An in-depth guide to churn prevention

Get proactive about churn prevention with eight proven strategies to keep customers happy.

A customer leaving your service is bound to sting.

It costs five times as much to attract a new customer than keep an old one.

So if you're tired of the subscription cancellations or last-minute backouts from leads, it's time to get proactive about churn prevention. At Churnkey, we're going to take a deep dive into what customer churn is, why it may be happening, and cover eight proven strategies to keep customers from walking out the door.

What is customer churn?

Churn, also known as customer attrition, is the percentage of customers who stop doing business with you over a given period.

The saas churn calculation is rather simple. You just need to note two things: your total customers at the start of a given period (like your first quarter), and the number of customers you've lost during that period.

Why churn prevention is so important

There are a few key reasons you'll want to keep your churn rate low:

- Churn prevention is easier than customer acquisition. It's much easier (and cheaper) to keep a customer than find a new one, so you should be focused on retention from day one.

- Churn hurts your cash flow. When customers churn, they take their future payments with them. This can put a major strain on your business if you're not careful.

- High churn rates indicate underlying problems. If you're losing a lot of customers, it's a sign that something is wrong with your product or service.

Long story short: keeping your customers around is just as – if not more – important than acquiring new ones. In fact, research from Bain & Company revealed that a 5% increase in customer retention could increase profits between 25% to 95%.

9 types of churn that businesses face (avoidable vs. unavoidable)

While there are quite a few kinds of customer churn, saas business owners can categorize all of them into either avoidable and unavoidable churn, so it’s easier to see which ones need attention.

Avoidable churn

- Revenue churn – the amount of revenue that's lost within a given period. This doesn't necessarily mean that you've lost customers, but that you're just not making as much money from your customer base (e.g., if they downgrade on a plan, or spend less money on products).

- Competitor intervention – if a customer leaves because they found a competing product that offers more value, then you have some work to do. This could be in the form of lower pricing, more features, or better customer service.

- Unsuccessful onboarding – when customers sign up for your service but have a hard time using it, they're more likely to churn. This is why it's critical to have a smooth onboarding program that teaches customers how to make the most out of the product or service.

- Customers couldn’t reach their goals – if customers feel like they can't achieve their desired outcome with your product, or have tried and failed, they'll likely churn. Make sure you're setting realistic expectations and helping them along the way to ensure success. But do note that to an extent, this point may be unavoidable too.

- Poor customer service – this one is pretty self-explanatory. If your customers don't feel like they're being heard, or that it's taking too long to troubleshoot a problem they're facing, then they'll be less likely to stick around.

Unavoidable churn

While there are many things you can fix, don’t beat yourself up for the following reasons. Some things are just a part of life. Learn to live with them and focus on what you can control.

- You can’t please everyone (desired feature or functionality missing) – there will always be that small group of customers who want features or functionality that you just don't offer or can't get to at the moment, because the needs of the masses take precedence.

- Seasonality – some businesses are naturally seasonal, so there will be times when churn is higher than usual. The key here is to know your numbers inside and out so you can plan accordingly – like encouraging saas customers to pause their subscription instead of canceling.

- Company closure – if you have to close up shop for any reason, all your customers will churn. This is the most extreme form of customer churn and one that's impossible to prevent.

- Technical difficulties – whether a customer's credit card failed or your servers crashed, it could lead to churn. It's important to monitor your side of things because although unexpected crashes or malfunctions happen, staying vigilant about it can prevent further, unnecessary churn.

How to tell if a customer is going to churn (watch for these behaviors!)

While we can't predict what's going on in our customers' heads, there are certain measurable churn indicators that we can monitor to catch whiff of a customer who's thinking of canceling their subscription with you.

- Decreasing usage level. Customers who are about to leave might not use the product as often, or they might stop using certain features. This is why it's important to keep track of how customers are using your product, so you can identify any red flags early on.

- Payment method and setting change. Customers who switch from automatic payments to manual are more likely to churn. This could be because they're trying to save money, or because they no longer need the service. Either way, it's a sign that you should reach out and see what's going on.

- Customer support interactions. Suppose a customer starts contacting customer support more frequently or about a serious issue. In that case, it may be a sign they're having difficulty using the product, or that they're unhappy with something. In either case, it's a good idea to reach out, see how you can help them solve the issue, and even offer a gift or discount for the trouble.

- Lack of feature adoption. Every product or service has those key features that customers need to use in order for it to be valuable to them. If you notice that a customer isn't using those features, it could be a sign that they're not getting the value they need from the product.

- Customers aren't hitting their KPIs. While you can't hack into their Google Analytics account and social media metrics boards, you can ask if your service is working for them through surveys, phone calls, or transactional emails. Because if your product or service isn't helping customers hit KPIs, why should they keep paying for it?

Related: SaaS Reporting Analytics Guide: Metrics, Tools, Examples

8 proven ways to reduce customer churn rate

Go over your target personas

Operating a business 101 is knowing that customers won't pay for a product or service that doesn't speak to them. So if you're seeing rather high churn rates, it could be because you're not going after the right kind of customer.

This is where you can look at data from customer surveys, product statistics, and social media engagement to identify which buyers are getting the most of your offering – so you can refine your ideal customer persona.

After that, it's time to look at how and when they're churning. If customers are leaving within the first 30-90 days, you may want to review your onboarding process and see if it needs tweaking. But if long-time customers churn, the answer may lie with a recent update to your product – or lack thereof. And so on.

This way, you learn more about your ideal customer, you learn what's annoying them, and you fix it, thus closing the leak and retaining more paying customers.

Offer alternative remedies to cancellation

When a customer doesn't feel the need for your product or service anymore, their first instinct is to cancel. If you want to lower churn, give customers something else to think about.

A great example is Zubtitle, a one-stop video editor for social media content creators. Since their customers tend to make content in batches, there would be periods where the service wouldn't be used, and thus churn grew during those times.

But with a cancellation flow from Churnkey, they were able to offer an array of offers before users churn like subscription pauses, discounts, so-called "hidden" plans, and funnels into customer support teams. By offering these alternatives, 26% of customers who would've canceled stuck around, and Zubtitle recovered $17k in MRR within 2 months of implementing these options.

That's all to say, many times customers choose to cancel because that's the only option. If you go the extra mile and show them other potential routes, you may surprise yourself at how many customers willingly accept.

Consider offering annual plans as an option

Customers on an annual plan tend to stick around longer than monthly subscribers (surprise, surprise). In fact, companies that have 25% to 50% annual contracts see only 5.63% monthly revenue churn, compared to 10.40% with none.

The reason is simple – when customers make a yearly commitment, they're less likely to shop around and compare you to other options because they've already invested a lot of money into your solution.

But that doesn't mean you should ditch the monthly option altogether. You'll still want it as an option for those who want to pay month-to-month, or for those who want to try before they buy.

Provide incentives for customers to keep using your service

When you first start a subscription with a service, you're likely getting some sort of discount or bonus for signing up. But why stop there? As a business owner, you can continue to offer incentives throughout your customer's time with you.

For example:

- Dropbox gave their users an extra 500MB of storage space for every friend they referred to the service.

- Spotify has a similar referral program where you get a free month for every person you refer.

While you don't need to give out free storage or service, think about what kind of incentive would keep your customers coming back. Referral programs are smart because they keep your current customers happy while incentivizing them to find more business on your behalf.

For you, it could be a discount on their next purchase, a free month for every year they stay with you, or even just a thank-you note. Remember the timing can play to your advantage – if your customer(s) are approaching the end of their contract, this can be a good time to swoop in with an offer.

Talk to your quitters – and send irresistible recovery emails

Just because a customer quit doesn't necessarily mean they're done with you for good. It just means they were unhappy with the current state of affairs – so here's where you knock on their door and send a "win-back" email.

And while you don't want to beg, there's nothing wrong with a little guilt: Your subject line could be something like, "We miss you!" or "What happened?" Then, in the body of the email, keep it short and sweet,

"We're sorry to see you go and we want to know if there's anything we could have done to keep you as a customer. We're always looking for ways to improve our product, and your feedback would be invaluable.

If you have a moment, please let us know what we could have done better."

Alongside asking for feedback, you want to make it easy for them to come back, so include a link to reactivate their account with just one click. Finally, for the best results, you want to offer an irresistible discount or incentive for coming back – something like 70% off their first month or FREE for two months.

Keep an eye on the competition

Losing customers or clients to competition can be painful. When you're looking to lower your churn rate, you need to make it seem (and actually be) better than your competitors.

Whether it's a unique feature or unparalleled customer service, defining a competitive edge helps customers remember why they're with you. A smart way to stay on top of your high service standards is by benchmarking your overall performance and customer satisfaction against competitors.

For instance, you may want to determine your Net Promoter Score (NPS), which measures the willingness of customers to recommend a company's products or services to others. It's an excellent way to keep tabs on how loyal your customer base is and how you compare to other companies in your industry.

Create a community around your customers

One of the best ways to keep customers engaged and coming back for more is to create a community around your product or service. This could be something as simple as setting up a Facebook group or an online forum where customers can interact with each other, or it could be a more formal process like organizing in-person meetups or customer events.

60% of customers are more loyal to a brand when they feel like they're part of a community. The key is to make your customers feel like they're part of something bigger, and that they have a personal connection to your company.

Alongside surveys, communities also help identify top priorities for your business (and may even be more effective). When you create a space that welcomes authentic and free-flowing conversations, you have a wealth of information – including invaluable pointers to areas of improvement for your business (i.e., what most people are talking about/upvoting). By addressing them first, you keep the masses happy.

Lastly, communities act as a "self-serve" customer support option. Did you know that 90% of customers expect you to have one? They don't want to wait around for customer service agents or spend time chatting – they want the problem gone asap. A large community of users opens the gate for quick responses, different perspectives, unanimous decisions and opinions, and all the conversations are there forever for future users to access.

Make giving feedback easy and troubleshoot why customers are leaving

If you can't hang on to your customer's money, at least hang on to their word. By learning what's causing every customer to cancel, you can begin your troubleshooting process to reduce the churn.

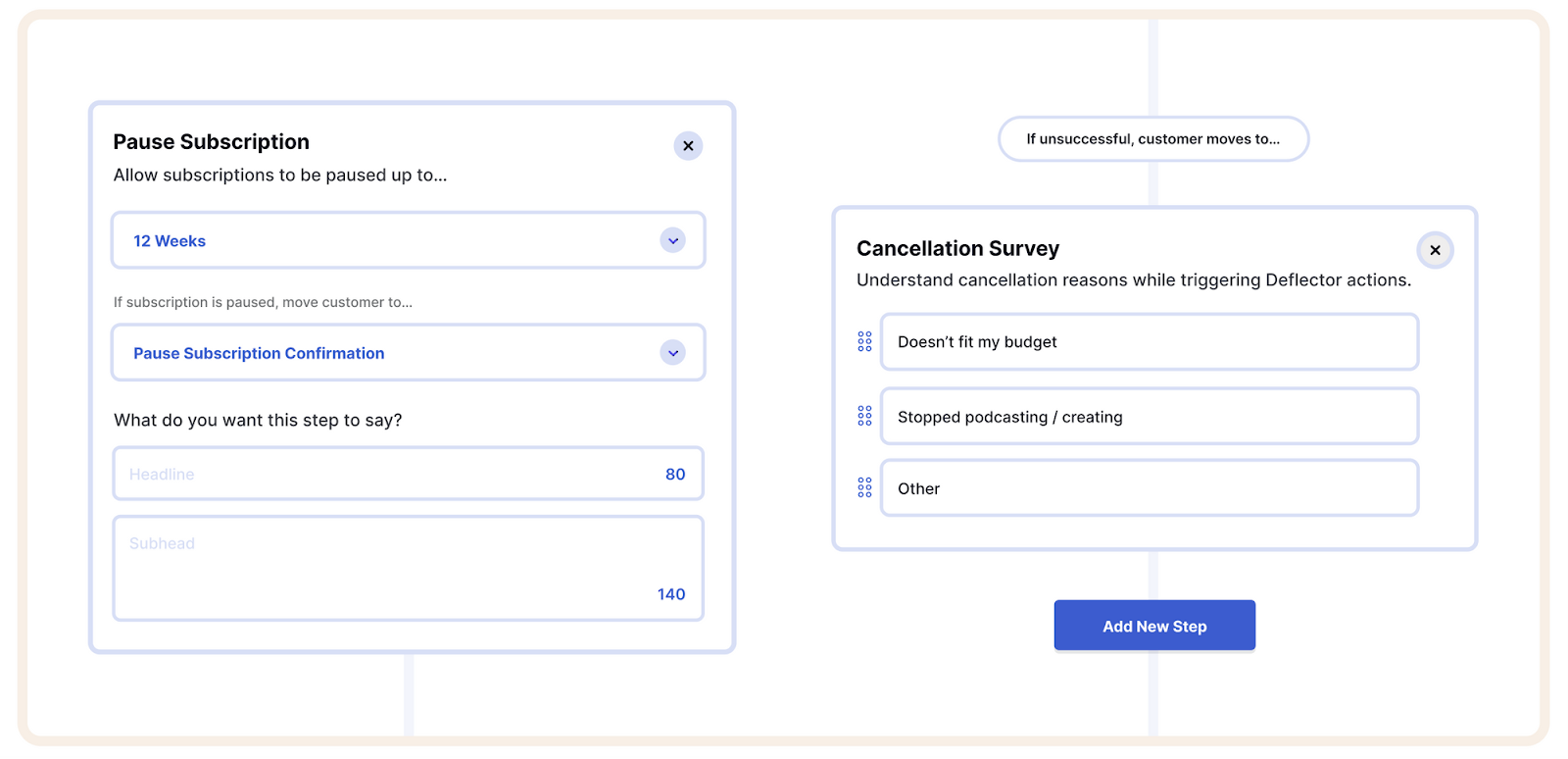

You want to make it as easy as possible. So that means choosing an easy cancellation survey with the common cancellation reasons, over providing a blank text box that's prone to be skipped or abused.

We can't stress this enough, but feedback is truly powerful. Wavve, a video creating and editing tool for podcasters, realized that they weren't collecting enough information on why voluntary churn was occurring. By implementing Churnkey's cancellation surveys, one of the insights they uncovered was that their customers needed to take seasonal breaks.

They used this information to easily integrate a "Pause Subscription" feature and alternatively offer a 50% coupon both through Churnkey. Ultimately, Wavve increased its growth ceiling by $44k in MRR, and reduced churn from 14% (an industry high) to 8% – all because they made feedback giving easy.

Start reducing your churn rates with Churnkey

As you can see, customer churn is a complex issue with many different contributing factors. The first step to reducing churn is understanding why your customers are leaving in the first place.

Churnkey's cancellation surveys make it easy for customers to give feedback and for businesses to understand what's causing churn. Then you can use this data to create intelligent cancellation flows that offer your customers customized and compelling offers and discounts based on their selections.

Businesses like yours can cut voluntary churn by up to 42% by trying Churnkey today.