The SaaS Founder's Guide to Inflation

Why don't software founders adjust pricing more frequently, testing higher price points, or at least peg their monthly rates to inflation?

Lately, we’ve seen a lot of inflation concerns from SaaS and subscription company founders: how will inflation affect profitability and runway?

The dominant question: “should I raise prices? In this market?”

There’s a great deal of fear, uncertainty, and doubt when price increases enter the chat. You wonder about increasing your churn, ruining your reputation, and, ultimately, disappointing customers who mean a great deal to you and your business.

So what’s the answer here? I dove deep into the research. Reality is harsh, but here are some angles to come out of this stronger.

First some bad news: Higher prices are probably here to stay, and inflation tends to compound over time. Take a look at this Cost of Living chart from 1971.

Are you kidding me? Can you imagine going to Harvard for $2,600 or buying a new car for $3,000?

This is a reality that no longer exists — and never will. Price increases from inflation tend to be permanent.

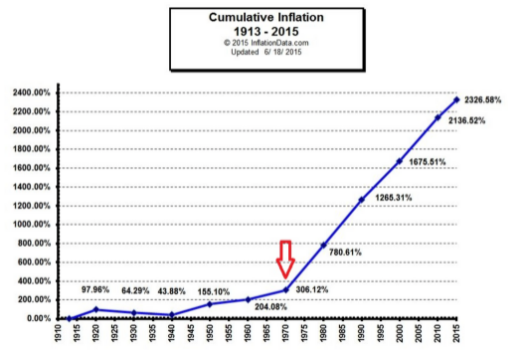

Now, here’s the other aspect of inflation: it compounds. Compound growth can be hard to grasp — but if you work in SaaS — you're well aware of the beauty of compounding recurring revenue growth.

Imagine the opposite when you picture years of inflation. What would happen if you waited three years to raise prices when inflation is 8%, 5%, and 3%, respectively?

This is something we can visualize. Take a look at the chart below showing the rapidly surge in prices since 1971.

When we combine this with the latest inflation data released by the U.S. Government — June YoY CPI at 9.1%, which is arguably low, given that the Chapwood Index shows a much higher cost of living increase of 16-18% across most of the United States — you can see how dire the latest inflation rate is to your business.

Speaking of your business, let's say you sell a product for $100 per month and haven't changed prices since 2017. Watch what happens after 5 years of compound inflation. How long can you afford to leave prices where they are?

Airlines, restaurants, and other industries are quick to change prices when economic conditions change. Large publicly traded software companies are also quick to adapt (for obvious reasons).

So why don't small- to mid-sized SaaS companies do this? So why don't software founders adjust pricing more frequently, testing higher price points, or at least peg their monthly rates to inflation?

From our experience speaking to hundreds of founders, the reason is simple: fear.

Fear that:

- Growth will flow due to price sensitivity

- There will be a customer backlash and a mass exodus

- Their reputation will be destroyed in public and their brand irreparably damaged

What if I told you…

It’s possible to:

- Increase prices for both existing and new customers

- Minimize customer frustration

- And prevent churn from the price hike

Step One

How to raise prices for existing customers without making it about you

One of the biggest things we’ve learned about price increases is proper telegraphing: be open and honest with your customers and give them plenty of time to adjust to the changes.

I recommend the following approach when talking with customers about a price update. This should be a personalized email that can get a response if replied to…

In other words, steal this email template!

Subject

Updates on your PRODUCTNAME account

Message Body

Here's a brief update on your CUSTOMERCOMPANY account alongside some big new product developments.

[Remind them of the benefits you’ve provided and the features they use often]

During that time, we've added:

[List out a few big updates from recent memory]

We're on the cusp of introducing:

[Show them that there’s a full pipeline of new product updates on the way]

Here's the other half of this news: we need to increase our prices so we can continue to make PRODUCTNAME more powerful for you. [Show empathy by recognizing how long they’ve been with you, and that you’re going to ease them into pricing.]

[We recommend raising prices over the course of 2-3 months. This all depends on the price point you’re at and the level to which you’re going. Some can pull it off more quickly, some should expand the transition for up to six months.]

Thanks again for your incredible support, Reply back with any questions!

If you don’t think this new price point is fair, let’s figure something out that works for everyone.

Step Two

What to do if cancellations increase (and how to find a new price equilibrium)

Even talking about raising prices can be painful. But most people will be fine with this approach. There are, however, likely to be a number of customers who — for whatever reason — simply aren’t able to justify the new price and choose to cancel their subscription.

Here’s where Churnkey comes in: use your cancel flow as a price discovery mechanism. Since you just increased prices, set up a new question in your exit survey with something like “Too expensive,” or “No longer fits my budget.” Or if you want to be bold, you can easily add a direct survey option akin to “Latest price increases are too much.”

This is where it gets interesting. Not only can you quantify how many customers are leaving because of price increases, you can now target them directly with specific offers. This way, you can empathize with them while figuring out what new price points might work for these specific customer segments. Our data shows a high degree of success in retaining price-sensitive customers.

Step Three

Fight inflation by monitoring your funnel and tracking conversion dips

Pushing new pricing to new customers isn’t just set-it-and-forget it — monitor changes in conversion rates, failed onboardings, and new customer cancellations. If there’s a negative material change, chances are you may have pushed too hard.

That’s fine if you did. Just immerse yourself in the data, recalibrate, and try again.

Eventually, you’ll find your inflation-pressure pricing equilibrium.