Launch: Improve Failed Payment Recovery Rates With Our Intelligent Retries

Churnkey knows when, how, and why a payment will likely succeed. The effect: boosted recovery rates by 4-12%. That's big.

Churnkey’s Failed Payment Recovery product ensures you get paid before charge failures lock you out of your customers forever. This type of involuntary churn can cause up to 40% of your customer churn.

That’s a lot of headache for a problem created by banks, card companies, their opaque policies, and not you.

Too much is on the line for your reputation to take a hit because of someone else’s problem. But you’re not going to become a dunning expert, and why should you?

We got your back. Churnkey recovers up to 81% of failed payments with our modern infrastructure and a fresh approach to dunning. Take, for instance, Dunning Offers: a feature that turns a risky customer segment into a revenue expansion opportunities by enticing them to update their cards with personalized offers.

Introducing Churnkey Intelligent Retries

Given that, we’re always improving our modern payment recovery service for modern companies, and that’s why we’re launching an improvement to behind-the-scenes recovery efforts: Intelligent Retries.

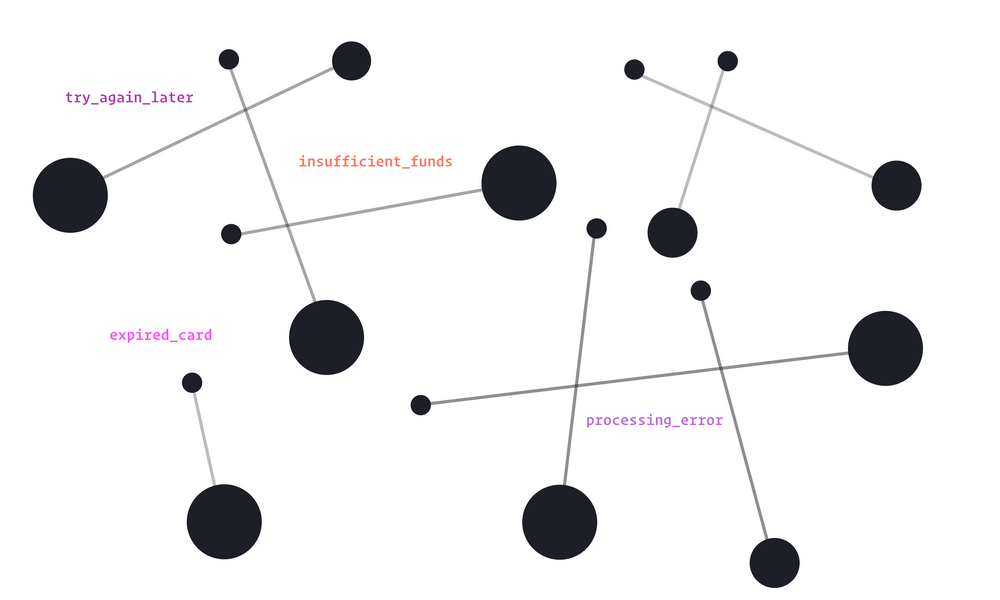

Here’s the context: you can actually resolve a significant portion of payment failures without even talking to a customer. But this is the classic so-called threading the needle problem, since card issuers only allow you to retry from six to ten times.

Those add up quickly.

Innovation without any effort on your part

But with Intelligent Retries, we use machine learning and algorithmic processing on data from billions of transactions to know when, how, and why a payment will likely succeed—with optimal retry conditions based on:

- Card type on file

- Geographical location

- First and last successful payment date

- Failure reason

- If a card is stolen, lost, or marked as “do not retry”

- Pay days in certain countries

- Temporary, throw-away card status

- …and over a dozen other factors

But that’s not all. Armed with this intelligence, Intelligent Retries work in tandem with Churnkey’s failed payment recovery campaigns. Together, they coordinate their operations, effectively double-optimizing for the best way to resolve your customers’ past-due payments.

All in, this is a big win.

We’re seeing it in the numbers: recovery rates are boosted by 4-12% with Intelligent Retries.

Intelligent Retries will evolve based on industry and economic dynamics, so we're always looking out for you.

Recover more failed payments today

Turn on Churnkey Failed Payment recoveries today, and you’ll see ROI immediately. That’s because:

You get the first month free

Companies under $300K ARR get dunning free

You’ll only pay fixed rates, never a percentage (hint: our prices are the most aggressive in the business)

You’ll see recovery rates up to 81% without blinking an eye

- Our average rate is about 61%

- Industry averages are in the 38-52% range

You’ll start recovering payments immediately after going live

So try out Churnkey Payment Recovery now, send me an email (scott at churnkey dot co) to learn more, or schedule a quick chat to ask us anything that’s on your mind.