customers to relevant features or documentation without forcing them to dig for it.

- Understand and track your key value metrics. What are the signals that your most successful customers are sending? How do they use your product versus those who churn early? Take this knowledge and use it to reorganize your product’s surface area.

4. Reactivated MRR

We already know that MRR churn is a huge threat to SaaS growth. The good news? Churn doesn’t have to be the end of the road. The best SaaS companies put measures into place to get prior customers back. And reactivation MRR metrics help you track how much of your recurring revenue comes from previously churned and returned sources.

Reactivated MRR Equation: Sum of all monthly revenue from customers that formerly churned = Reactivation MRR

How to reactivate more customers

- Run personalized reactivation campaigns. It doesn’t stop once your customer cancels their subscription. Finely-tuned reactivation campaigns can be more efficient than new user funnels. Use Churnkey webhooks to update your CRM with critical information and follow up on promises.

- For example, if a first month customer with cancellation intent responded that they couldn’t figure out the product (or that they didn’t get around to it), you should be following this up with an easy to digest tutorial email.

- You can also store data about which customers were looking for additional features, and send outbound updates to this audience after features have been launched.

5. Customer acquisition cost (CAC)

CAC is the amount you’re paying to get new customers. And it’s an important number to know if you want to understand the actual damage of your churn. If the amount you’re paying to get new customers (CAC) is higher than how much your customers are worth (LTV), then that’s bad news for your company.

CAC Equation: (Total cost of sales + Marketing) / number of customers acquired

6. LTV / CAC ratio

Here’s where we get to bring the above metrics together. For most businesses, If you’re going to focus on one metric, this is the one. This is the metric that best predicts your overall SaaS growth potential. Essentially, if this ratio is high, you’re doing great. If it’s low, it’s time to work on some changes in strategy.

LTV to CAC Ratio Equation: LTV / CAC

Improve your customer retention metrics with Churnkey

Confusing graphs, conflicting values, and painful data comparisons are the norm for most subscription metrics. Worse yet, these products don’t actually fix the problem for you.

With Churnkey, all of your retention metrics are tracked in one place and optimized for maximum legibility. You’ll be able to see cancellation patterns, track how product releases affect churn, and uncover startling trends before they become systemic threats to your business.

Better yet, we do something about it. Typical Churnkey customers see cancellations drop by 42%, failed payments recovered at rates above 68%, and LTV increased by 28%. Boost your MRR with a demo or start combating churn now with a free trial!