Churn Rates for Streaming Services: Benchmarks and Market Reality

Churn rates vary across platforms, and the reasons are different, ranging from rising prices to content gaps to subscription fatigue. So, you must understand not just the churn rates, but the patterns behind them.

In this article, we explore the current churn data for major streaming services, comparing which platforms have the most loyal audiences and which struggle most with retention.

Key Highlights:

- Music streaming maintains 2% churn through daily habit formation.

- Video platforms struggle with 5-10% churn due to content-specific subscriptions and completion-triggered cancellations.

- Serial churners (23% of the audience) rotate services to follow content. They're cost-optimizing consumers responding to fragmentation.

- Bundling is the single most powerful retention strategy in streaming.

Statistical Benchmarks for Streaming Services: Who's Winning the Retention Battle?

Churn rates are different for streaming platforms, revealing which retention strategies work at scale. The gap between the best and worst performers is massive; some platforms lose subscribers three times faster than others.

Sources:

- Disney+ and Hulu Cancellations Doubled

- No exact source

How do You Calculate Churn Rate for a Streaming Service?

Basic Monthly Churn: (Canceled subscribers in month ÷ Total subscribers at month start) × 100 = Monthly churn %

But basic churn rate only tells you how many people left, it doesn't tell you why, when they're likely to return, or how much revenue you're losing. You must track net churn, use cohort analysis to measure churn by signup date, separate voluntary churn (user clicks cancel) from involuntary churn (payment failures), because the fixes are different.

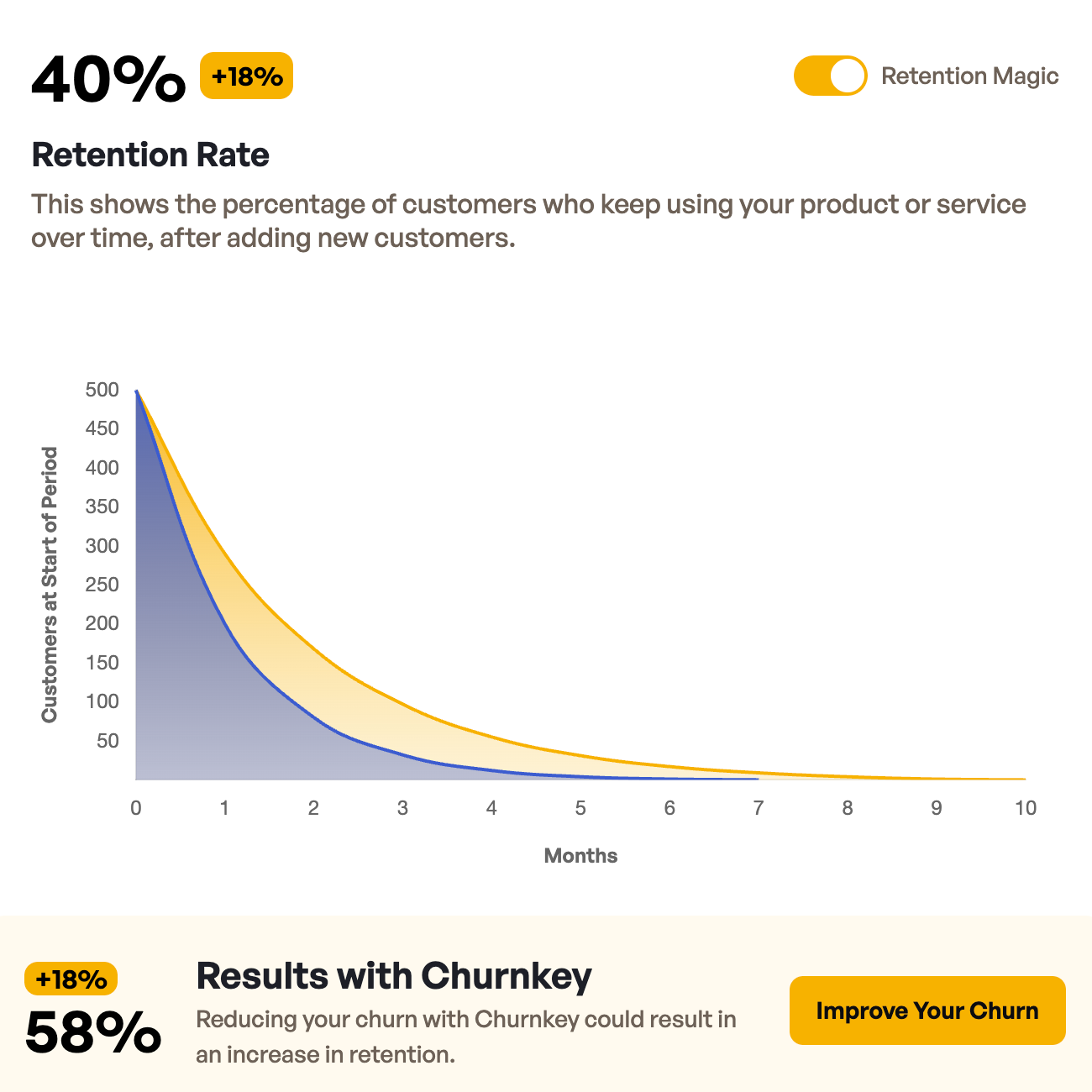

To make the calculations easier, Churnkey offers free calculators for churn rate, lifetime value, retention rate, and stickiness ratio. Just plug in your numbers to see where you stand against industry benchmarks. The real insight comes from tracking all these metrics together.

Video vs. Music Streaming: The 40% vs. 12% Divide

Music and video streaming are monthly subscription-based services facing different retention challenges. Audio services keep subscribers at the lowest churn rates video platforms can only dream of achieving. The gap comes down to how people use these services.

Why Audio Services Dominate Retention: The Psychological and Behavioral Gap

The annual churn rate for audio streaming is 12%, while video streaming suffers a 40% churn rate, meaning video subscribers are more than three times as likely to churn.

Spotify leads all subscription services with a monthly churn below 1.5%, an exceptional rate for any recurring revenue business.

Netflix is the leader among video platforms at 2% monthly churn, but that's still 33% higher than Spotify's rate. Most video platforms deal with 5-10% monthly churn rates, which is from 2.5 to 6 times worse than music streaming's top performer.

The gap isn't explained by content quality or brand strength alone. The difference comes down to how people use these services.

The Psychology of Habit Formation: Music = Daily Integration

Music streaming services benefit from passive consumption that video platforms can't replicate. Users listen during chores, workouts, and work sessions, and any other activities that happen daily. There's no "completion point"; you don't finish music the way you finish a TV series.

The format itself creates switching costs. Users invest time building playlists, discovering new artists, and training recommendation algorithms to understand their taste. These personalized libraries become harder to abandon with each song added.

Video streaming operates on a different consumption model. It requires active attention; a higher bar for daily engagement. The result is content-specific subscription behavior: users sign up to watch particular shows or movies, then leave when they're done. Data shows 26% of subscribers cancel after finishing the content they came for.

Platforms that release entire seasons at once see subscribers consume content in days or weeks, then question whether they need to keep paying. The bigger the show, the faster subscribers come and go.

The Freemium Buffer Effect

Spotify's free tier acts as a retention safety net that video platforms lack. When Premium subscribers cancel, many don't leave the platform, they downgrade to the ad-supported free tier. This keeps them engaged, familiar with the interface, and likely to upgrade again when circumstances change.

The model works because music consumption is habitual. Even with ads and limited features, the free tier delivers enough value for the users to want to stay. Spotify's expansion into podcasts gives users more reasons to stay connected even when they're not paying.

The Streaming Churn: Why Everyone's Canceling

Streaming services churn spikes because of a number of reasons, including aggressive price increases, content fragmentation, and psychological overload. The result: monthly churn jumped from 2% in 2019 to 5.5% by early 2025, with nearly half of all subscribers canceling at least one service annually.

Cost is the number one reason subscribers cancel, cited by 45% of users. Since 2021, the average cost for ad-free streaming has jumped 54%, outpacing inflation and wage growth.

In 2022, 17% of consumers were willing to spend more than $60 monthly on streaming; by 2024, that figure dropped to just 13%.

The second pressure point is structural. Media companies pulled their shows from Netflix and Hulu to start their own streaming services. One-third of consumers now report that fragmentation across platforms is damaging their television experience; a figure that jumps to 40% among the 25-34 age demographic. Services that once offered comprehensive libraries now require multiple subscriptions to access the same content. If you want to watch all the shows you used to find on Netflix, you'll need Netflix, Disney+, Max, Paramount+, etc.

The third reason is psychological. In 2025, consumers spend an average of 14 minutes searching for content per viewing session. When finding something to watch takes too long or isn’t successful, 49% are willing to cancel a service

Noteworthy 💡:

Twenty-three percent of the U.S. streaming audience now qualifies as "serial churners," subscribers who cancel three or more services within a two-year period. They chase free trials, time their subscriptions around new season releases, and cancel after finishing what they came for.

Retention Strategies for Streaming Services: What Works to Keep Subscribers

Bundling is the single most powerful weapon against churn.

Bundling works so well because it increases perceived value, it creates multi-reason retention, there's psychological friction: canceling feels like a bigger decision when it affects multiple content sources, and it reduces subscription management fatigue by consolidating billing and access.

Ad-supported tiers are another churn prevention strategy. The solution is simple: provide a downgrade path instead of cancellation, and preserve the relationship even if revenue per user drops temporarily.

Stopping password sharing was the move everyone hated that worked. Netflix took the blow in mid-2023. Although some people canceled, conversions outweighed cancellations: between late 2023 and Q4 2024, Netflix added 50 million net subscribers, growing from 238 million to over 300 million globally. Disney followed in 2025. CFO Hugh Johnston said the initiative is "working out well," with full financial benefits expected throughout the year.

Platforms with consistent monthly content releases show 18-22% lower churn than those with irregular release patterns. Some platforms are shifting back to weekly episode releases after years of binge-all models.

Another proven strategy is switching from competition to cooperation: Disney and HBO Max, direct competitors, now bundle together because a combined package is harder to cancel than individual services.

The platforms implementing these strategies at scale also use churn software like Churnkey Intelligence Suite to automate the intervention timing. The system tracks the same engagement signals, declining watch time, reduced logins, scrolling without selection, and deploys the appropriate response: downgrade offers to ad tiers before cancellation, or personalized win-back campaigns for users who have already left.

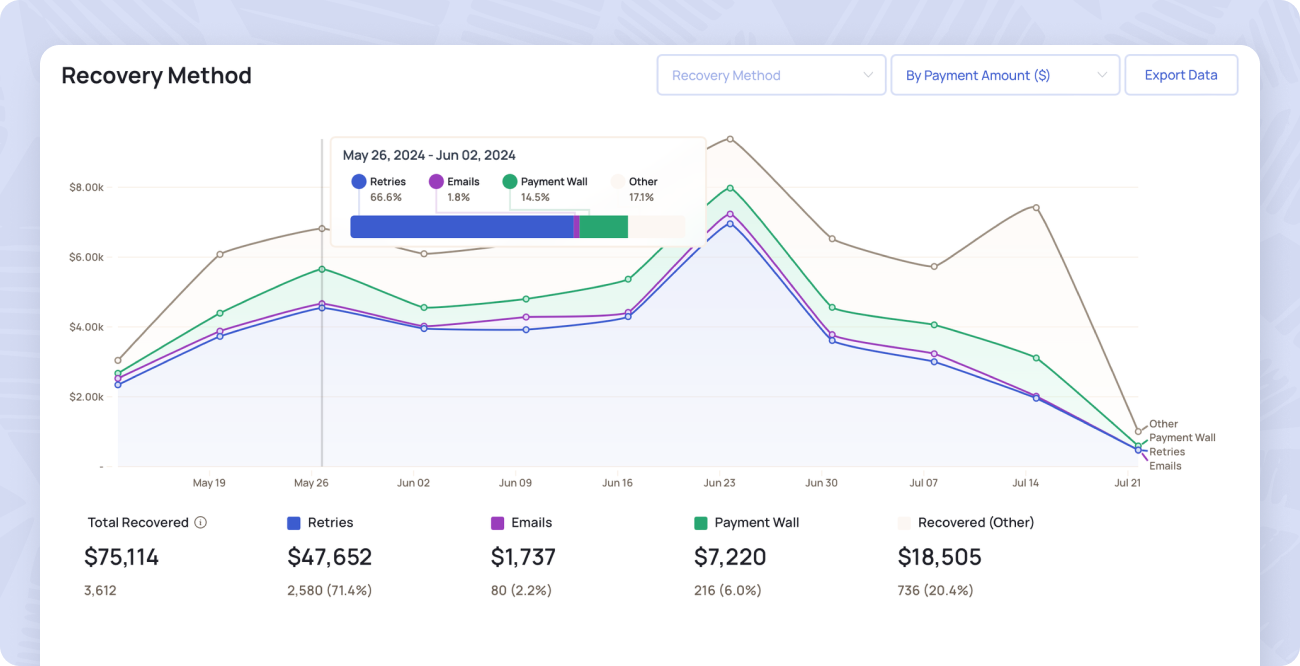

The Involuntary Churn Recovery Opportunity

Most platforms spend millions on content while ignoring a simpler problem: subscribers who want to stay but can't because their credit card has expired.

The causes are: expired credit cards, insufficient funds, bank declines, and outdated payment information. The fix is automated dunning systems that recover failed payments before they become cancellations.

Account updaters automatically refresh expired card information through payment networks. The card company sends your subscriber a new card with a new expiration date, and the software pulls that data without the user doing anything.

Smart payment retries when the software knows when to charge the card again, a couple of days later.

Grace periods give users time to fix issues before losing access. Instead of immediate cancellation: "Your payment failed. Update your information in 7 days to keep access."

Multiple payment options, like PayPal, digital wallets, and Apple Pay, so users can switch if one method fails.

Subscription businesses using software like Churnkey reduce involuntary churn by 40-60%. The system handles everything: detects the failure, retries intelligently, notifies the user with one-click fix options, and escalates only if automation fails. Most issues resolve without anyone touching them.

Why This Matters More Than You Think 💡:

Payment friction doesn't just cause involuntary churn. It creates voluntary churn. User sees failed payment, clicks the email, lands on a confusing payment update page that requires login, navigation through three menus, and manual card entry. What started as a technical glitch can become a permanent loss because you made fixing it annoying.

Also, check our involuntary churn benchmarks research article.

Conclusion: Retention is the New Growth

Monthly churn went from 2% in 2019 to 5.5% for streaming services in 2025. The streaming platforms that win are the ones keeping the subscribers. If you're running a streaming platform, audit your retention strategy against the above benchmarks. Stop obsessing over preventing every cancellation and start focusing on shortening the time between churn and resubscription. When investing in streaming, subscriber growth numbers are less important than retention metrics in a mature market.

The streaming platforms winning the retention battle don't rely on manual processes. Churnkey helps subscription businesses recover revenue from payment failures, predict churn before it happens, and win back subscribers with automated, intelligent workflows.

References

- https://research.mountain.com/trends/u-s-streaming-subscriptions-rose-10-in-q2-2025/

- https://www.mediaplaynews.com/us-streaming-rides-into-2026-on-wave-of-uncertainty-says-parks-associates/

- https://www.deloitte.com/us/en/insights/industry/technology/digital-media-trends-consumption-habits-survey/2025/digital-media-monitor-dashboard.html

- https://www.scribd.com/document/884283710/Trends-Deloitte-Digital-Media-Trends-2024-25

- https://www.forrester.com/blogs/preview-the-state-of-streaming-services-us-2025/

- https://www.fool.com/research/state-of-streaming/

- https://www.tvtechnology.com/news/new-data-streaming-service-users-are-wasting-more-time-looking-for-something-to-watch

- https://www.statista.com/statistics/496011/usa-svod-to-tv-streaming-usage/

- https://www.antenna.live/insights/a-whole-new-netflix

- https://www.emarketer.com/content/disney-announces-fourth-streaming-price-hike-many-years

- https://www.dcfmodeling.com/products/para-pestel-analysis

- https://www.antenna.live/insights/antennas-2024-top-subscription-insights-serial-churn

- https://www.nexttv.com/news/disney-bundlers-59-less-likely-to-churn-research-company-says-chart

- https://www.cabletv.com/streaming/best-on-demand-streaming-tv-providers-in-customer-satisfaction

- https://www.antenna.live/insights/ad-supported-plans-are-finding-an-audience

- https://www.demandsage.com/netflix-subscribers/

- https://ir.netflix.net/financials/quarterly-earnings/default.aspx