Dunning Management: What Is It and Why Should SaaS Companies Care?

Proactively manage customer and revenue churn through a process known as dunning management.

“A promise made is a promise kept” isn’t always true—especially in a recurring revenue business like SaaS.

Whether it’s due to a declined credit card or missed payment, sometimes your customers won’t be able to pay. This doesn’t seem like a huge problem on a case-by-case basis, but it can create serious problems at scale. Over time, outstanding revenue will start to pile up and leave you with a monthly cash flow that’s less than desirable.

So how do you track down and collect on revenue that’s rightfully yours?

The answer: Dunning management.

To ensure long-term success and consistent revenue growth, SaaS companies need to proactively manage customer accounts through a process known as dunning management. This method automates the collections process so you can avoid involuntary churn from customers with late, failed, or missing payments.

In this article, we will dive deeper into what dunning management is, why it should be a top priority for SaaS leaders, and how it ties into important metrics such as customer churn, cash inflows and outflows, net revenue retention, and overall revenue growth.

What is dunning management?

Dunning management is a process that SaaS companies can use to track down their outstanding invoices and ensure they get paid on time.

A typical dunning management process involves sending out reminders to customers who haven't paid their bills, and escalating the follow-up process if necessary. This can include sending out late payment notices, scheduling custom dunning emails, or even using collection agencies to retrieve money that's owed. By keeping on top of dunning, businesses can ensure that their cash flow stays healthy and that they don't have to chase down customers for payment.

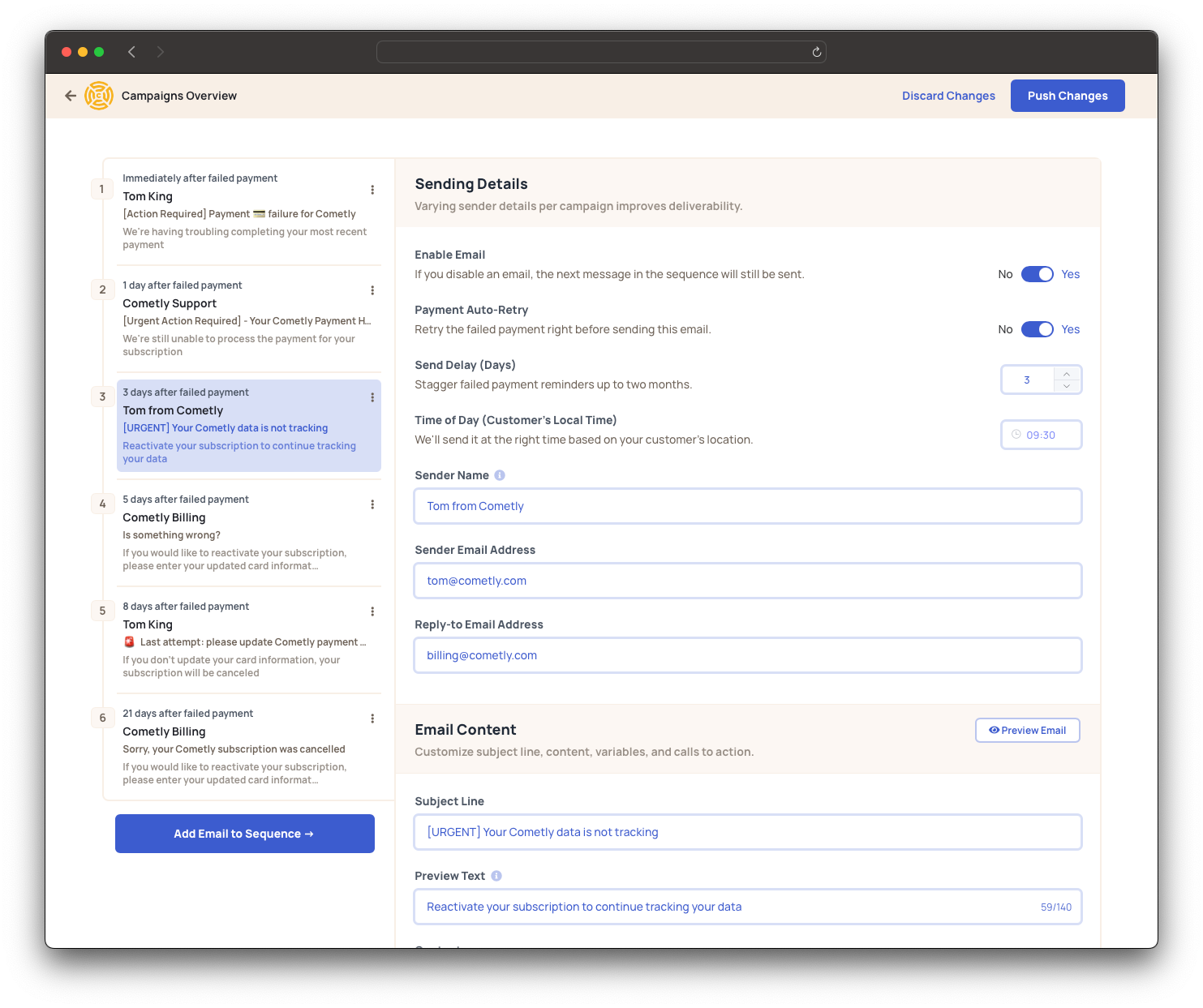

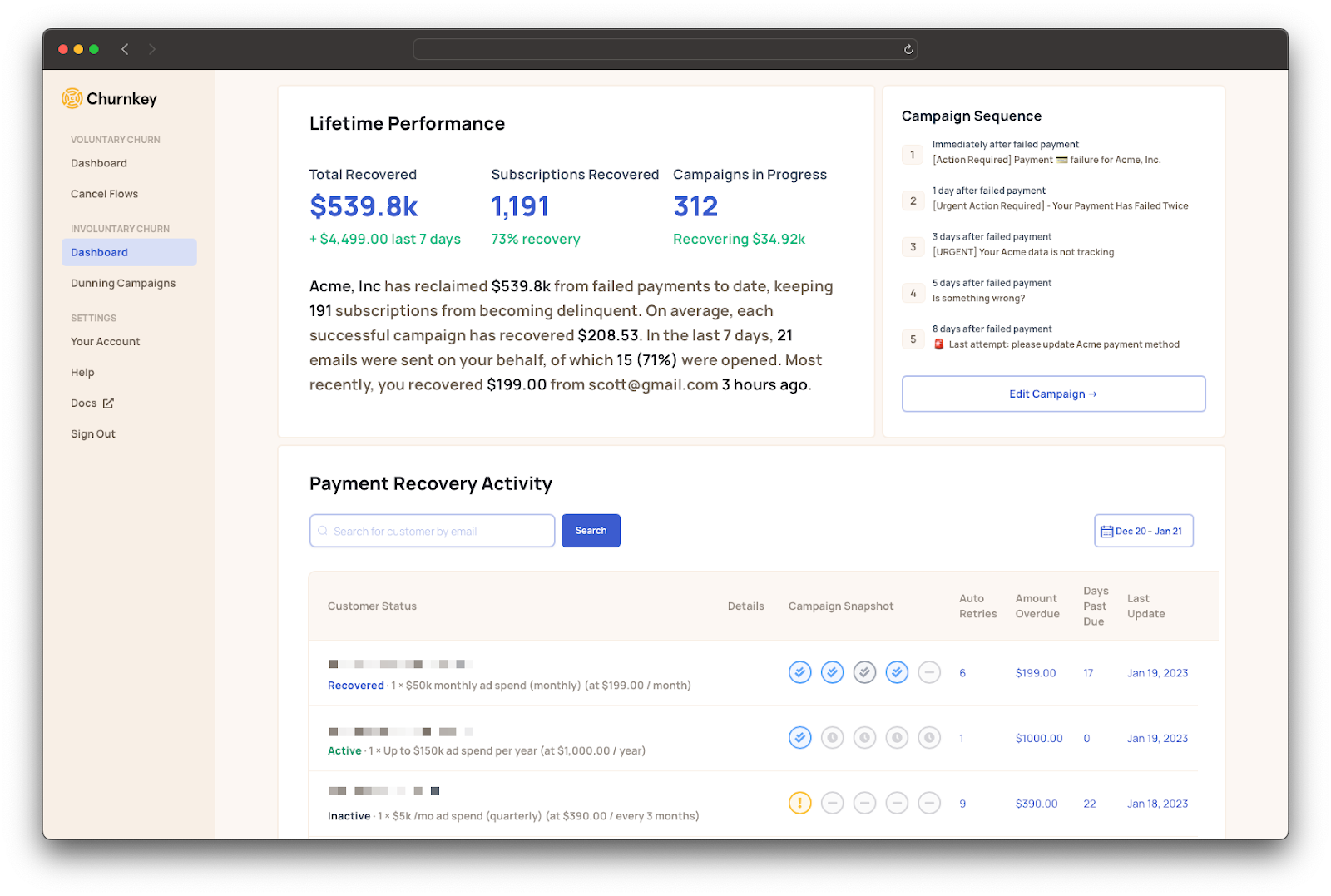

For example, at Churnkey, we help our customers recover failed payments automatically with done-for-you dunning management. Instead of having to rely on an aggressive collections agency or handling collections all by yourself, a tool like Churnkey automates the collections process for you.

Common reasons for payment failures

One of the most frustrating parts of dunning management is that, most of the time, failed payments aren’t even your fault. Here are the most common reasons for failed payments in SaaS:

- Credit card expiration: The customer's credit card on file may have expired, resulting in the failure of the payment.

- Insufficient funds: The customer's account may not have enough funds to cover the payment.

- Declined transactions: The customer's bank or card issuer may have declined the transaction for various reasons such as suspicion of fraud or insufficient credit.

- Incorrect payment information: The customer may have entered incorrect payment information, such as an incorrect expiration date or security code. This can easily be solved by keeping your customer’s payment information on file—especially when you’re managing larger accounts with a higher average ACV.

- Subscription cancellation: The customer may have canceled their subscription before the payment was processed. In this case, you should have a customer success rep or churn management platform like Churnkey at the ready to avoid voluntary cancelations.

- Payment gateway issues: Technical issues with the payment gateway may prevent payments from being processed. If you’re experiencing issues with a payments provider, you may need to request support on their end to resolve the issue.

- Lack of communication: Late and missing payments are typically caused by a lack of communication. Instead of outsourcing collections to an agency or trying to handle them on your own, you can use dunning management software like Churnkey to provide your customers with timely reminders for upcoming payments.

Why you need dunning management in SaaS

Whether you’re VC-backed or bootstrapped, one of the most important things you need to keep an eye on is your cash flow. After all, if you're not getting paid on time, you're going to have a hard time keeping your business running. That's where dunning management comes in.

Here are some of the key benefits of using dunning management for SaaS companies:

- Maintaining stable cash flow: By keeping on top of dunning, you can make sure that your cash flow stays healthy and that you don't have to chase down customers for payment. This is especially important for SaaS companies that rely on recurring revenue.

- Preventing revenue leakage: A dunning management system can help you identify and prevent revenue leakage, which is when customers involuntary cancel their subscriptions as a result of failed or missing payments.

- Reducing churn rate: Dunning management can also help you reduce churn by sending out reminders and escalating the follow-up process. With a tool like Churnkey, you can make sure that customers are aware of their outstanding invoices, pause their subscriptions, and take the necessary steps needed to avoid involuntary churn.

- Higher valuation: As investors continue to prioritize growth and retention metrics, reducing involuntary churn and maintaining a stable cash flow will help you achieve a higher valuation.

The danger of failed payments and your bottom line

It's estimated that almost half of subscription churn is caused by failed payments. That’s no small statistic.

To make matters worse, it becomes increasingly difficult to manually keep track of failed, late, and missing payments as your company’s customer base grows. You might not even be aware that a customer's credit card has expired or that they have insufficient funds until it's too late.

Without a dunning management process in place to manage and reduce the chance of payment fails, you risk losing your hard-earned revenue to problems that are outside of your control.

A closer look at manual dunning vs. automation

What do you do when a customer isn’t able to pay their invoice?

Freezing a customer’s account too fast can create unnecessary friction, but being too lenient could leave you with a noticeable revenue gap in your monthly statements—this is what happens when you try to handle collections all by yourself.

However, with a dunning automation tool, you can keep track of outstanding invoices and make sure you get paid on time. Here's how else it can impact some of the key tasks involved in dunning management:

- Identifying overdue invoices: Automating your dunning processes can help you quickly and easily identify which invoices are overdue so you can take action right away.

- Sending payment reminders: With automated dunning you can send out payment reminders automatically, so you don't have to worry about remembering to do it manually. This will give you a leg up on customers who are at risk of payment issues due to a failed transaction.

- Issuing late payment penalties: Want to encourage your customers to pay on time? A dunning automation tool can help you issue late payment penalties whenever a customer fails to pay on time.

- Escalating unpaid invoices: Dunning automation can help you escalate unpaid invoices to the next level of follow-up, such as assigning a customer success rep to step in and manage the account.

By automating these tasks through dunning automation, you can minimize unnecessary friction with customers, reduce collections errors, ensure consistency and scalability, and free up your team to focus on more important tasks.

For example, Grant Cooper, Co-founder of Cometly, was able to “ship fast and grow faster” by using Churnkey to automate his dunning management processes.

No founder wants to think about failed payments or has the time to deal with them. Churnkey stepped up and did it for us — setting us up quickly and optimizing everything — so we could focus on what we love to do: ship fast and grow faster."

Don’t let failed payments hinder your growth

Between macroeconomic factors, long sales cycles, and an increasingly competitive marketplace, SaaS companies have enough obstacles to overcome in order to hit their growth goals.

You can’t afford to lose customers due to payment failure, and you need the right tools to stop it

With a payment recovery platform like Churnkey, you won’t have to worry about following up on outstanding revenue or failed payments ever again. Schedule a demo or sign up for a free trial to see how Churnkey is helping SaaS companies like yours stay on top of their collections.

FAQ

What is a dunning strategy?

A dunning strategy is a set of actions and processes that subscription businesses put in place to manage and collect outstanding revenue. It typically includes sending payment reminders, negotiating payment plans, issuing late payment penalties, escalating unpaid invoices, and reviewing and updating policies and procedures. A successful dunning strategy helps SaaS companies maintain a stable cash flow, prevent revenue leakage, and reduce churn.

What is the difference between dunning and bill collection?

Dunning and bill collection are both processes used to manage outstanding invoices, but they refer to different stages of the process. Dunning is the process of sending reminders and escalating follow-ups for unpaid invoices, while bill collection refers to the process of taking legal or other action to recover unpaid debts. Dunning is typically a less aggressive approach to managing unpaid invoices, while bill collection is the final step taken when all other efforts to recover the debt have failed.

When is dunning an effective strategy?

Dunning is an effective strategy when SaaS companies want to manage outstanding invoices and ensure timely payment. It is particularly useful for businesses that rely on recurring revenue, as it can help them maintain a stable cash flow, prevent revenue leakage, and reduce churn.