SaaS Reporting Analytics Guide: Metrics, Tools, Examples

Our top SaaS metrics that will help you run your business most effectively.

With so much data trapped inside a SaaS business, it’s easy to get lost in the SaaS reporting pool. That’s why we put together this guide to help you discover missed opportunities and potential gaps in your business’ metrics and reporting strategy.

A business without data is like a traveler with no map; you may try to make your way around following your gut, but you’ll most likely get lost. To ensure that your business is on the right path, you need to have a quality reporting system and SaaS key metrics that’ll help you maintain business growth.

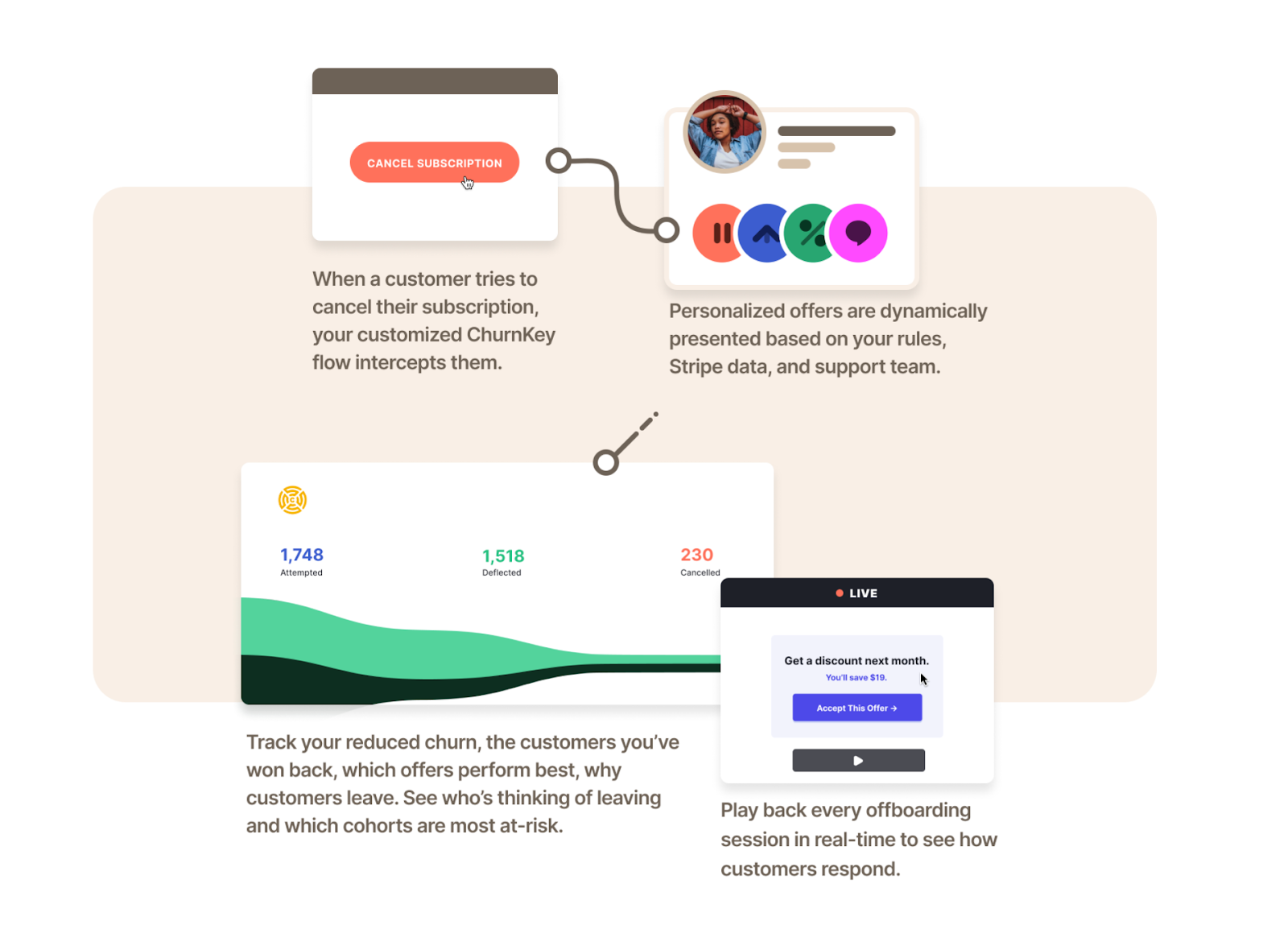

In the past, a simple Excel sheet could do the work just fine. However, in today’s hyper-competitive market, where businesses invest in sophisticated metrics, you don’t want to under-invest and lose out on valuable insights. This is where a SaaS product like Churnkey comes at hand with customized analytics that allow you to measure, analyze and review your churn rate and offboarding flow.

In this guide, you’ll learn:

- Key SaaS metrics you should monitor

- Best SaaS reporting tools

- How to take advantage of your SaaS analytics

Saas Key Metrics You Should Monitor

Not knowing where to focus your attention in your SaaS analytics could get overwhelming and confusing. That’s why it’s important to specify SaaS key metrics and KPIs that’ll guide you through critical decisions. Here are our top SaaS metrics that will help you run your business most effectively:

1. Average Revenue Per User (ARPU)

ARPU is used to calculate the average revenue a SaaS business generates per user or unit over a specific period. It can accelerate your MRR growth by focusing on higher-paying customers and fuel your LTV in the long run. In addition, monitoring your ARPU can help your business align its products' price and value, therefore, boosting your overall sales and marketing system.

To calculate your ARPU, follow the equation:

Total revenue generated during a time period / by the number of users during the same time period = ARPU

So, if your total revenue during December 2021 is $500.000 generated by 2.000 subscribers, your ARPU is 500.000/2.000 = $250 average revenue per user.

2. Monthly Recurring Revenue (MRR)

Like most SaaS businesses, you’ve probably based your business model around monthly or annual subscriptions. Therefore, you must be able to track how much revenue your current customers generate and thus measure your MRR. SaaS MRR can later be used to calculate the ARR (Annual Recurring Revenue) and give you an overview of your gross margins and growth rate.

For example, if you have a cloud computing company with 200 customers paying $20 per month in their subscription plans, your total business MRR would be $4000. That’s why “recurring” stands for the income you expect to be earning on a regular basis.

3. Conversion Rate

Conversion rate is the percentage of people who visited your website vs. the people who actually converted. This SaaS sales metric can be extremely valuable in mapping the traffic you need to generate for your site to hit a specific number of sales. It’s also an excellent indicator of how efficient your sales funnel is or if it needs to be altered.

To measure the conversion rate, you simply divide the number of conversions by your total website visitors and multiply everything with 100:

Conversion rate = number of conversions / total visitors * 100

So, for example, if your SaaS music editor has 1000 visitors every month, from which only 20 turn into paying customers, your conversion rate is (20/1000) x 100 = 2%.

4. Churn Rate

The churn rate calculates the percentage of customers, bookings, or revenues your business lost over a specific period. Naturally, you want to keep this SaaS performance metric as low as possible in your SaaS reports; otherwise, it could signify a gap in your customer retention strategy. A churn audit like the one Churnkey offers can be your ultimate guide on understanding why your customers are leaving and what to do to prevent it.

Customer Churn vs. Revenue Churn

Customer Churn counts for the percentage of customers who didn’t renew or cancel their subscriptions. A decline in a SaaS company’s customer churn indicates unhealthy business dynamics.

To calculate a customer churn, follow the equation: customers lost in a given period divided by the total customers at the beginning of that period, multiplied by 100.

Churn rate = Customers lost in a period / total customers at the beginning of the period * 100

So, for example, if a company started in 2021 with 200 customers and lost 50 of them by the end of the year, by plugging the numbers into the equation, we conclude that the customer churn rate equals (50/200) x 100 = 25%. This number can be a crucial indicator of necessary alterations in your customer retention strategy.

On the other hand, revenue churn stands for the amount of revenue your SaaS business lost in a given period. This revenue loss could be due to software downgrades from existing clients, which means your higher pricing tiers are less attractive than your competitors’, or people simply canceling or pausing their subscriptions.

To calculate a revenue churn, follow the equation:

Revenue churn rate = ((revenue in the previous period - revenue in this period) / divided by the revenue in the previous period) * 100

For example, if your SaaS business had a revenue of 20 million in 2020 and a revenue of 16 million in 2021, by plugging those numbers in the equation, you’ll find that your revenue churn is [(20-16)/20] x 100 = 20%. As a rule of thumb, for normal revenue SaaS churns, you want this percentage to be lower than 10%.

5. Expansion MRR

Expansion MRR stands for the extra revenue your business acquired in a given period from upsells, cross-sells, or upgrades. This SaaS company metric can help develop strategies encouraging current clients to invest more in your business. In addition, it’s an excellent mitigation factor of high churn rates.

To calculate your expansion revenue rate, follow the equation:

Expansion MRR % = New revenue from upsells and cross-sells in a given month / Revenue you had at the end of the previous month

For example, if you managed to earn 10.000 additional revenue from SaaS upgrades in March 2021 with a 200.000 revenue at the end of February, your expansion rate is (10/200) x 100 = 5%.

6. Cost Per Acquisition

Cost per acquisition measures how much money you need to spend to acquire a new customer. This single SaaS metric helps companies develop their pricing strategy to ensure that they make more revenue than it costs to acquire new customers.

To calculate cost per acquisition, follow the equation:

CAC = (marketing + sales expenses) / # of new customers

So, for instance, if your total expenses to market a product and sell it to the consumers is $30.000, and your acquired customers are 2000, the cost per acquisition equals 30.000/2000 = $15 for each new customer.

7. Lifetime Value (LTV)

Lifetime Value is a crucial metric to determine the amount of money a customer will bring to your company from the moment they sign up till they cancel their subscription. LTV should be at least 5 or 6 times higher than cost per acquisition so that your business is profitable. By adjusting your strategy with informed LTV and CAC data, you will be maximizing your growth.

To calculate LTV, follow the equation: number of transactions (T) multiplied by average order value (AOV), multiplied by average gross margin (AGM), multiplied by average customer lifespan in months (ALT), and divided by the number of clients for the period.

CLV = T * AOV * AGM * ALT / Number of clients for the period

So, if your monthly transactions are 100, the order value is $500, the average gross margin is 1.5, the customer lifespan is 4 months, and your monthly clients are 200, your LTV is (100 x 500 x 1.5 x 4)/200= $1500.

For example, Wavve had an ARR of 1M but was suffocating due to industry-high churn rates at 10% to 14%. With Churnkey’s help, it managed to retain over 2000 customers by reducing its churn rate by 8%. This escalated the company’s growth, increased the customers’ lifetime value, and allowed better budget allocation to marketing and sales.

Best SaaS reporting tools

Now that you know which SaaS customer service metrics you should be paying attention to, it’s time to decide on the right tools that could upgrade your SaaS reporting game. Here are our top choices:

- Churnkey. We might be a little biased on this one, but it’s only because we do exceptional work! Churnkey not only delivers a complete breakdown of your SaaS analytics to understand why your customers are canceling their subscriptions, but it also offers them personalized incentives to make them prolong their subscription with you. A win-win for both parties!

- Sisense. A reporting solution that can be infused everywhere, from business applications to workflows and processes. It provides ad-hoc reports in real-time, and you can customize your SaaS analytics experiences to your needs. In addition, Sisense empowers your employees to infuse analytics where they need it to improve their deliverables regarding their skill levels.

- Paddle. A tool that helps B2B and B2C SaaS companies keep an overview of their compliance, pricing strategies, global conversions, and top customers. It connects to a SaaS business’s billing and taxing systems allowing to create new subscription models in the long run. It also reconciles the data collected from subscriptions with accounts’ data, leaving space for identifying top customers from top geographic regions and MRR movement.

- ChartMogul. If you’re looking for an all-in-one tool to keep an overview of your SaaS business metrics, ChartMogul might be the way to go. However, keep in mind that this tool doesn’t specialize in a particular field, per se, improving your churn rates. It’s considered a jack of all trades, but it’ll do the work if you’re looking for an overall SaaS analytics warehouse. For example, you can track your MRR, net cash flow, LTV, subscribers in SaaS dashboard examples, and more. You can even merge customers, edit your MRR, and connect subscriptions for more accurate data.

- Holistics. A self-service tool that allows SaaS companies to curate their own SaaS product metrics without writing SQL or bothering technical teams. Similar to Sisense, it generates ad-hoc analytics reports and delivers them to the whole team in real-time.

Take advantage of your SaaS analytics

Accurate SaaS reporting can help your business overview your cash flow by understanding SaaS sales metrics and taking control over them. Without the proper data, your company will run blind in the dark, unable to scale up or move forward. Specifically, reporting allows you to answer these SaaS analytics questions:

- Why are customers churning?

- Has your revenue increased?

- Which are your top customers?

- Are customers satisfied with your service?

- How can you increase expansion revenue from software upgrades?

- How much money should you be spending to acquire new customers?

- Is your pricing strategy efficient compared to the value for money?

Naturally, all this data means nothing without the right tool to monitor and report them. Churnkey can significantly improve your customer retention while allowing you to reduce your churn rates. Start with a free trial today!