What is Voluntary Churn: The Foundation

The majority of your customer loss is happening because customers are choosing to leave. But you can do something about it.

The companies that win at retention are not just tracking churn on a dashboard somewhere. They're treating it like the strategic priority it is; the kind that shapes everything from your product roadmap to your pricing to how you talk to customers.

What is Voluntary Churn for Subscription Businesses?

Voluntary churn is straightforward: a customer makes the conscious decision to hit the cancel button. Maybe the product stopped delivering value. Maybe they found something cheaper, or they're tightening their belt, and you didn't make the cut.

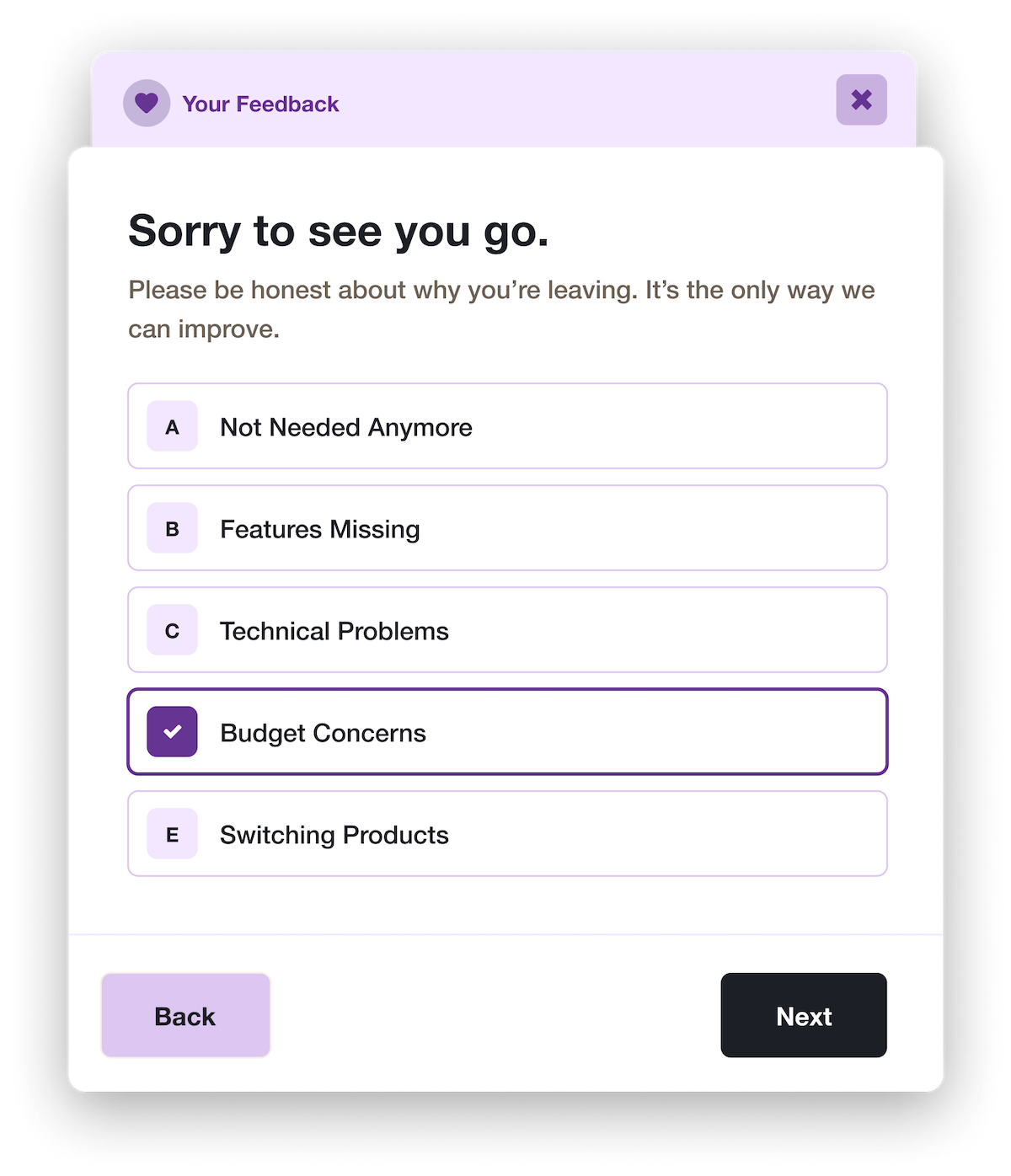

The moment of cancellation is your last chance to show up with the right offer, the right message, or remind them what they paid for and what they're about to lose.

Calculate your voluntary churn rate by dividing the number of customers who intentionally canceled by your total customers at the start of the period, then multiplying by 100. We cover measurement strategies in detail later in this guide.

Voluntary vs Involuntary Churn Differences

Understanding the difference between voluntary and involuntary churn is critical because they require different strategies and solutions. Voluntary churn happens when customers choose to leave.

Involuntary churn occurs when subscriptions end due to failed payments, expired cards, or billing errors; customers who want to stay are automatically canceled because of payment issues.

The Business Impact of Voluntary Churn

Every customer who cancels takes their subscription revenue with them, turns your acquisition spend into a sunk cost, and slows down your momentum. It compounds over time, and not in a good way.

Voluntary churn is the only metric where customers literally tell you what's wrong if you ask correctly.

Here are key reasons why managing voluntary churn is critical for any SaaS business:

- Most of your churn problem is fixable. In B2B SaaS, about 84% of churn is voluntary on average.

- Customer Acquisition Cost (CAC) waste: When a customer churns, all the marketing and sales dollars spent to acquire them are lost. It means customers you worked hard (and paid) to win over are leaving prematurely, dragging down your ROI on acquisition.

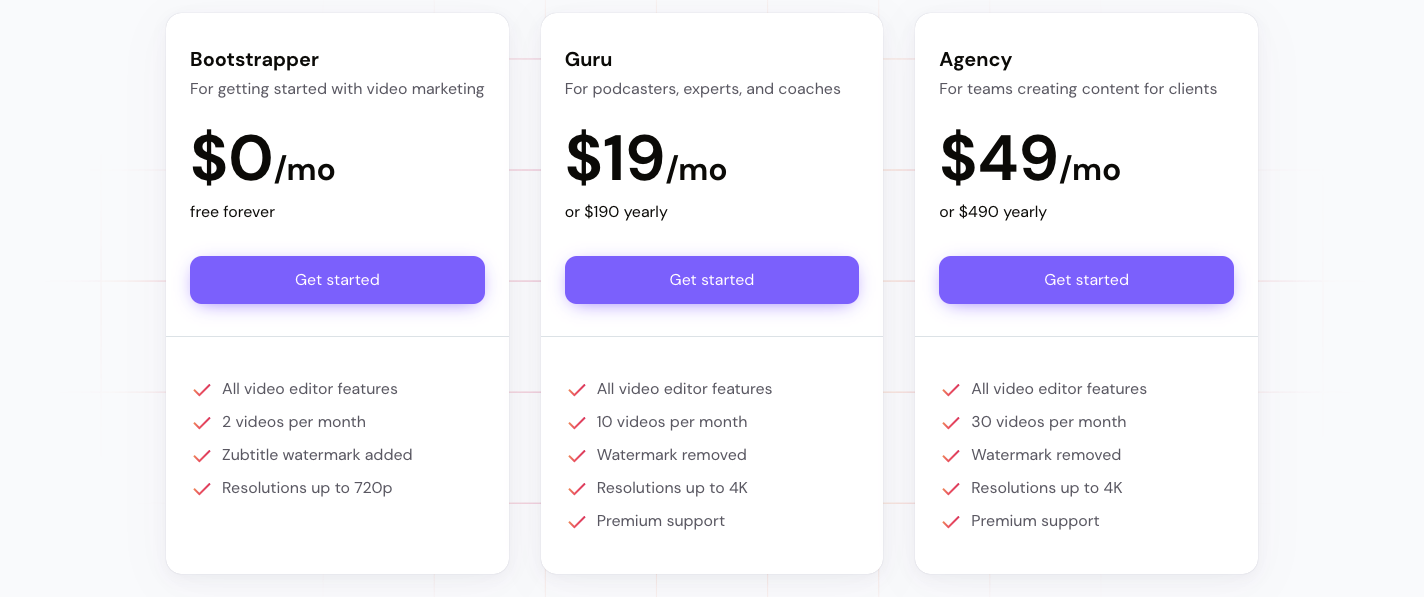

- Profitability and LTV: The longer customers stay (and upgrade their plan), the higher their lifetime value (LTV) and the more revenue you earn relative to costs. You can use our free calculator to determine your LTV.

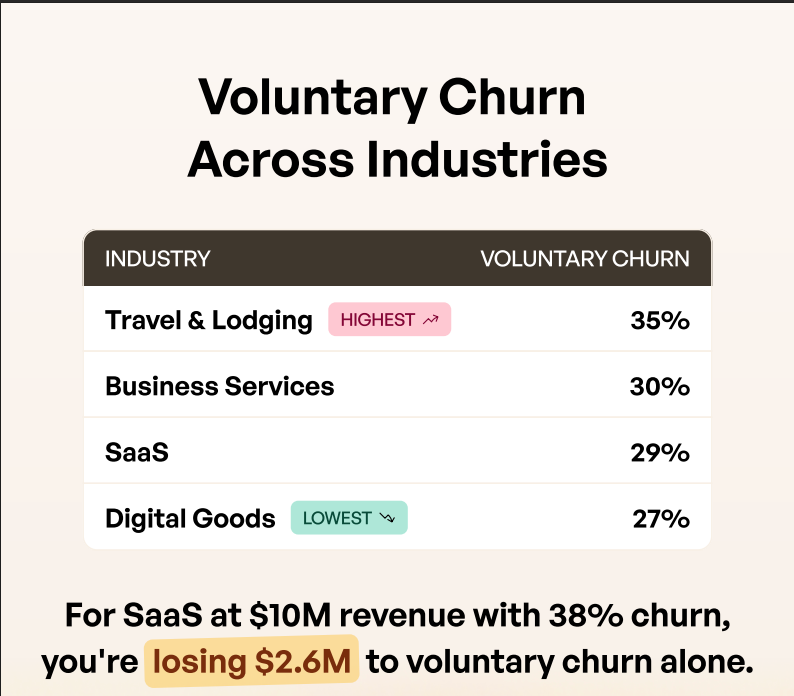

- Benchmark comparisons: While “acceptable” churn varies by industry and business model, many B2B SaaS companies aim for <5% annual churn.

Revenue loss and growth impact: Churn directly translates to lost revenue and limits your growth potential. Consider a SaaS company doing $10M ARR with ~38% annual churn (around the SaaS average). If ~78% of churn is voluntary, that’s roughly $2.6M in revenue lost per year from customers deciding to cancel.

Root Causes of Voluntary Churn (With Solutions)

Churn follows clear, predictable patterns with warning signals you can spot and measure. Once you understand the root causes driving your customers out the door, you've got specific intervention points.

Pricing and Budget Constraints

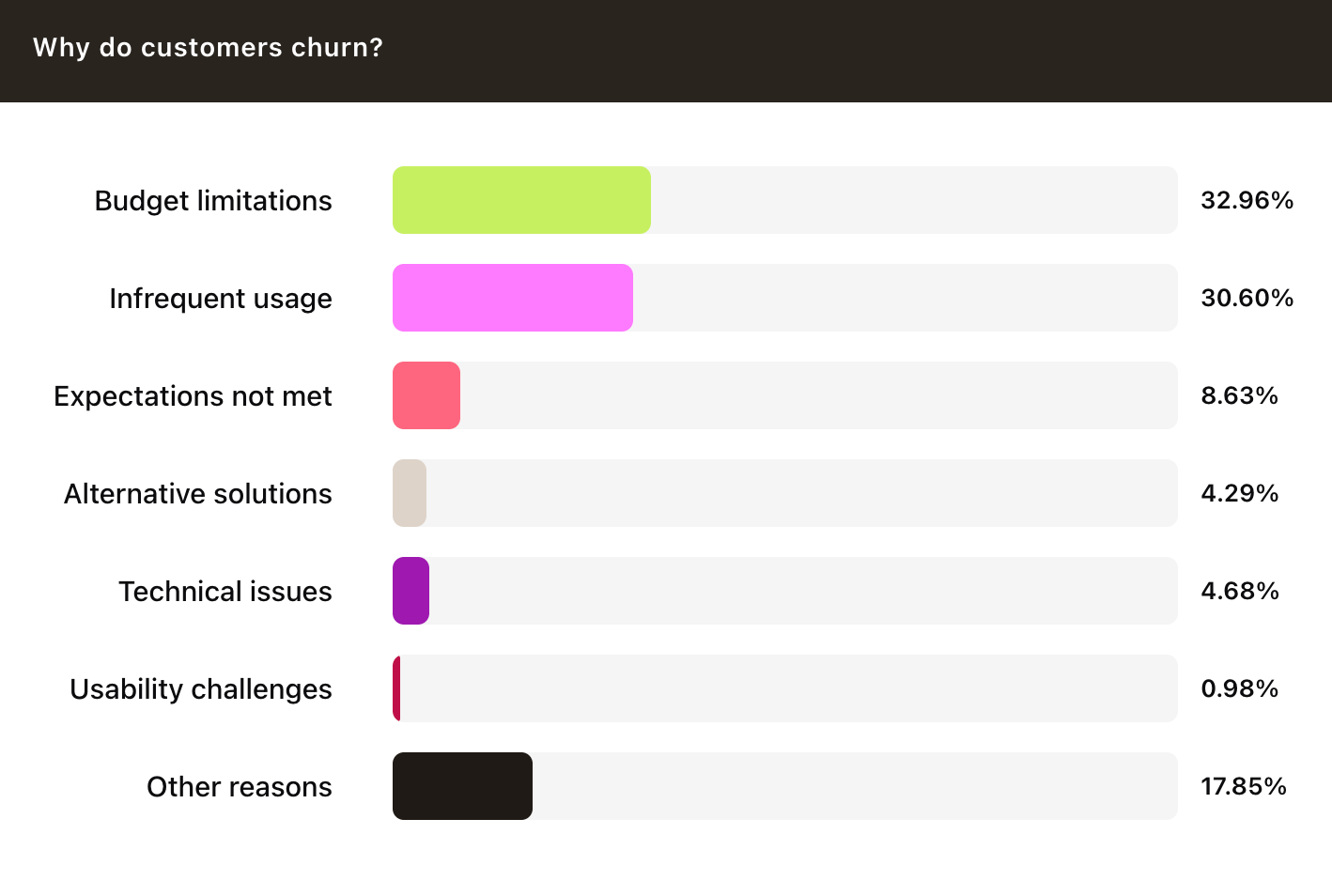

Look at the data from Churnkey's cancellation analysis: about 32% of people who cancel do it because they're just not using the product. It happens because either the product didn't deliver what they expected, or they never figured out how to get value from it in the first place. If someone isn't opening your product regularly, they're not going to keep paying for it.

Budget limitations were cited in ~33% of cancellations; the #1 reason in Churnkey's dataset of 2+ million cancellation responses.

Warning signals:

- Customers on your highest-priced plans are canceling at higher rates.

- Churn spikes after price increases.

- Downgrades from annual to monthly.

- Cancellations increase around renewal periods or when the fiscal year ends.

What you can do: When a customer selects "too expensive" or "budget constraints" in your cancel flow, you can immediately present a tailored offer: maybe 30% off for 3 months to get through a tight budget period, or a downgrade to a lower plan to keep them in the ecosystem.

Infrequent Usage and Lack of Perceived Value

Infrequent product use accounted for ~30% of cancellations in Churnkey's analysis, making it one of the top two reasons customers leave. This often happens because of unmet expectations: the product didn't deliver what they hoped for, or they never understood how to extract value from it.

When customers aren't using the product regularly, they won't justify paying for it.

Warning signals:

- Declining login frequency.

- Feature usage is dropping off after initial exploration.

- Low engagement with core features.

- Days or weeks between logins.

What you can do: When customers select "not using it enough" or "doesn't do what I need," you can respond with personalized reminders of features they haven't tried.

Feature/Capability Limitations

Your product doesn't have a feature the customer needs: they outgrew you as their needs expanded, or they never fit in the first place.

Warning signals:

- Feature requests from customers who later churn.

- Support tickets about workarounds.

- Customers asking about integrations you don't support.

- Usage is concentrated in only the basic features.

What you can do: When customers tell you which feature would have kept them, that's actionable product intelligence. Some businesses use cancel flows to offer trials or pauses for customers waiting on specific features, saying, "Stick around, the feature is coming."

Competitive Alternatives

It means a competitor has attracted your customer away with better features, pricing, or positioning. Around 4% of churned customers said they found an alternative solution that fit them better.

Warning signals:

- Sudden drop in usage after competitor launches/announces.

- Customer requests for data export.

- Comparing your product to alternatives in support conversations.

What you can do: When customers select "found a better alternative" in your cancel flow, you have one last chance to win them back. Some businesses present comparison charts highlighting advantages, or match competitor pricing temporarily.

Technical Issues and Usability Challenges

Your product can do what customers need it to do, but your customers are leaving anyway because bugs, performance issues, or a confusing interface are making it too painful to use.

Warning signals:

- Multiple bug reports from the same customer.

- Support tickets about how to do basic tasks.

- Customers are abandoning key workflows mid-stream.

- Higher churn among users of specific features with known issues.

- Negative feedback about UI/UX in surveys or reviews.

What you can do: When customers mention technical problems or usability issues in your cancel flow, it's a last-chance intervention point. For example, some businesses offer a discount or pause while the problem is being fixed, saying, "We're on it, please give us another chance."

Poor Onboarding Experience

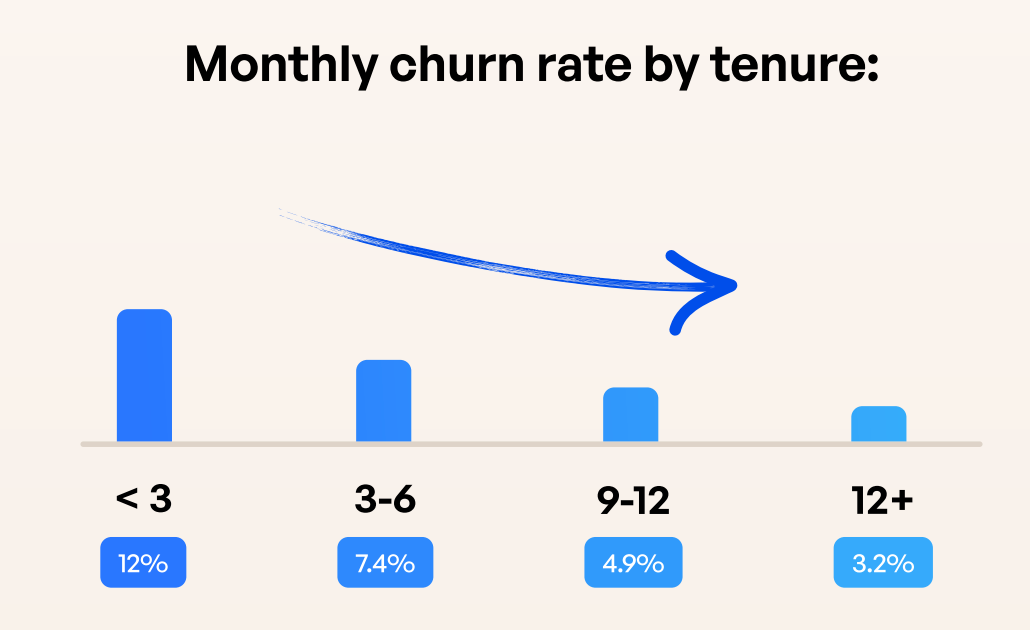

New users don't understand how to use your product or see its value, so they never fully adopt it. Churn is highest in the first few months of a subscription. Customers in their first 3 months have a ~12% monthly churn rate, far higher than the ~3% rate for customers past one year.

If you're seeing a spike in cancellations within 14 days of signup, you've got an onboarding problem.

Warning signals:

- Low feature adoption in the first 30 days.

- No return visits after initial signup.

- Trial users who never complete the setup.

- Support tickets are increasing in week 1.

What you can do: When early-stage customers hit your cancel flow, the feedback they provide tells you where onboarding broke down.

Change in Customer Circumstances

Companies shut down, personal situations change, projects end, etc - life or business changes that make your product no longer relevant.

Warning signals are hard to predict, but sometimes customers explicitly state that the situation has changed.

What you can do: When customers select "no longer need it" or "circumstances changed," you can offer a pause (1-3 months) instead of full cancellation.

How to Calculate Voluntary Churn Rate

Count how many customers intentionally hit cancel during a period, divide it by your total customers at the start, and multiply by 100. If you had 1,000 customers on day one of the month and 30 of them walked away on purpose, you're looking at 3% monthly voluntary churn.

Segment the churn number: break it down by cohort, plan tier, customer size, and lifecycle stage. You might find out that customers who came in through a Black Friday promo are churning at 2x the rate of your organic signups. Or annual customers who make it past the 13-month mark never leave, while your monthly folks are stuck at 3-5% no matter what you do.

Measuring and Monitoring Voluntary Churn

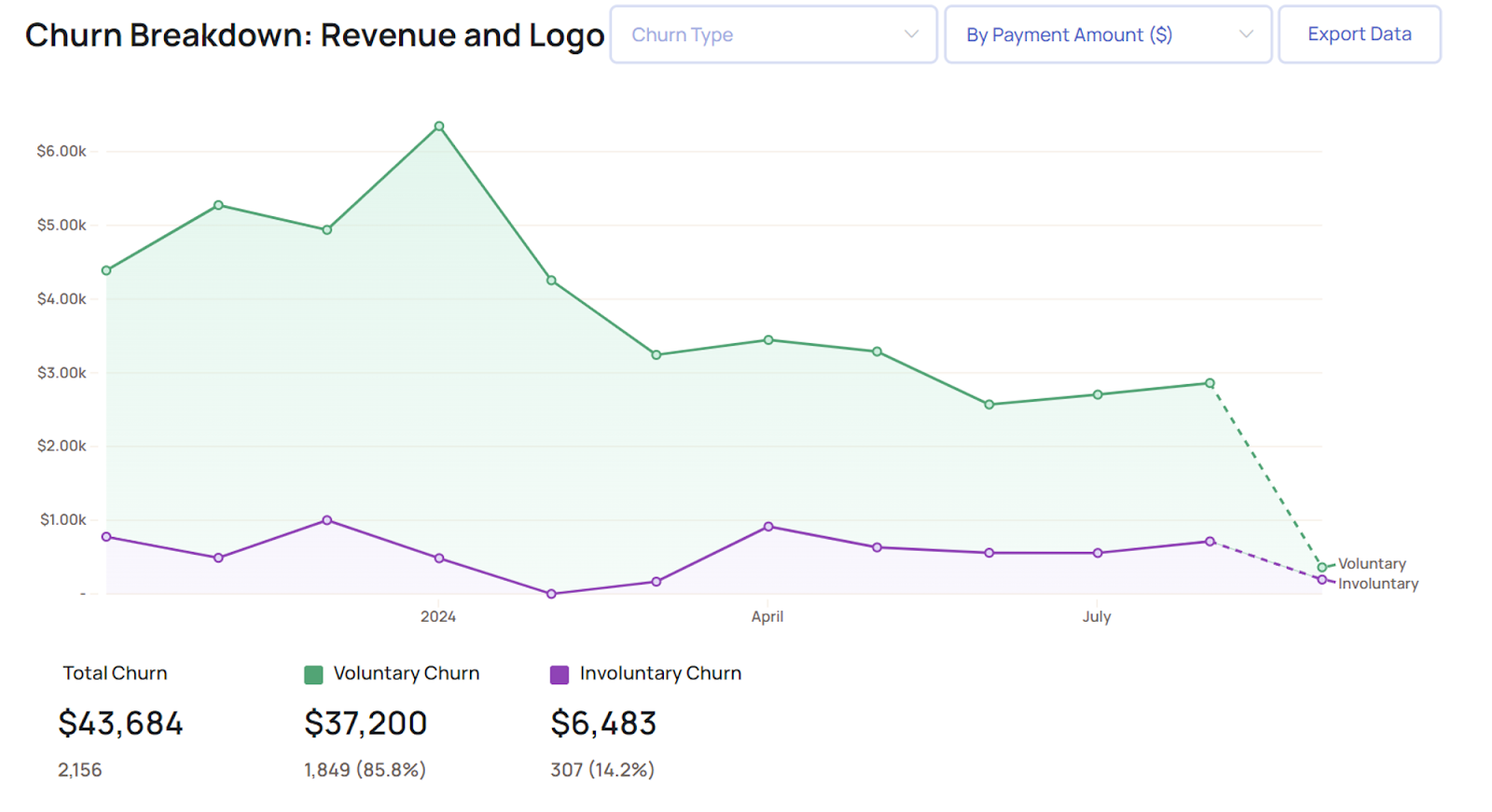

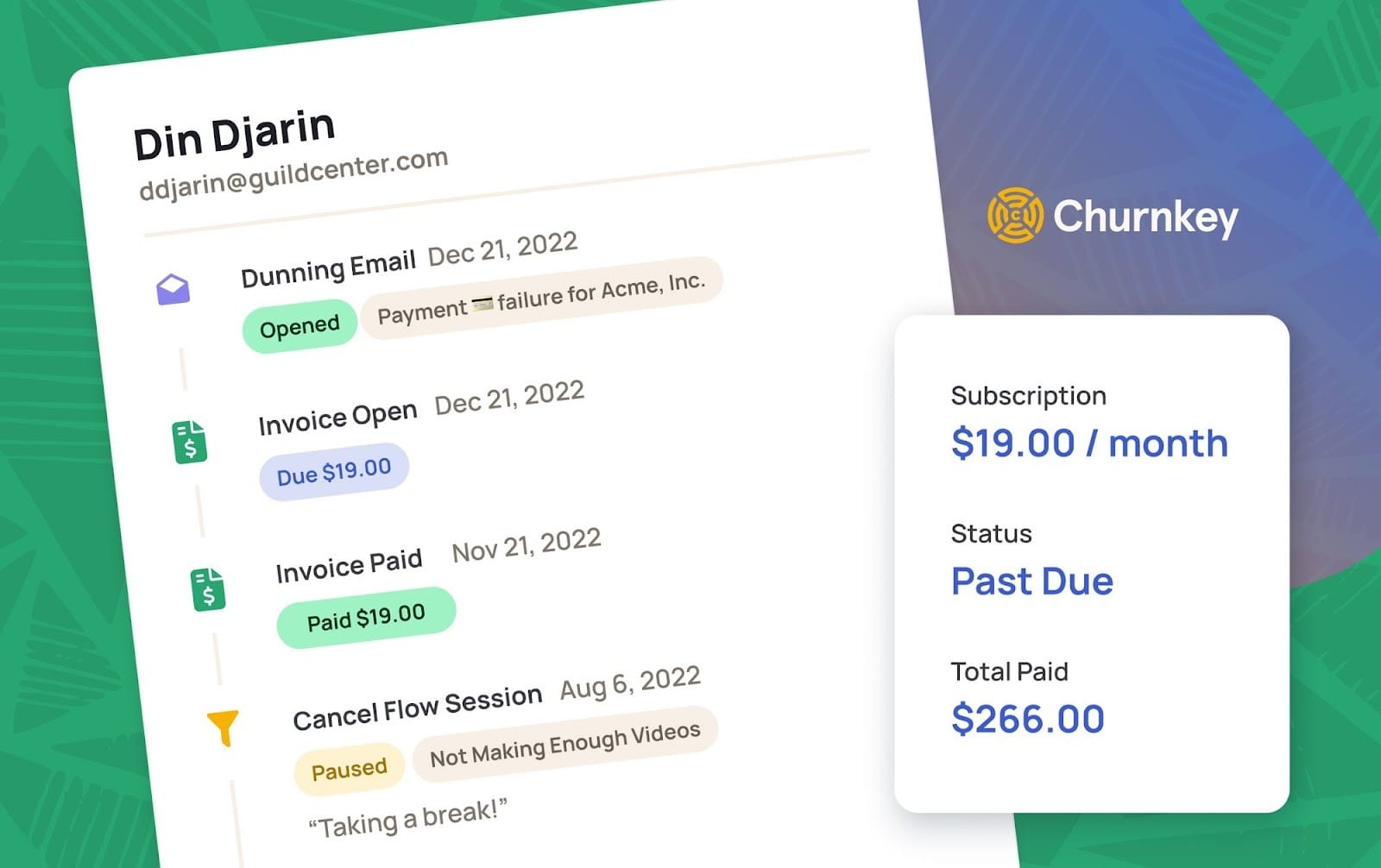

Rule number one: split voluntary and involuntary churn in your analytics. Most subscription tools handle this automatically, including Churnkey.

You need cohort analysis to see when customers bail and why. Segment by acquisition channel first: you might discover paid ad customers churn at 8% while content marketing leads stick around at 3%. Break it down by plan tier, customer size, and lifecycle stage.

Every cancellation is data. Exit feedback isn't nice-to-have; it's mandatory. Add a cancellation survey in your offboarding flow. Ask why they're leaving.

At Churnkey, we tie churn reasons straight to lost revenue. You can see exactly which issues cost you the most MRR. When 30% of cancellations cite "missing feature X," and that's $50K in lost ARR, your product roadmap just wrote itself.

Always track voluntary churn against benchmarks. Best-in-class companies in your vertical running 2% monthly voluntary churn, while you're at 5%? The 3-point gap isn't abstract; it's a quantified opportunity sitting right there. Set real goals: "reduce voluntary churn from 5% to 3% over six months." Then monitor it.

The Voluntary Cancellation Journey Map

Most SaaS companies obsess over why customers leave, but they miss how they leave.

Voluntary churn is a process that plays out over days or weeks, and at each stage, there are signals you can track and moments where stepping in works.

Stage 1: Disengagement

Churn starts days, sometimes weeks, before anyone clicks a cancel button. Login frequency drops off. Feature usage declines. They stop getting value, but quietly. The signals most companies miss here are the hidden ones: your power user who logged in daily now shows up weekly.

Stage 2: Active Decision

There's usually a trigger: they see their credit card statement and realize they haven't touched your product in weeks, or a competitor just announced the exact feature they've been asking for. Sometimes you can catch this if you're paying attention: sudden activity after weeks of silence, support questions about data exports.

Stage 3: The Cancellation Moment

They click cancel and hit your offboarding flow. A good cancellation flow takes several seconds; that's your window to interrupt the pattern, remind them of value they forgot about, and present alternatives.

Stage 4: Post-Cancellation

There's an immediate regret window in the first 24-48 hours. Customers sometimes realize they acted too fast. You also have a broader win-back window, usually the first 30–90 days, where they're still open to coming back if things change.

Most companies focus on Stage 3. But if you want to win the game, you must catch problems at Stage 1 and have playbooks ready for every stage.

Proactive Strategies to Reduce Voluntary Churn

Fixing voluntary churn isn't a one-department job. Here's what that looks like in practice:

- Nail onboarding. New customers are your highest churn risk. The first 30 days determine everything.

- Keep showing them the value. Don't assume customers see everything your product does for them. Most don't.

- Watch the signals before they become problems. Track usage drops, engagement signals, and health scores.

- Reach out proactively. Waiting for them to complain is already too late.

- Use the feedback you're collecting. In-app surveys and cancellation flows are only valuable if you close the loop.

- Match the offer to the reason they're leaving. If generic discounts don't work, offer a downgrade or suggest a pause.

- Test everything. A/B test by segment, plan type, and usage pattern.

- Make pausing dead simple. Let them pause for 1-3 months instead of canceling.

- Build pricing flexibility from the start. Pricing is the #1 reason for voluntary churn. If your model's rigid, you're making churn inevitable.

- Don't overlook support quality. It's only ~5% of explicit churn reasons, but it's what turns "maybe I'll stay" into "definitely leaving."

- Use cohort analysis to find patterns. Different segments churn for different reasons at different times.

- Win back the ones who left. Some churn is inevitable, but many churned customers will reactivate if you fix what drove them away and give them a reason.

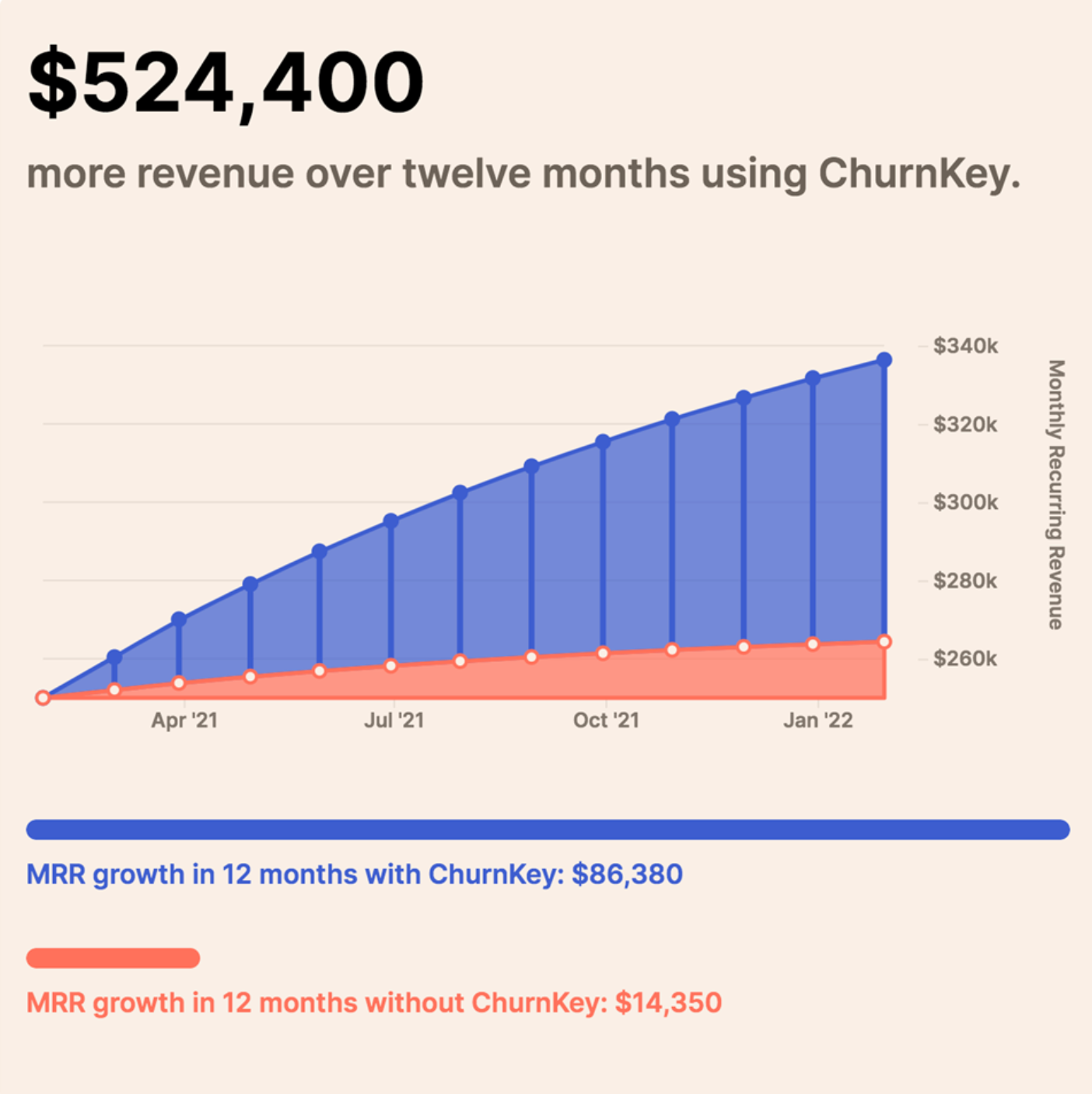

How Churnkey Helps Reduce Voluntary Churn

Churnkey gives SaaS teams an edge by addressing the problem at every intervention point we've discussed throughout this guide. We put it into one suite, so all Churnkey customers benefit from the collective data. It's like having a 24/7 retention team that never forgets to present the right offer, never misses collecting feedback, and learns the best ways to save your subscribers.

Conclusion: From Metric to Strategy

Fixing voluntary churn isn't a one-team job. Your product team needs to keep shipping value, your CS team needs to spot the warning signs before customers hit the cancel button, and leadership needs to build the systems that know when to step in with the right offer at the right time.

The companies that win at retention don't just put the voluntary churn in a dashboard and call it a day. They treat it like the strategic priority that shapes everything from what features you build next to how you price your product to how you talk to customers.