Customer Churn: What Churn Is, Why It Happens, How to Improve Your Churn Rate

Customer churn—caused by cancellations and payment failures—is an inevitable issue for every SaaS business. It silently chips away at your bottom line and, over time, can significantly harm the health of your company. So if you want to grow your revenue and break through a looming growth wall, defeating customer churn is one of the most effective ways to do it.

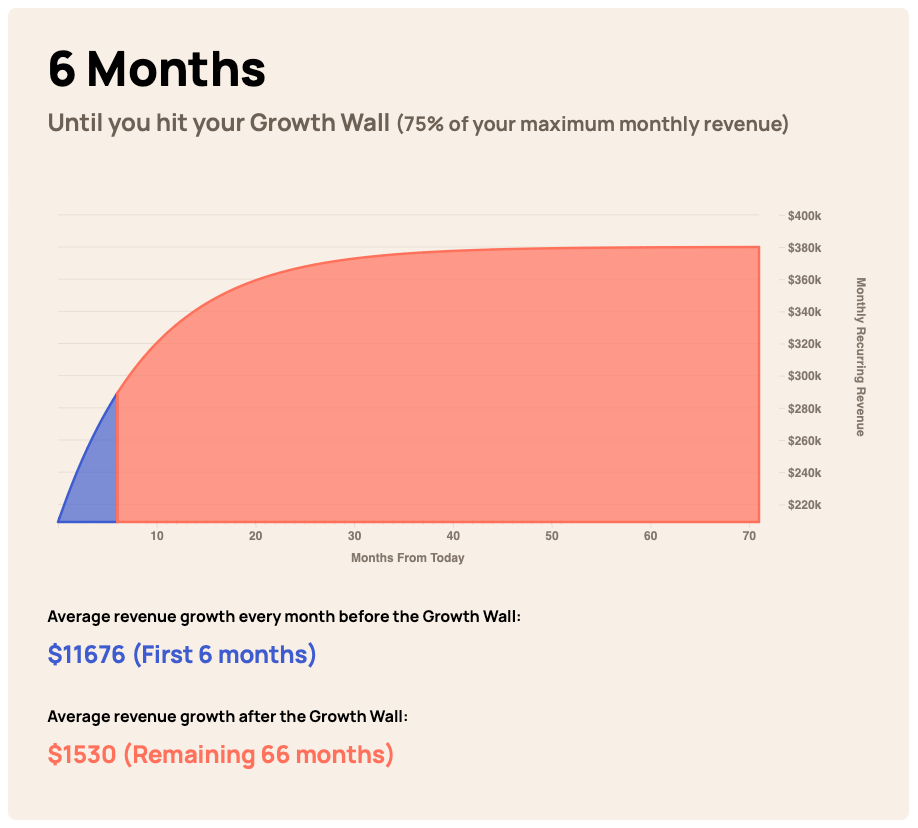

To see the effect churn has on your medium- to long-term growth, consider a hypothetical business. Let's call the company SienarCast, which:

- has 10,000 customers

- adds 2,000 customers per month

- makes of average of $19 per user

- has a monthly churn rate of 10%

With that churn rate, SienarCast will hit a growth wall around six months.

Now, let's cut that churn rate in half to 5%. Suddenly, SinearCast's MRR growth is extended out to 21 months👇

Of course, reducing customer churn is easier said than done. It’s not always intuitive, and there’s no one-size-fits-all solution. In order to effectively prevent churn, you need to have a complete, well-rounded understanding of churn.

As churn experts, we’re here to let you in on all of the details you need to know. Let’s talk about exactly what churn is, why it happens, and what strategies you can use to combat it.

What is customer churn?

Customer churn, sometimes referred to as user churn or customer attrition, is the total number of customers who canceled their subscription during a given period. Customer churn happens in a SaaS business when a customer or subscriber cancels their subscription for any reason. Churn is calculated as the percentage of lost customers compared to total customers over a certain period of time.

Why does customer churn matter?

Of all the metrics associated with SaaS businesses, customer churn is arguably the most important. Why? Because in a subscription-based business model your company’s overall revenue is tied directly to sustaining that recurring customer relationship.

Customer churn affects recurring revenue

When customers churn, it reduces your recurring revenue. And monthly recurring revenue, or MRR, is what sustains any SaaS business. Without this recurring revenue, it will be impossible to sustain your business in the long-term.

Customer churn increases your costs

Here’s an incontrovertible fact: it’s always more expensive to acquire new customers than it is to sustain existing ones. Customer acquisition cost, or CAC, refers to the total cost of sales and marketing that you need to bring in new customers. Your company’s CAC will be a defining factor in the overall profitability of your company and potential for future growth.

A successful SaaS business needs to have a CAC that is significantly lower than your customer lifetime value (LTV). And in order to increase your LTV and decrease your CAC, you need to effectively combat customer churn.

Customer churn makes it harder to improve customer engagement

Not only is it more expensive to acquire new customers than to keep existing ones — you’re also more likely to get more engagement and more revenue from your current customers. That’s because existing customers are more likely to spend more money than new customers.

After all, they’re current customers for a reason. They’re already using your product and likely already have a certain degree of brand loyalty. And if they’re already finding value in your product, then they’re more likely to be interested in add-ons or higher tiers. That makes them significantly easier to upsell to than newly acquired customers.

Improving the engagement of your existing customer base and upgrading current customers is one of the best ways to increase your overall revenue.

Why does customer churn happen?

In order to reduce your overall customer churn rate, you have to dig into the root of your customer churn issue. And that answer is going to be at least slightly different for every SaaS company. After all, customers churn for a variety of reasons. Reasons for customer churn will fall under one of two categories: voluntary and involuntary churn.

Many SaaS businesses tend to focus on involuntary churn. Involuntary churn happens when a customer’s subscription is cancelled, but they didn’t actually take any action to cancel it. This typically happens when there’s a payment failure as the result of a credit card issue.

But voluntary, or active churn, is actually the most common type of customer churn in SaaS businesses.

Voluntary (or active) churn happens when a user actively intends to cancel their subscription. There are many reasons for churn that fall under the category of voluntary churn. Let's jump into a few reasons why your customers might cancel.

Poor customer service or experience

If your customer doesn’t feel like they’re receiving adequate service or assistance with troubleshooting, or they’re not having a good experience within your product, then they may begin to feel they’re not receiving adequate value for their money. This can lead to voluntary customer churn.

Unsuccessful onboarding

When a customer isn’t onboarded well, then it’s much more likely that they’ll have a hard time seeing the full value of your product. And if they’re not seeing value, then they’ll likely cancel eventually. That’s why a smooth and informative onboarding process is so critical when it comes to churn reduction.

Seasonal churn

For many SaaS businesses, subscriptions may drop off more substantially during certain times of year. That can be due to season churn, where businesses are inherently seasonal and therefore cancel their business subscriptions during the periods of the year when their business is slower and they’re trying to cut costs or they no longer need certain services.

What can you do about customer churn?

Fighting and reducing customer churn is only possible if you have effective systems and processes in place. Once you’ve taken the time to determine what factors are driving churn in your particular business, you can start using the appropriate strategies to address those specific issues.

Create effective cancellation flows

If the only thing standing between your customers and cancellation is a big “Cancel my subscription” button, then you’re missing out on a prime opportunity to prevent customer churn before it ever happens.

Start by asking the right customer exit survey questions. It's essential if you want to reduce the maximum amount of churn. The best strategy is always to present a short-form, simple exit survey so that your customers are more willing to engage.

This initial survey will help you inform product development. The results will highlight where your product has the most opportunity to improve.

In our research, instituting an effective cancellation flow can not only help you reduce customer churn, but it can increase customer loyalty and provide valuable data for what makes customer cancel.

Reduce probable churn

When it comes to most types of churn, you can use strategies to identify at-risk customers, predict churn before it happens, and prevent them from churning by addressing their concerns. One way to do that is to provide targeted, relevant offers or incentives to at-risk users in order to retain them as customers, giving you an extended opportunity to demonstrate your product’s value.

Aim for a negative churn rate

MRR is your total monthly revenue derived from recurring subscriptions. This metric combines both annual and monthly subscriptions. MRR can be calculated as the total recurring revenue generated by your existing customers.

A negative churn rate means that your MRR is greater than the revenue lost to churn. In short, you’re earning more than you’re losing. By aiming for a negative customer churn rate, you can skyrocket your company growth—which some of the best subscription businesses in the world have figured out how to achieve:

- ZenDesk (123% Dollar Retention Rate)

- New Relic (115% Dollar Retention Rate)

- Box.net (130% Dollar Retention Rate)

Handle customer churn automatically with Churnkey

Clearly, customer churn is a complex issue. But that’s why we created Churnkey.

With Churnkey, you don’t have to worry about manually following up with each and every at-risk customer. Instead, you can identify and stop churn in its tracks before it occurs with customer-centric, user-friendly experiences.

Are you ready to start combating customer churn? Sign up for a free trial and see how firsthand Churnkey is helping SaaS businesses reduce churn and retain more users.