How to Predict Churn and Improve Retention

When churn prediction is done well, it can allow your SaaS company to identify at-risk customers and retain them before they churn.

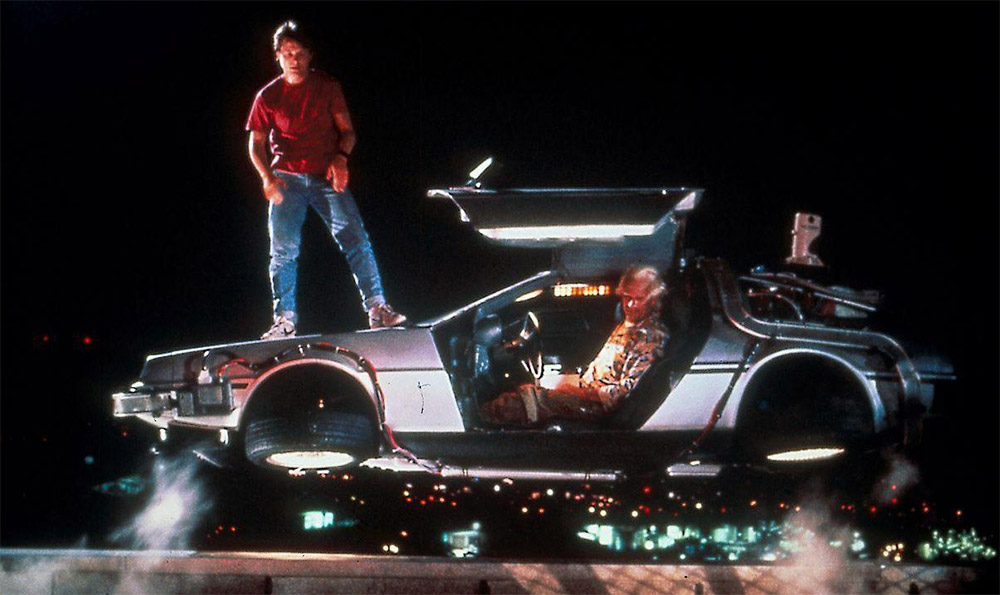

What if you traveled to the future? And when you were there, what if you saw some things in the world, or your life, or the lives of the people you care about that you wanted to change?

When you returned home to your own time, you'd probably make some changes. Intercede in ways you thought could shift negative or less-than-great-outcomes.

Thing is, this isn't a time travel fantasy. When it comes to your subscription business, there's a way to predict which of your customers are more likely to churn. And when you have this intel, you can do something about it.

What is churn prediction?

Churn prediction is the process of collecting and analyzing data in order to predict which customers are at the highest risk of cancelling their subscriptions. When churn prediction is done well, it can allow your SaaS company to identify at-risk customers and retain them before they churn, as well as recognize common pain points or sources of friction amongst your customer base.

How can you predict churn before it happens?

While we can’t actually see what’s going on inside our customer’s heads, here’s the good news: there are measurable indicators you can use that are so helpful it’s almost like taking a peek into the future. We’ve got a few solid strategies to predict churn and identify at-risk customers before they hit the cancel button.

Know your customer health score

The idea behind this is simple: a happy customer is less likely to churn. On the other hand, a less-than-happy customer…well, you get the picture. That’s where your customer health score comes into play. A customer health score is a metric that SaaS companies can track in order to keep an eye on overall customer health and use as an indicator of customers potentially at risk of churning. This value measures a customer’s engagement and satisfaction with your company in general and your product. Check out our guide for calculating your customer health score.

Segment your customers

In order to accurately predict churn, you need to understand your customers and how they behave. That means you need to track important customer data (like product usage levels, what features they use most, etc.), identify patterns, and segment your customers by grouping them together. You can segment based on shared characteristics, such as demographics, purchase history, when they signed up, which plan they're on, or usage patterns.

Identify common churn drivers

Once you’ve segmented your customers, you can start to identify the churn drivers. These are the factors that are most likely to cause a customer to churn. Some common churn drivers include price, product dissatisfaction, and poor customer service. By identifying the churn drivers, you can focus your retention efforts (which we’ll get to soon) on the areas that are most likely to make a difference.

Leverage customer support data

Whenever you receive a customer support ticket or any kind of communication from a customer with customer service, you’re getting data that can not only be used to identify customers at risk of churning but also provide insights into overall issues or gaps within your product. Make sure you collect and analyze your customer support data and pay attention to what trends, if any, you see.

How can you improve retention?

Of course, just realizing which customers are at risk and predicting churn before it happens isn’t the end of the road. None of that information is useful if you can’t use it to actually stop that churn from happening. Once you’ve looked at your data and calculated your retention rate, here are some tactics you can use to improve retention.

Provide point-of-cancellation offers

We mentioned earlier that a big part of churn prediction is identifying at-risk customers before they ever hit the cancellation button. But that doesn’t mean that you’ll be able to actually stop all of those at-risk customers from ever touching the cancellation button. That’s why point of cancellation offers are so important.

Essentially, you want to hit customers who are about to cancel with an offer they can’t refuse. You have a few different options here. You can offer to shift the customer to a different pricing tier, provide them with a temporary discount, or even offer a subscription pause. The key here is to have an effective cancellation flow in place.

Automate failed payment management

Did you know that payment failures could be causing up to 40% of your churn? That’s why dunning management is so important if you want to improve customer retention. Dunning management is a process that SaaS companies can use to track down their outstanding invoices and ensure they get paid on time. By implementing a done-for-you dunning management system, you can automatically recover failed payments before they cut into your bottom line.

Clearly communicate value

One extremely common (and simple) reason for churn is that customers aren’t seeing the value in your product. If this is an issue that your churn prediction data is revealing, then it’s imperative that you connect with your at-risk customers and ensure they’re getting maximum value out of your product. Try sending targeted email campaigns to at-risk customer segments — for instance, you could focus on a customer segment that’s failed to adopt a major feature or update. You could use these emails to give nudges, provide ongoing education, solicit feedback, etc.

Do you want to predict churn and improve retention?

With Churnkey, you don’t have to worry about manually following up with each and every at-risk customer. Instead, you can predict and stop churn in its tracks before it occurs.

Sound helpful? Sign up for a free trial and experience firsthand how Churnkey is helping SaaS businesses reduce churn and improve retention.