4 Types of Churn and How to Prevent Them

A discussion of customer churn, revenue churn, voluntary churn, involuntary churn. Learn about each type of churn and why they are important.

There are all sorts of KPIs for tracking customer retention. If you're not a finance guru, it can be downright confusing. You'll hear metrics like customer renewal, retention rate, customer churn, revenue churn, involuntary churn, net promoter score (NPS), and customer satisfaction rate.

As a SaaS founder or operator, it's important to understand the different types of churn. Some are more important than others (depending on your business). And understanding the difference between them can be the difference in solving for churn or not.

I'm going to introduce four types of churn and decode each one in some detail in this article.

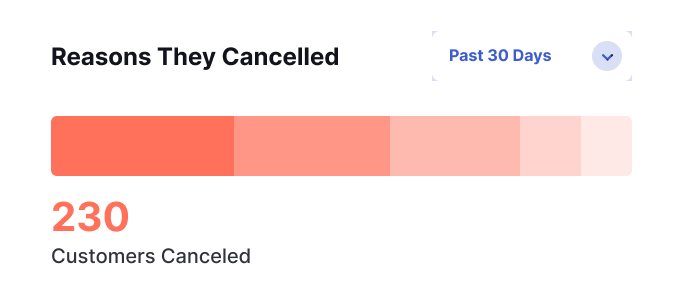

Customer Churn

You might also see this called user churn. It tracks the total number of customers who canceled their subscription during a given period. If you have a user who pauses their subscription or applies a 100% off coupon for two months, this change will not impact your churn rate. Keep in mind that no payments for those two months will be reflected in your revenue churn rate.

Why Customer Churn Matters: This metric tells you how many customers are leaving. I like to think of this as a metric that indicates product health. If customer churn is high, it can indicate that there are issues with your product or product-market-fit. To get the full picture of your customer churn, you can segment customers that have canceled and look for trends that tell the actual story. For example, if new customers (say, within the last 14 days) are canceling, that may indicate a problem with onboarding.

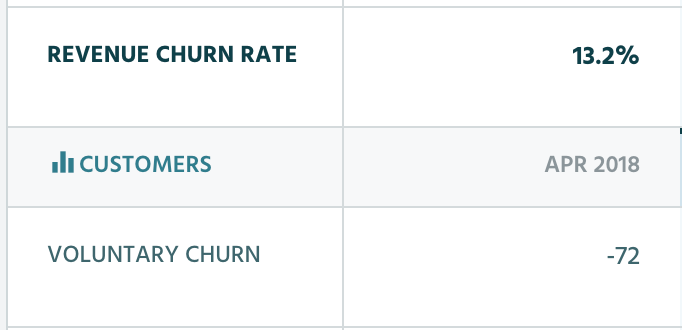

Revenue Churn

This figure represents total revenue lost across all subscription changes. It's different from customer churn, because it factors in any subscription changes that affect payment amount. Think of subscription plan changes like upgrading or downgrading. Some B2B companies have been able to achieve the SaaS holy grail of negative churn. To have negative churn, your existing subscription base needs to net positive revenue. This is achieved through incredibly low customer churn, and aggressive revenue expansion efforts like plans upgrades, add-ons, or usage based pricing.

Why Revenue Churn Matters: If you are trying to improve your growth rate (aren't we all? 😁), this is the most important churn metric to pay attention to. Revenue churn tells you how much money you are losing from the customers that left. This metric usually indicates whether or not your pricing and business model matches with customers and their anticipated product fit.

It's entirely possible to have low customer churn and high revenue churn or vice versa. This would indicate that high LTV customers are the ones churning or lots of low LTV customers are churning. It's important to dig into these metrics to understand what is happening with your business.

What percent of your churn is voluntary or involuntary?

Voluntary Churn

When a user actively intends to cancel, it's called voluntary churn. This would be when a user clicks the cancel button or emails your support team asking to cancel. We've created a number of effective ways to reduce voluntary churn. Sign up for Churnkey today, and with our easy 15 minutes setup, you can start protecting your revenue today.

Why Voluntary Churn Matters: This metric tells you how many customers are leaving on their own volition. It's vital that you survey customers as they exit to understand why they are churning. With Churnkey's customizable offboarding flow, you can not only survey customers as they exit but present incentives for them to stay based on their survey responses.

Involuntary Churn

This is when a customer's subscription is terminated, and they didn't take any action to cancel it. Typically this happens when there's a problem with the recurring credit card charge and after a series of attempts to retry the card, the subscription gets removed. Credit card charges can fail for a number of reasons, and it's important to make sure you've got a dunning management (separate post) solution in place to mitigate this.

Why Involuntary Churn Matters: This metric tells you how many customers are canceling due to inactivity. Involuntary Churn usually points to an issue with user engagement. It's best to view this metric through the lens of how high or low touch your product is.

Churn rates are computed on a monthly basis but don't wait around for next month to make a change.

Read more about involuntary churn →

Start Containing Churn With Churnkey

We’re excited to be leveraging the latest churn prevention patterns to help you growth your SaaS businesses! Don’t hesitate to reach out and talk about how our product can work for you, especially if:

- Your current monthly customer churn rate is greater than 5%

- You have more than 100 active subscriptions (if you have more than one cancellation a day, Churnkey will almost certainly give your growth ceiling a significant bump)

- You use Stripe as a payment provider (support for more payment providers coming soon)

Ready to check out what Churnkey has to offer? Click here to create a free account.