Understanding Subscription Churn and Why It Matters to Your Business

The types of churn and how you can improve your retention rates.

Trying to grow your revenue? Defeating subscription churn is one of the easiest ways to do it. Whether you’re a marketer or a founder, there are all sorts of statistics flying at you every day. It’s difficult to know which ones are important. Tracking subscription churn will help you identify weak points in your business.

Every time a customer elects to cancel their subscription, they face a choice. Your goal should be to make it as obvious as possible to the customer that continuing their subscription is the right option. Using Churnkey, a product to reduce subscription churn, you’ll be empowered to analyze your cancel flow and improve your customer’s cancellation experience. As a result, you’ll retain far more customers and fuel your revenue growth.

Now, let’s take a closer look at subscription churn, why it happens, how to measure it, and how to reduce it.

What Is Subscription Churn?

Subscription churn arises when a customer or subscriber decides to intentionally cancel their subscription. If you run a business that uses a subscription model, reducing subscription churn is one of the simplest ways for you to increase your profits.

What Are the Different Types of Churn?

There are multiple ways to describe churn, and some of them overlap. Here are four different examples of subscription churn.

Voluntary vs. Involuntary Churn

We can separate churn into two different types: voluntary and involuntary churn. Voluntary churn occurs when a customer decides that they’re going to unsubscribe or downgrade from their current plan. A customer might decide to do this for any reason. What’s important to know here is that the action of unsubscribing was made with intention.

Whereas voluntary churn arises from a deliberate action on the part of the customer, involuntary churn happens incidentally. Maybe the subscriber has an expired or rejected credit card, or perhaps there’s an issue with your payment processor. Either way, involuntary churn is especially painful because the customer was perfectly willing to continue using your services.

In the case of voluntary churn, you need to take steps to win the customer back. This occurs during the cancel flow. Meanwhile, you can solve involuntary churn by taking the appropriate measures to protect your payments.

Customer Churn

Customer churn is another word for subscription churn. When you think of it this way, you’re looking at your subscription churn in terms of what percentage of your customers you’re losing every month.

This is significant as a high percentage of customers canceling their subscriptions might imply that your product no longer satisfies them. On the other hand, it could indicate that you need to improve your cancel flow.

Revenue Churn

Instead of looking at what percentage of your customers are choosing to cancel your services, you could look at how much revenue you’re losing. This will be a major part of your customer lifetime value calculations which you’ll learn about later.

Many would argue that revenue churn gives you more information about your business than customer churn. After all, if you’re losing a bunch of low-paying customers, then that type of information won’t show up in standard customer churn analysis. Instead, you need customer segmentation based on revenue.

Common Causes of Subscription Churn

To analyze subscription churn properly, you must get to the root of the issue. We can attribute voluntary subscription churn to several factors. Some are not entirely in your control. However, it’s important to take measures to reduce subscription churn whenever you can.

Bad Offers

Sometimes, customers will cancel their subscription if they feel they’re no longer getting adequate value for their money. While outside factors like budget may have an influence on cancelations, it’s possible to manipulate the variables under your control. Your best bet is to use a product like Churnkey that allows you to test different pricing and messaging schemes.

Poor Cancel Flow

If the only thing standing between your customers and cancellation is a big red button, you’re not doing your job correctly. That said, you shouldn’t take your customer's hostage with a lengthy cancel flow either. By viewing session recordings, you can gain valuable insights into where your cancel flow goes wrong, and how to fix it.

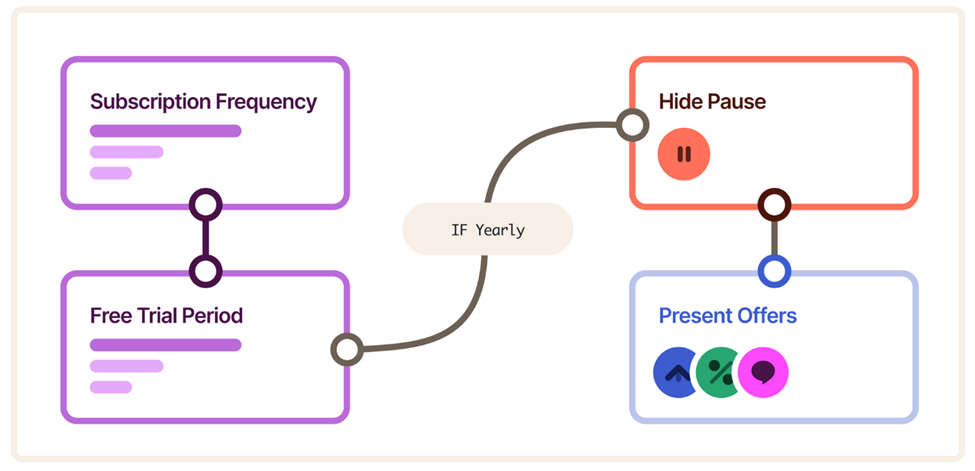

The above is an example of how you could improve your cancel flow by surveying your customers. Afterward, you could generate a custom offer based on those survey insights.

Seasonal Churn

Many businesses find that their subscriptions drop off around a certain time of year. For example, SaaS businesses frequently observe an increase in churn during April’s tax season. Effective messaging can help counter this, among other tactics.

How to Measure Subscription Churn

Now that we’ve piqued your curiosity, let’s examine how to measure the churn rate for subscription services. The calculation is simpler than you might think.

Subscription Churn Rate Calculation

Simply put, you calculate the subscription churn rate for a period using the number of subscribers churned and the total number of subscribers at the period start. We use the following formula:

Subscription Churn Rate = Subscribers Canceled / Total Subscribers at Beginning of Period

The concept is best illustrated using an example. Say, for instance, that you began the month of May with 2,000 customers. Over the month, 160 customers canceled their subscriptions. Hence, your churn rate for May is 160/2,000, in other words, 8%.

Revenue Churn Rate Calculation

Alternatively, you could consider your subscription churn rate in terms of revenue. To do that, use this formula:

Revenue Churn Rate = Revenue Lost from Customers Canceled / Total Expected Monthly Revenue from Customers at Beginning of Period

Once again, a case study will help you get a better picture of this. If in May, you lost $4,000 worth of subscriptions from customers while you were expected to gross $80,000 in revenue from subscriptions at the beginning of the month, then your revenue churn rate is $4,000/$80,000 = 5%.

If your revenue churn rate is much lower than your customer churn rate, then you’re losing the less valuable cohorts based on LTV.

Now that you have two different ways to obtain that churn subscription rate figure, what will you do to reduce subscription churn? You’ll need to be aware of figures like LTV to put your churn rate into context.

Lifetime Value (LTV)

Lifetime value measures how much money a customer will spend over the lifetime of their contract with you. Knowing the LTV of your customers will help you understand whether you should put effort into retaining them. Indeed, you can easily target segments of your customers with the right customer retention tool.

The formula for LTV is as follows:

LTV = Average Sale Value X Number of Transactions X Retention Time Period

The higher your average churn rate, the lower your average retention period, and thus, the lower your LTV. That’s why knowing your subscription churn rate is so fundamental to your business. Increasing your customers’ LTV will increase your company valuation.

How Do You Calculate Churn in a Business Subscription?

Calculating churn in a business subscription (B2B subscription) is no different from the subscription churn rate calculation for customers (B2C subscriptions). That said, B2B subscriptions typically see a lower subscription churn rate than B2C subscriptions.

Whether you sell B2B or B2C subscriptions, the challenge behind calculating churn rate isn’t about deriving a complex formula. Rather, it’s about measuring the churn subscription rate accurately and taking the appropriate actions to lower it.

Therefore, you need to reduce subscription churn by using a cancel flow tool like Churnkey. On average, customers who use Churnkey wind up decreasing voluntary churn by 34%. Moreover, they extend the lifetime value of their customers by around 26%.

Our clients achieve this using powerful customer segmentation that tells you which of your customers to target with dynamic offers created specifically to entice that segment into staying.

What is a Good Churn Rate for Subscription?

A good subscription churn rate will depend on the type of business you run. As we noted earlier, B2B companies typically see a lower churn rate than B2C companies.

The Average Churn Rate for Subscription Services

For a B2B SaaS company, you can expect a churn rate of 4 to 5% most months. Meanwhile, B2C SaaS companies have a monthly churn rate of around 7%. During April, you can expect a 1% increase in subscription churn for all businesses. You can attribute this to tax season, which causes businesses to examine their budgets with a critical eye.

Generally speaking, businesses spend more time weighing the pros and cons of their purchasing decisions. That’s why a normal churn rate for B2B tends to be lower.

The Average Customer Churn Rate by Industry

We already covered the typical churn rates seen in SaaS businesses. However, subscription churn is an important factor to look out for in many other industries too.

If you feel bad about your SaaS company’s churn rate, don’t. Your business’s churn rate is probably far lower than the average in the credit card industry, which is about 20%. Meanwhile, cell companies experience churn rates of up to 38% per month.

That said, business services, healthcare, consumer goods and services, education, and IoT subscription services all see subscription churn rates of about 10% or lower. It depends on the nature of your industry and the degree of loyalty you can expect from your customers.

Why You Should Care About Subscription Churn

Many businesses are so focused on expanding that they forget to properly maintain relationships with the customers they already have. It’s no surprise since this is likely what caused your success in the first place. You flourished due to your insatiable pursuit of growth.

Ignoring subscription churn is like driving your car on the highway while pulling a 20-ton trailer behind you. You’ll never get up to speed without exerting far more energy than you need. Don’t let subscription churn slow you down.

Customer Acquisition Cost (CAC)

One of the main factors in subscription churn analysis is customer acquisition cost. If you’re going to ignore old customers and go after new ones, you should be certain that it’s going to cost you less than it would cost to keep your old clients.

The cost of acquiring customers is the money it takes to reach them using various marketing channels. You could choose to run Google Ads, social media campaigns, or even engage in SEO and content marketing. All those marketing tactics are expensive when done right. You’re usually better served to focus on the customers you’re losing first.

Customer Acquisition Cost Calculation

To determine if keeping a segment of customers is worth it, you should use the following calculation:

Customer Acquisition Cost = Marketing and Sales Expenditure / Number of Customers Acquired

Oftentimes, it is much cheaper and more effective to design a proper cancellation flow for your business than it is to chase new ones. Compare the CAC calculation to the cost of designing a successful cancel flow before you shell out for a big advertising budget.

Increased Company Valuations

It’s hardly surprising. If you focus on growing your revenue efficiently, your company will be worth more money. When it comes time to demonstrate your achievements at the end of the year, you’d do well to say you boosted revenue by reducing subscription churn.

Companies with low subscription churn stand out because their MRR (Monthly Recurring Revenue) is more secure. By contrast, companies with high subscription churn must constantly throw money at acquiring new customers simply to maintain the level of revenue that they’re already at. This can turn into a vicious cycle.

Investors are quite wary of the effects that a high subscription churn rate can have. In 2019, Netflix announced that its subscription churn rate had increased in its second quarter. Consequently, Netflix’s stock fell by about 10%. You might not run a public company as big as Netflix, but you can be sure that any potential investors in your company won’t take kindly to high subscription churn.

Reduce Subscription Churn with Churnkey

Subscription churn is a complex and multi-faceted issue. Fortunately, effective solutions are within your reach. By using our analytical tools to review user sessions, you’ll have the best chance to upgrade your cancel flow and retain more customers. Churnkey empowers you to create custom cancel flows that target the most valuable customer segments you possess.

If you feel ready to make an investment in your business and reduce subscription churn, then create a free account today.