Stripe Dunning: Best Practices and Limitations

The recommended settings for Stripe Smart Retries, Emails, and Expiring Cards.

Dunning campaigns help you recover involuntary churn.

The payment fails and you need to ask the customer to either

a) update the card, or

b) silently retry it if it's a soft decline

Stripe Dunning Is Awesome But..

Stripe dunning can help you go from 0 to 1.

But not from 1 to 100.

At Churnkey, our retention software helped companies recover $250M in revenue across 15M subscriptions in 2024. We saved companies 20-40% of the revenue they'd otherwise lose to churn.

Many of those companies run on Stripe. We partner with Stripe.

This article will show all the tricks and tips you can use in Stripe's dashboard.

We'll also show what Stripe doesn't do today and why we built Churnkey.

This will help you make an informed decision whether to use Stripe. And when is it time to graduate to Churnkey as your default dunning system.

Let's get started.

Stripe's Three Dunning Products

- Retries

- Emails

- Automated Flows

Retries

Sometimes payments fail for reasons like insufficient funds, do not honor, or try again later. These are called soft declines. The solution is to simply retry the card. The customer doesn't need to do anything.

Types of Retries Available in Stripe

- Smart retries: Stripe decides when to retry using AI models

- Custom retries: You decide when to retry

Note:

If you're using Stripe's Smart Retries with Churnkey's Precision Retries, our customer success team will provide custom settings to help achieve an additional ~20% lift in addition to what Stripe recovers.

Bank Debit Retries

If you have accounts with custom invoicing options, you can set up the ACH retries as well.

Subscription Status Settings for Retries

This defines what happens if the user doesn't pay in the given time period, as set in your retries policy. For most businesses, cancel the subscription is the recommended solution.

The three options are:

- cancel the subscription

- mark the subscription as unpaid

- leave the subscription past-due

Invoice Status Settings for Retries

- Mark as uncollectible

- Leave it as past-due

For most businesses, leaving it as uncollectible will get you the best reporting setup.

Stripe Dunning Emails

Stripe provides some simple dunning email flows, accessible in the email tab.

It has two components:

- Recovery emails

- Expiring card emails

Stripe Recovery Emails

You can send an email via Stripe when the payment fails. This is a vanilla dunning email. It's also branded from Stripe. The core action is to update the billing information.

You have two options.

- You can link to a hosted page from Stripe

- Or you can use a custom link. This might be directly to your account updater page in-app.

Stripe is an excellent choice if you're doing nothing. It might even be better than some lifecycle marketing tools.

But take a look at Churnkey to see how we combine the best of both worlds to make a significant impact on your churn.

Churnkey vs Stripe Hosted Page

Brands that use the 'custom link' option via Stripe should be extra careful. The end-user experience can be very janky and the links don't perfectly work because of bugs your team might ship (and won't be aware of).

I've personally had issues updating cards even at companies like Vercel, Pinterest, Github etc. Code can be buggy and you must QA this often. The biggest drop off occurs because the links in the email don't consistently deeplink correctly to the card updater page and users get lost. With Github, the non-dev billing admin was forced to login and had trouble getting to the updater screen.

The best option will be to use Churnkey since it brings the best of both worlds:

- A hosted payment page similar to Stripe so users don't have to login. Unlike Stripe's hosted page, Churnkey feels native to your brand and can be hosted on your domain if you prefer. You can control the copy of the emails and CTAs.

- The benefits of the custom link experience with in-app paywalls, feature gates, and card updater page so everything just works.

- We can offer discounts in the invoices, that Stripe doesn't.

- You get email analytics to understand your copy effectiveness.

- Everything is 30 min setup, much like Stripe.

- Churnkey also allows you to set up a grace period for customers before taking away their access.

- You can communicate via SMS too, and personalize with a custom billing URL

- Unlike Stripe, you can rotate emails for the highest open rates and send it in the customer's local timezone.

- We also bring in custom variables from Stripe automatically, like plan name, subscription age and all the good stuff without slowing down your engineering team.

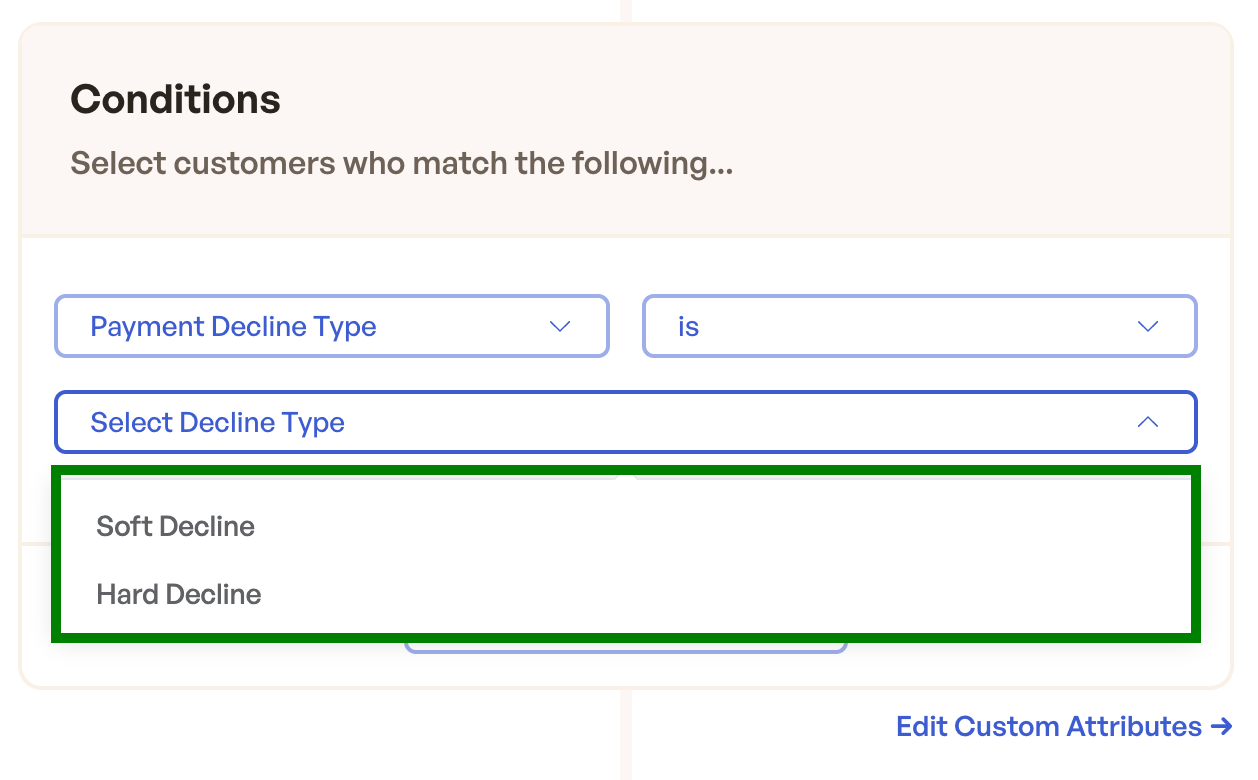

- Customize the email based on a host of different variables. For example, send a different email flow to users whose payments failed due to a soft decline (like do not honor) vs a hard decline (expired card).

- Your dashboard will show how much revenue you have recovered from failed payments.

- For example, this customer has recovered as much from the in-app payment wall as they have from emails.

Churnkey is Built to Recover Revenue

Neither Stripe nor lifecycle marketing tools will get you the same lift or the iteration capacity that Churnkey can.

- For example, if you are a newspaper or periodical, you want to let the customer know they'll be missing out on your 'hard hitting journalism'.

- If you are a SaaS product, you want to give them a sense of the value they'll lose if they don't update their card.

- You might want to offer a discount in the later emails to 'win back' customers who are already considering themselves cancelled.

A lot of it is not possible to configure with Stripe. Most lifecycle marketing tools don't have all the converting features either.

Churnkey is built for one purpose: to help you increase LTV.

All our dunning features are designed to maximize revenue recovery. Our north star metric is your boosted revenue.

In 2024, our data showed that 70% of all involuntary churn we detected was recovered (one of the highest recovery rates in the industry). Read more here.

Expiring Cards

Cards often expire, out of security protocols. These may happen sooner than the date on the card.

You can enable these or disable expiring card notifications.

Studies have shown that enabling this increases churn and card tokens have largely made this a thing of the past. This is not a blanket recommendation for all cases, but it outweighs card expiration email side effects.

If you're a Churnkey customer, don't hesitate to reach out to us for tailored recommendations. We protect billions in revenue and might have the data to recommend whether you should turn it on, keep it turned off, or test it.

Next Steps

- Visit Churnkey

- Sign up or book a demo

- Consider the pros and cons of using Churnkey

- Configure the payment recovery

Want to Learn More About Dunning and Churn?