The Hidden Damage Churn Does to Your Business

Sign up for Subscription Heroes 👇

Sign UpHey, I'm Brady, your host for this episode of the Subscription Heroes podcast. In this episode, you're going to learn all about the pain of lost customers, what it's costing your business to lose customers, not just in lost revenue but lost growth opportunities and Lost Enterprise Value.

Really putting the brakes on everything that is growth in your business. So if you are a retention manager, a chief customer officer, or anyone who's interested in growth, this episode is going to be really interesting for you.

We're going to hear from Baird and Nick, the co-founders of churnkey.co, where they've seen thousands of businesses and millions of customers leave those businesses. They're going to

give you some really great practical advice on what you can do in your business to stop the leaking bucket that is your

churn, and things you can do today to increase your Enterprise Value and to grow like crazy.

What is the Hidden Damage Churn Does to Your Business?

0:54 Brady - Guys, while you've been running churnkey.co for four years now, you've seen millions of customers leave businesses, so Nick, could you kindly get us started on what the real pain of a lost customer is and how businesses should be thinking about their lost customers.

1:05 Nick - Going forward, yeah, losing customers' insurance is so painful, for founders, for growth engineers, for anybody in the growth world, as well as customer success. It impacts the whole business, and at various stages, it's very easy to focus on other things like growth: it's fun, and it's exciting. And it can be scary to start thinking about churn: reading customer feedback when you look at it through a business lens, and you're just totally logical and objective.

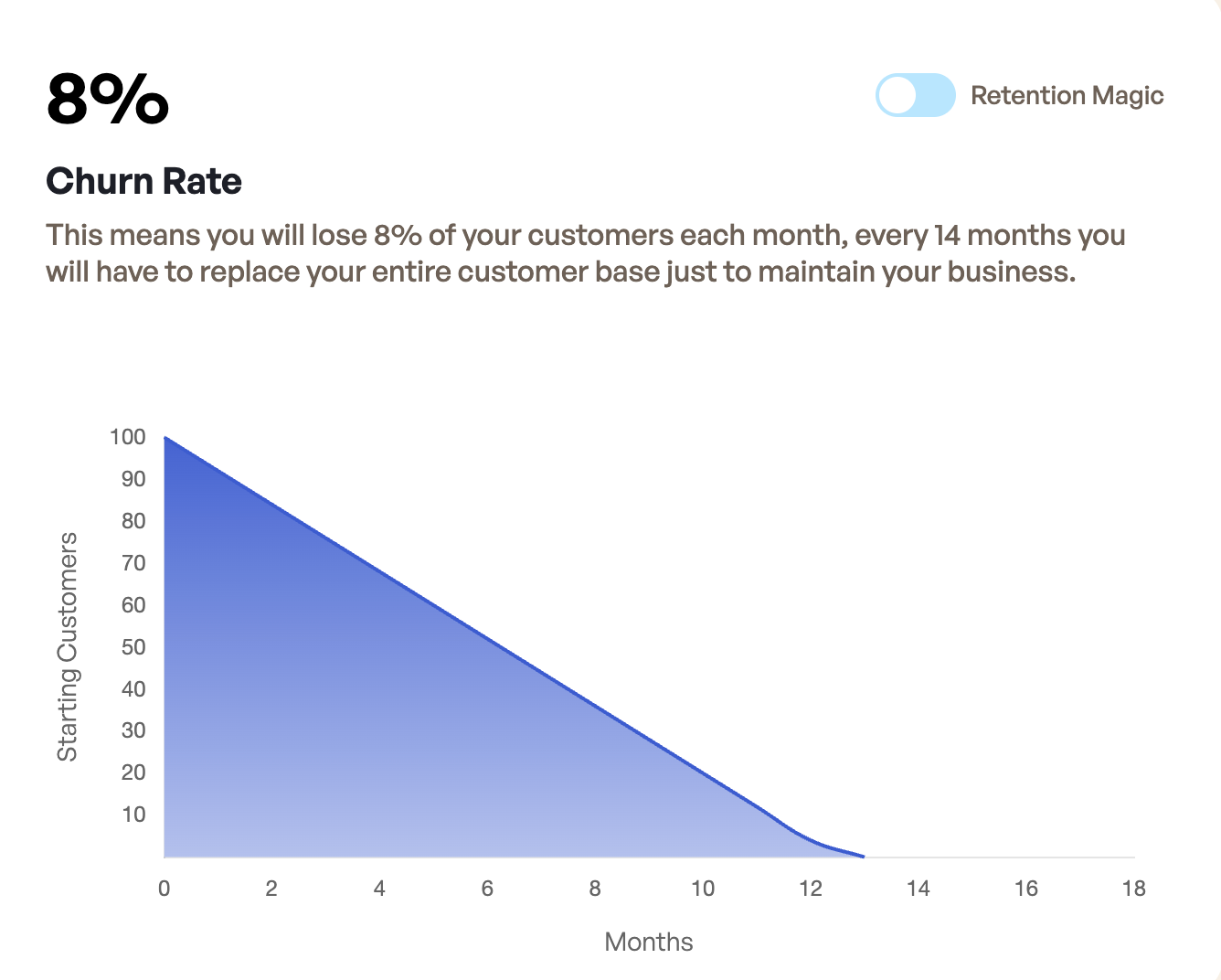

I mean, most people look at churn monthly, and it's not a really great way to visualize the full impact of churn. So just to start off here with some numbers, if you look at it:

Let's say you've got 8% churn. What does that actually mean for your business?

Well, if you have 8% monthly churn, that could be that you have to acquire 63% of your customers just to maintain that size. You've got to go back annually at 63%, but the better way to think about it is with 8% monthly churn compounding. At that rate, you're going to have a complete turnover of all your customers in 12 to 13 months, so you're basically starting from scratch every year if you have 8% monthly churn.

2:21 Brady - Yeah, and that's horrifying,

2:24 Nick - Yeah, and Baird and I had been there before, that's why we built churnkey.co through our last business.

How Churnkey.co Was Founded

2:30 Nick - Baird, do you want to talk about that moment, maybe where we realized, like, there's a pretty big problem here.

2:38 Baird - Yeah, I think it's pretty common for. We were first-time founders, it was our first business - a subscription SaaS business that served podcasters, ironically, while we're sitting here on a podcast, and other content creators. And we were just obviously obsessed about growth because with your first business, all you can think about is getting it off the ground and going. And so you just get into this habit of doing nothing but focusing on growth.

And, I think, it happens to a lot of first-time founders: they don't really understand that growth is churn combined with new subscription acquisition. And growth is what's left over when you kind of put those two things together. We were growing and just high-fiving constantly virtually, of course, while we were just hitting all these milestones. And then, all of a sudden, it just plateaus; it’s almost like the brakes got put on. We're like: What is happening? Why is the business slowing down to a halt?

All of a sudden, we realized we were running about 14%. I mean, we knew we were running churn. It was in our dashboards. We saw it, but it doesn't really hit you until you see that growth plateau happen, and then you start digging in. Like, you know, founders are great problem solvers, so they eventually run to dive into it. And then it gets horrifying really quickly when you start realizing what's been happening. When it comes to, you know, customers leaving each month, what that actually does to the business.

We were actually trying to sell the business eventually and knew that any acquirer was going to look at that and just get scared. Rightfully so. That's kind of how this whole journey started - us having that big realization and kind of just going to work internally on reducing it.

Why Do SaaS Companies Wait Too Long to Address Churn?

4:21 Brady - Yeah, and I think kind of what both you guys were talking about there, sort of that psychology of starting. It's so real. So my last role was at an AI company notorious for high churn. It was dealt with too late, and it was kind of allowed to build up until it was this sort of undeniable problem when it was hindering growth. And then, once I got in there, basically serving as the retention manager, my pretty much only metric that I was graded on was churn. I remember looking at our Stripe metrics and being like, "Oh my gosh, if we stop getting new customers tomorrow, I can count on one hand how many months this business has left." And that's like there's no worse place to be for a SaaS business than right there.

5:06 Baird - Yeah, and the psychology of it we talk a lot about, how this might seem a little far-fetched, but let me try to land the plane on this. Once I put it out there that you can kind of relate churn to, like high blood pressure: something that people might know that they have. But there are no acute symptoms; they live with it for a long time. Until, all of a sudden, they can feel it's causing issues. And then they go to the doctor and try to treat it, and it turns out there's a pretty easy solution to that with blood pressure medicine.

But the psychology of it, it's easier to stick your head in the sand and just hope it doesn't become a big problem. But you're really just kicking the can down the road and something else while we're talking about, like the beginning of thinking about churn for a business constantly.

What I hear through all of our sales calls, when we're talking to companies that are in this exact moment, the first question they want to know is: Is my churn good or bad, is it good or bad? Just tell me how bad. You know, they want to know how bad it is, and it's a hard question.

Because I think it's where most people should start: like, what should my churn be? And there's no perfect answer. You know, B2C versus B2B is different. The prosumer segment that kind of sits in between: your churn is dictated a lot by your pricing model, your offering, your customer base, and seasonality.

So there’s, you know, a hundred different factors that go into it. But I think for most customers, or really, for most SaaS companies, the best place to start is figuring out what I call the “churn band.” Like, where should you be? What’s the upper realistic churn level, what’s the lower, and how do you work your way down toward that lower end of the band?

Because I think it's also important to note that when you're talking about churn, it is inevitable to a degree. Like, I guess, some businesses will have (you know, like Churnkey has) net positive retention. So, our accounts are growing, but still, like everybody else, we're going to lose customers from time to time. So, it's not something that you can totally stop, but if you don't pay attention to it, it can get out of hand really quickly.

The Hidden Financial Impact of Churn

7:17 Brady - Yeah, so in that theme of it, the thing is that you can't stop. But like, there's never a number that's low enough for churn. Let's sort of switch to what the real cost of a lost customer is, and how the different ways that affect a business. And, if you're someone who is, say, a retention manager, chief customer officer, head of growth, and these kinds of roles where you just want to make the business bigger and have like produce that leaky bucket: how should you be thinking and presenting to stakeholders? Like, guys, this is what churn is costing us, and this is why we need to go after it.

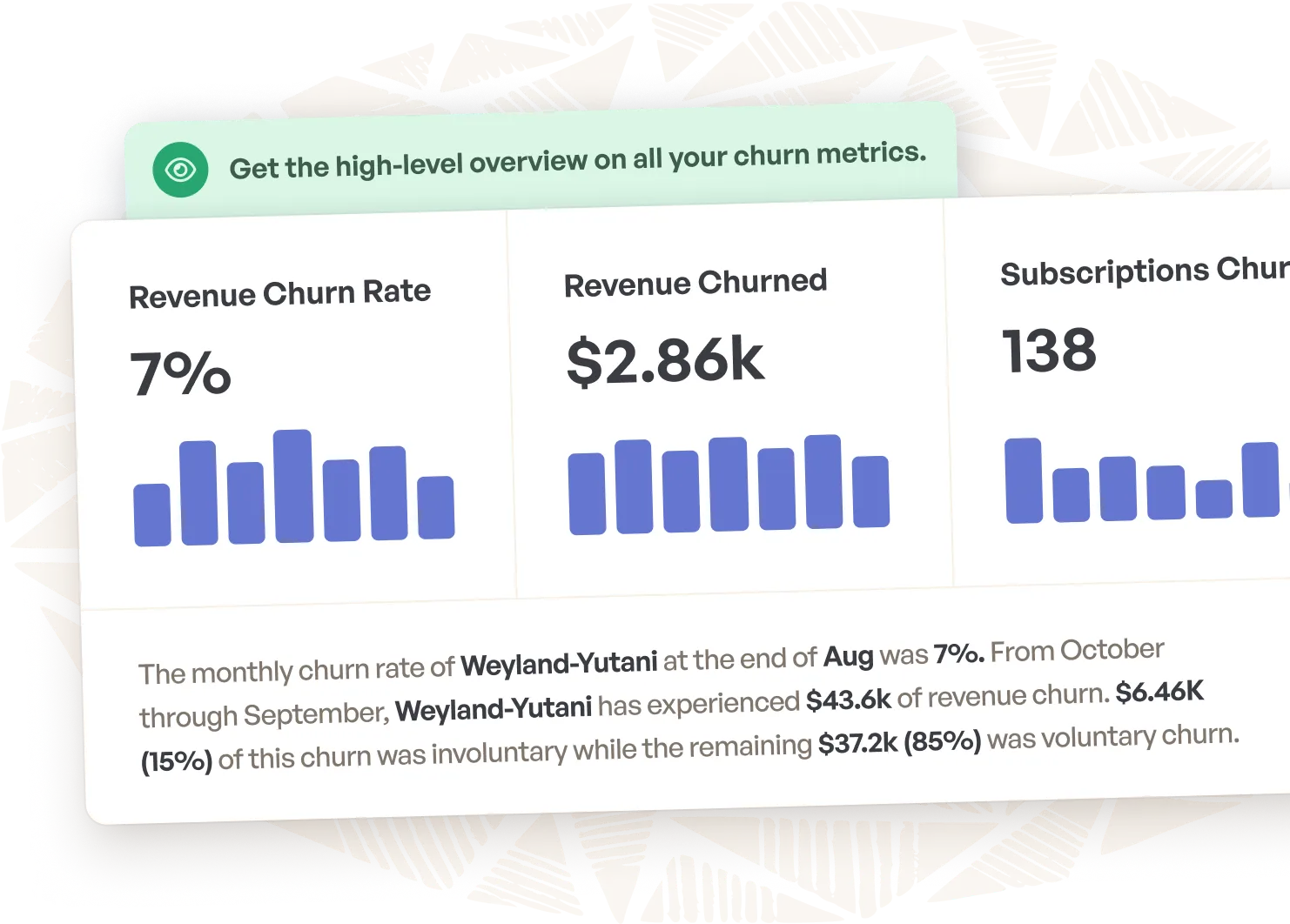

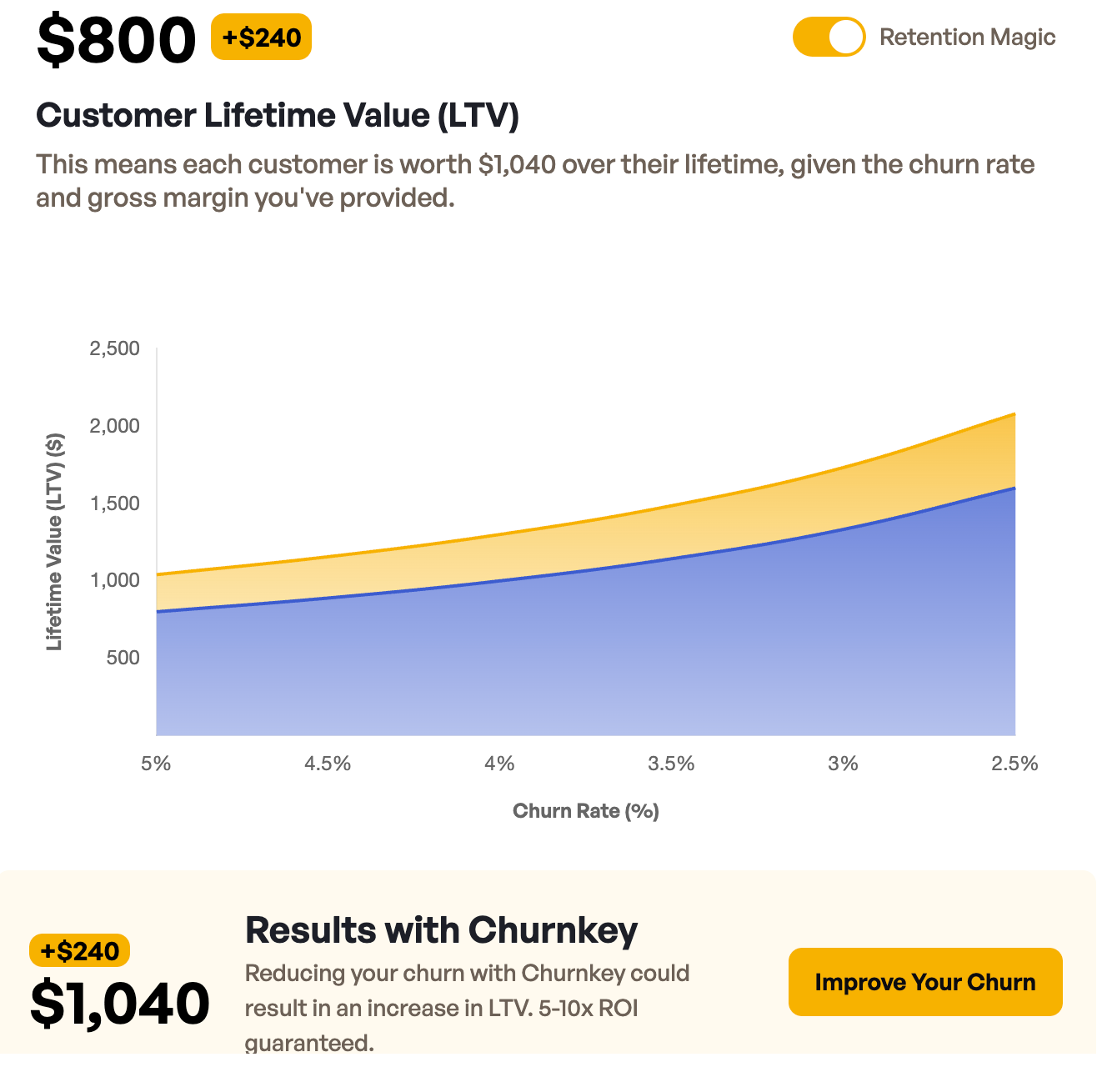

7:48 Nick - You know, going back to the story that Baird was telling about our last business, we can use that as an analogy here. Because there's a cost when you're looking at your growth ceiling. Like, what can this business get to? I often wonder, when we were running Wave, if we tackled churn sooner, we could have grown that business much higher and had a much better outcome when we sold it.

But we actually met with a business broker, and we were talking about it, and you know, we knew we were taking an ARR hit when we looked at our financials and our churn metrics. The business itself was not growing as fast as it could, so that's one point of pain. But another one is the business valuation:

If one day you have aspirations to, maybe, sell your business, churn is one of the biggest factors in influencing that growth multiple.

When we met with a business broker, and we had like 14% churn. We had a number that we wanted to sell the business for, and he said there's no way you'll get that value multiple because of your churn rate, you're basically getting bumped in half. And, it was one of the many things, painful things, that forced us to take this side quest and start building all of our own tools.

And you know, the funny thing is, churn is so painful, we didn't even want to, like, do it ourselves at first. We were trying to, like, outsource it, so we spent a fortune on a consulting agency.

And, they were like taking us through onboarding issues, and onboarding is great. You know, there are all these differences; it's kind of like the blood pressure example: the silent killer. It's what blood pressure is referred to. The way high blood pressure is a silent killer, churn is a silent killer for SaaS businesses.

But they were, like you know, back to the blood pressure example - you go to the doctor, you have high blood pressure. Like, all right, well, you need to go to the gym, and run every day, and do all these things, and eat only this diet. And there are all these like external things, you know. And then we were doing a similar thing at Wave. Like, we were focused on onboarding - let's just get onboarding better. And we weren't addressing the acute need that was causing somebody to churn at that point of cancellation.

When we realized that and started building the tools out to actually understand why people were leaving, understand our churn bands. As we talked about where we could get it, well, that was an eye-opening experience because

we suddenly saw churn go from 14% down to 12% within just a few months by understanding why people were leaving and actually keeping them.

How Lowering Churn Expands Your MRR Ceiling and Enterprise Value?

10:15 Brady - And what did that 14 to 12% do to your MRR cap and your Enterprise Value?

10:19 Nick - Oh, it was massive. We used Baremetrics at the time as a metrics tool, and they had a really cool simulator where you could look at what is your forecasted growth over time based on your current stats. I started playing around with that, and I was like, okay, if we lowered churn by just half a percent, we got from 14 to 13.5. It added, like, another 20K to our AR just in the short term. And looking out even further, the results were even massive.

And then a 2% drop in churn, it was incredible what that would do. So, instead of going, you know, at that time I think we were thinking: okay, we're going to have an MRR cap at like 90k 20 100K. Does that sound right, Baird?

11:02 Baird - That's what we were thinking.

11:02 Nick - Yeah, we're like this growth ceilings here, like what on Earth are we going to do? And within the next year, we have grown to 150k, like we blew through that growth ceiling because we did something about churn. I think we got it down by three, four, maybe even five percentage points.

11:18 Baird - We've got to do single digits eventually, maybe even closer to eight some months. Which took a lot of work; it was a year and a half. You just have to focus on it non-stop, and I think the big, you know. We see this a lot with new customers at Churnkey, where they've neglected churn for a long time, like we did.

I always say that churn is never the most important thing, it's never the first priority for a company until, all of a sudden, it's the only priority.

It's the only thing that matters once they realize that it becomes a big problem. Everybody realizes it, and then leadership sends everybody on a big quest like - we're going to do nothing this month but focus on churn. Which is great, it's the same thing that we did. But what we really got good at was working on churn indefinitely and iterating, learning, and figuring out how to solve it properly.

Because there's no silver bullet when it comes to churn, there are a lot of things you can do that make an impact really quickly, but what we've seen is that, like great churn reduction at scale, it's all about these little tiny details and putting all of these small details together. That's how you really put a big dent in it.

I guess, to go back to the cost to churn, one thing that was really surprising to me, I always knew that it costs more to acquire a customer than it does to retain one. But when you are losing customers, you then have to go find growth models and/or growth channels that can not only replace them but then try to actually create growth, which gets very expensive.

We were spending, I can't even remember how much, on Google Ads because we were just churning out 14%. And we would just double down on paid ads at an inefficient rate just to keep things where they were. So, you wind up not just losing recurring revenue, you also wind up losing more money because you have to spend it to refill the leaky bucket. And it just can get out of control.

13:21 Nick - Yeah, that's a great point. Your unit economics become less appealing if you look at your CAC, it's like, - Oh, we're spending more money on customers, so our acquisition costs are higher. We have Facebook ads, impression-based ads, and we have Google Ads spending. All this money, and you know if your retention hasn't improved, then your lifetime value is the same, so your unit economics go down, your Enterprise Value is not there. And there are also these other hidden costs, like every time you onboard a new customer, there tend to be higher support costs, admin cost,s and things like that.

So, all these transactional costs add up, so it's just like a cascading pain across the entire organization.

How Reducing Churn Raises Profit Margins

14:03 Brady - And you guys might not have this data at hand, but I would be curious to know what it did to your overall profit margin. Because I was reading an article just last week by the Harvard Business Review that found that a 5% increase in retention, which is roughly a 5% decrease in churn, resulted in somewhere between a 60% and a 100% increase in the profit margin of businesses that increased retention.

14:25 Nick - When we sold that business, we had somewhere between 85 and 90% profit margins. Now, some of that is because we were cutting costs extensively as we moved into that time when we knew we were about to open up a data room, start fielding offers, that sort of thing. But this was also during Covid; ads were getting very expensive there, so we were able to kind of maintain our ad cost around the same level without continuing to increase it because we had lowered our churn rate, and we needed less growth to offset that.

14:57 Brady - And, since you guys have been running Churnkey, I mean, literally seeing millions of customers cancel across different businesses, are there any kind of examples or businesses that stand out in your mind? Like these guys really had a problem. And we're kind of moving the conversation from pain to what customers can do about this. Anyone who kind of stands out in your mind?

15:17 Nick - We got a couple of case studies on the website. I think Veed is a great example. A video editing software, they've been with us for a very long time now. They've seen phenomenal results. If you think about a product like Veed, you might have a lot of prosumer-type customers who come in, and they want to use it for a little while. AI products are similar in a way that you have some people who might be tire-kickers, or they might have good intentions and want to use a software tool for a period of time. They like the product, but they don't need it every single month.

The SaaS customers do want to come back, maybe every couple of months, and in those cases, something like a pause offer, or some kind of discount based on usage, can make a profound result.

I think there's another thing, too, that we've realized over time. When we started Wave, we thought that the customers, or the businesses rather, we could help them most with the super high volume, super high churn B2C prosumer types of businesses.

But the cool thing we've seen over time is that, while we serve a lot of B2B businesses that have low churn, like 2% to 3% per month, some of those businesses are saving literally millions of dollars a month through Churnkey. So, even with, like, lower churn, the amount of revenue that we can actually recover, even with low churn, is extremely significant. So I think that's important to point out that even if you have a low churn, you can get it lower. And the larger you are, the more of an impact that you can make.

16:47 Brady - Yeah, I remember when I was working as a retention officer at this AI company that I mentioned, we hired some consultants, coaches, whatever we could find, to help us lower the churn, because it was such a pressing issue. And I remember several times they would ask me, like an intro call or whatever, like what churn would you like to be at. And I was like less than zero, like there's no number that's low enough for churn. Like, there's no point at which your churn is low enough that you can't improve it more, you know. So it's like, where's the ideal churn? Oh, it's negative.

17:14 Nick - Even when it's negative, like our churn at Churnkey (like we have negative churn), but I want it to be more negative.

Where to Start With Churn Reduction?

17:15 Brady - Yeah, exactly, so let's start moving the conversation towards how people can actually reduce their churn? And I think there's probably no one in the world who's seen more companies do this than you guys. So, Nick, if you'd like to get it started again, on what are companies doing, best practices or what can someone start doing in their company today to start getting this dreadful number down?

17:40 Nick - There are a few things, two great places to start.

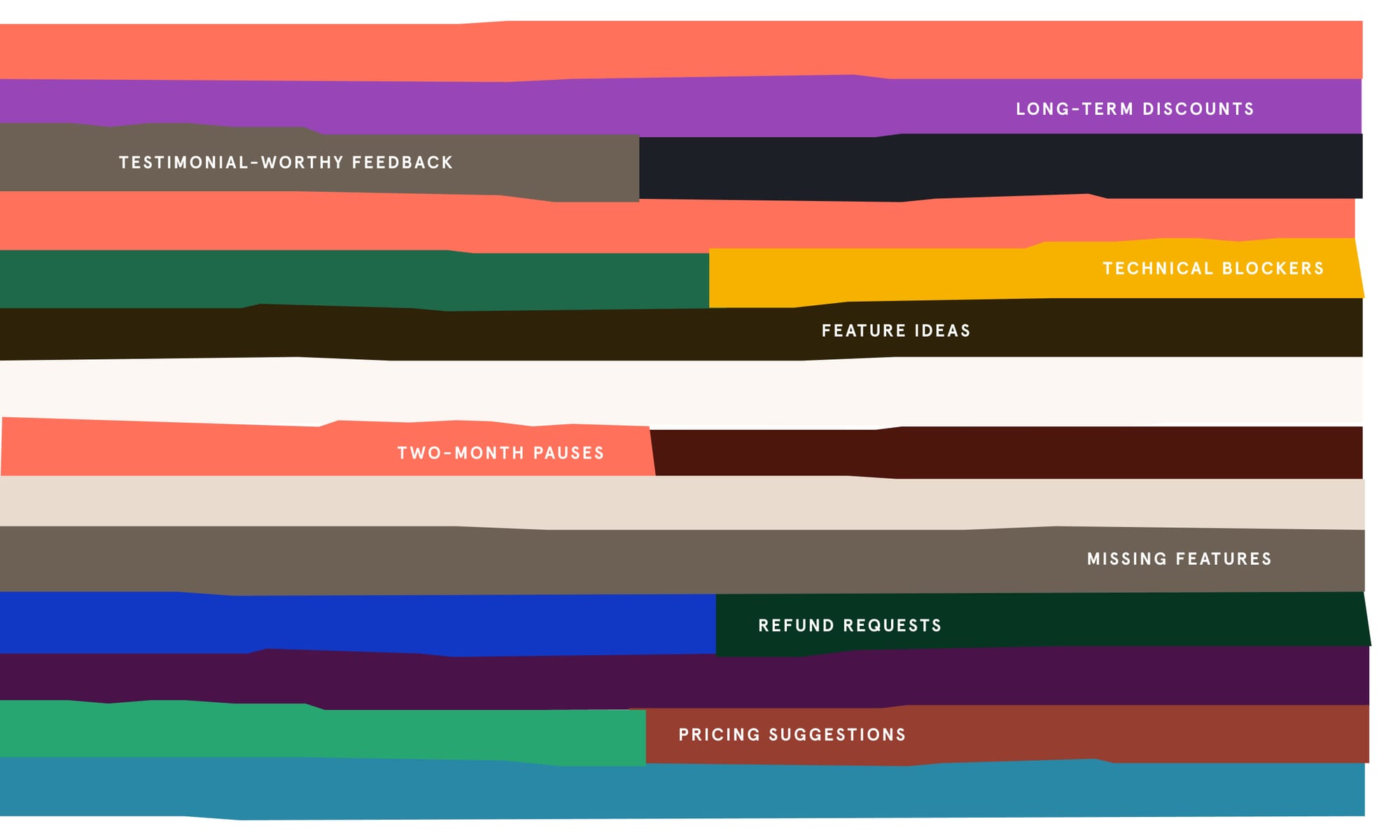

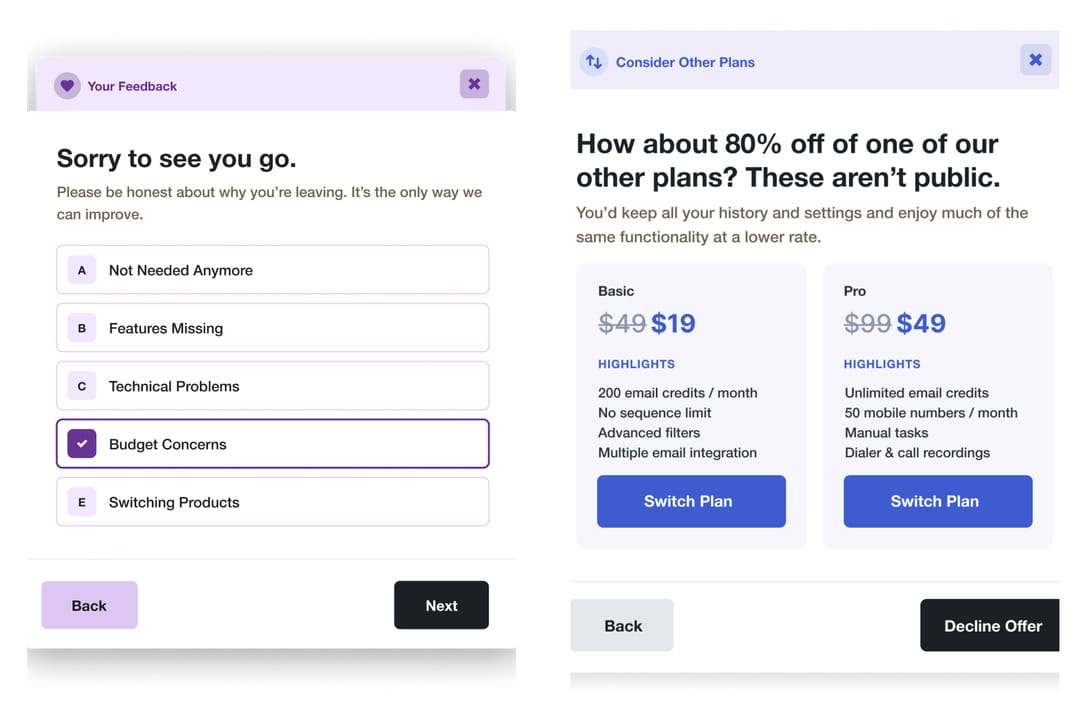

Number one - understand why your customers are leaving. So, you should be collecting feedback of some kind, so that you understand why is it that these customers are parting ways with us. Based on that, you can address that situation at the time of cancellation and really deliver a win-win for both your business and the end customer by offering them something.

If you know why your customers are leaving, you can offer them a reason to stay: it could be usage-based, maybe they need a different plan, maybe it's seasonal, or they want to pause.

So that's number one: if you can understand and collect the reasons or feedback, you'll have a much more intelligent view of your customer base over time.

And then tactical things you can actually do about churn, rather than just knowing about it. You can do something, probably like Churnkey obviously handles that.

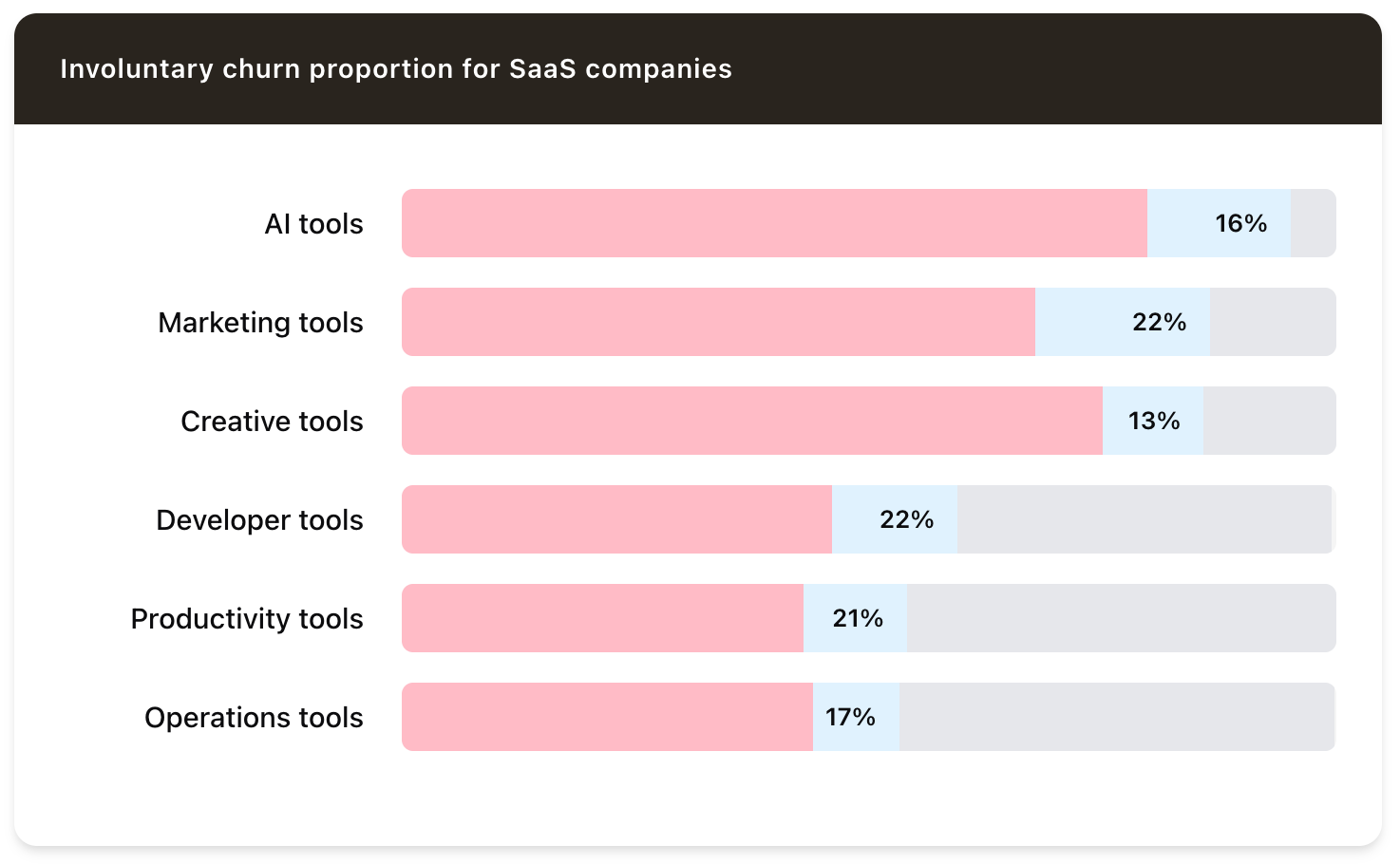

The second thing is involuntary churn or accidental churn. So this is when an invoice changes. This is very common; we see it more and more over time due to things like virtual debit cards and more aggressive fraud detection. Things like that that throw red flags or false positives.

And, if you're not doing anything about involuntary churn, it's going to be a massive help having some kind of Dunning campaign and retry capabilities.

And it's kind of like money under couch cushions. It's your money, the customer wants to stay, they don't want to be inconvenienced by being, you know, automatically cancelled. So, your customers are going to be happier because they get their cards updated before they're automatically canceled. You're much happier as a business because you're automating this thing, and you have a sense of the health of your involuntary churn.

And then, the big thing we see with B2B businesses where this is really impactful, is you'll probably have a customer success person that's manually trying to reach out. That hour or two that they're spending back and forth trying to track down a failed payment that costs you money as a business. So, that's another thing to think about when you're analyzing the pain and cost of churn

19:44 Baird - Yeah, I think it's a great point to start. You know why customers are leaving, collecting data, really understanding that. And then, I think the second natural question after that is:

When are customers leaving? Are they leaving immediately, are they hanging around for one to two months? Is it happening after 10 months?

We've actually got a free churn metrics product that anybody can download and connect their payment provider to get these charts. One of the best is the cohort churn analysis chart that shows you each month what the retention rate is. I was talking to a business this morning, actually, that if you took out month two on their 12-month cohort analysis, their retention was fantastic.

We're talking just, you know, single percentage point drops each month, but from month one to two, they had a 30% churn rate. They didn't really understand what was happening and, so when you look at it from that angle, probably for them, there are some issues with pricing, onboarding, maybe a little product market fit.

Those are, you know, kind of unique problems that the business has to look at. But I think figuring out when churn is occurring is pretty important. And then of course, you have to take into account your billing intervals. So if you're offering monthly, we're seeing more quarterly subscription offerings lately, which is interesting, and annually. Then see how churn is performing across those different cohorts. And then also break it down by plan.

Obviously, your lower price plans are going to have higher churn, but understanding the difference between your plans and the churn broken down is really important, too. So I kind of think of it as like looking at it from different angles to get the full picture, to try to understand kind of where you stand today. And then when you start doing those different things, the strategies sometimes start showing themselves.

Why Payment Providers aren’t Enough for Churn Reduction?

21:42 Brady - And kind of going off what you guys said as far as the cohort analysis, the solving involuntary churn, cards were expiring, or payment bills, or whatever. I think my experience was that I was trying to rely on our payment provider to do this, and it was woefully inadequate. And I won't say who it was, but it starts with s and rhymes with hype. But I could run the numbers and show that their cohort analysis was not correct by exporting data from that payment provider.

So I knew that the cohort analysis wasn't correct, and then I thought the involuntary churn, Dunning campaigns, as they're often called, was fine until I started doing something that actually worked. And I was blown away at how ineffective what they were doing was, and it was stunning because this was the person who we had all of our payment data in here.

We went to them for all of our analytics. Their cohort analysis wasn't correct, they didn't show churn by different subscription types, and their payment recovery wasn't doing good. So I would recommend people who are depending on your payment provider for this: you should not really look at other options, because I can tell you from experience, it just wasn't working that well for us.

22:51 Nick - Yeah, I think end users want something that feels more personalized. If you think about it, everybody's inundated with email, and if you're getting, you know, 150 emails a day or you know even less than that, it's really hard to actually stay on task and like get all of your emails filtered. You may see just a generic email, and it goes either straight to spam, or you just archive it.

These days, you have to have high levels of personalization, you've got to test, you've got to have AB testing, and the timing needs to be right. If you're just using an out-of-the-box email that looks canned, your rates are going to suffer when you're trying to recover those customers.

You know, one thing we should talk about that just occurred to me is pricing. So, like the relationship between your pricing and your churn.

One of the most common reasons for churning customers is price sensitivity, and we're living in this era of extended high inflation. I don't think that's going to go away totally over the next few years, and it's really hard for SaaS companies to protect their margins. Your cost to hire people is much higher, your ads are much higher, everything is much higher. I went to Chick-fil-A the other day, and it was like twice as much as it cost me a year ago. It seems like SaaS companies are falling behind on pricing.

So, how do you optimize pricing? Well, I mean, you could go and pay McKenzie or one of these pricing engagement agencies mid-five figures or six figures, and they'll tell you. It'll be pretty good. Or you can actually analyze your data automatically with a tool like Churnkey, and you can get a really clear sense of like each plan, each cohort, and understand price sensitivity. Some of those cohorts you may be able to increase prices on, on some of them you might want to lower prices on, and have more flexibility built in there.

We see this across a lot of customers, where they'll get a better sense of what customers are willing to pay right now for the things that they're using. So it just gives you a much more intelligent way to run your business and handle the most important thing, which is what you charge customers to use your product.

24:55 Baird - I think the next thing that's most important, after what Nick just said, is your pricing model. So, what we have seen is that your churn reduction strategies, a lot of them, start with what your pricing model is. And what I mean by that: are you charging based on usage features, seats, you know, like API usage consumption. There are a lot of different types of pricing models out there for SaaS companies, and the way you try to retain customers really should be based on that.

So, a real simple example, we talked about Veed earlier, any type of usage-based business that runs off credits. So, credit usage where you get so many per month for your subscription. We have found that appealing to credit usage, when a customer is trying to cancel, is really important:

A. Reminding them - here's the model that you signed up for.

B. Here's how many credits you have left.

And then here's what you're going to lose out on, so you're reminding customers of what they paid for and what they're going to miss out on if they actually cancel. Another good example would be if you are charging based on seats. And a lot of times, when a customer's canceling, we've got a large email provider that does this, they actually offer to swap seats with another user.

So, instead of letting that plan cancel, you transfer the seat to somebody else who might want to use it, which is another really effective strategy. So there are a lot of different ways to look at it. But I think start looking at your pricing model and kind of what the perceived value customers are hoping to get, and then start from there when you're starting to build strategies.

How to Understand and Reduce Voluntary Churn?

26:47 Brady - Yeah, so let's get into those more tactical nitty-gritty steps. Now we've got sort of a broad overview. You have your voluntary churn, so someone goes to click a cancel button because of some reason. And then, you have your involuntary churn, which is cards expiring or payment failed, or whatever.

So, let's start with the voluntary churn, and I think you guys were kind of getting into some of the tactics that people are using to make voluntary churn better. But let's give people a high-level overview of what should their voluntary churn should be. So someone goes to click a cancel button. If you're a business owner, what practices should you be implementing to both collect that feedback that you guys already mentioned, and then what?

27:23 Nick - I would say, first of all, you really already identified the common reasons for why somebody might sometimes leave. This is intuitive if you know your business, you know, based on history, that customers might be leaving:

- Because they're not using the product enough,

- There's a value misalignment,

- It could be a price issue, which is also a value-based reason,

- Sometimes it's just you've got price sensitivity for a period of time, it's not forever, it's just right now.

Other issues could just be that somebody might have varying degrees of (also usage-based) technical reasons. Like, hey, we didn't get around to implementing or going live, in which case you would want to have a well-tailored offer to solve that. Like a trial extension, somebody signs up, they don't get around to using it fully, so you offer them a trial extension.

So the key thing here is identifying just a few common cancellation reasons that represent most of your customer base. You don't want too many; that's overwhelming, but you want to capture 90% of the possible reasons within some kind of feedback form.

And then, immediately after that, they select an offer type, you want to tie that to something that will negate that churn intent. So offering them something that meets the reason why they're churning and addresses that automatically. Then you want to measure that over time so that you can track the trends you can see.

What's most effective at Churnkey, we have sophisticated A/B testing, we have all sorts of tools to do this intelligently and maximize the amount of retention. But that's probably the starting point, I'd say. Baird, do you have any other thoughts there?

29:02 Baird - Yeah, well, we see like a lot of customers or a lot of SaaS companies that come to us, have built their own cancel flow that's static, which means that they kind of hardcoded it themselves. And, generally, what you see is a pause offer, a survey, and then a discount offer.

Those three things, just like really basic: every customer gets the same cancel flow. Generally, it's around a 10% recovery rate or save rate on canceling customers, which is way better than nothing. So, if you at least have that, you're going in the right direction. But when we see customers go from that 10% markup to like 20 or 30%, they're doing what Nick mentioned:

- They're first segmenting their cancel flows to make sure that each customer is getting the right flow: their an annual customer, new customer, and old customer by plans.

- Then they're personalizing it, they're bringing in data from about the customer, about what they've done, what they've accomplished, and reminding them what the value was.

- And then tying those things to an offer that makes sense based on what the customer has put in or seen.

Then, when you segment/personalize, and then some FOMO in the copy is always fantastic too. It is really, really effective, which goes back to the psychology. This is a little anecdotal, I guess, based on what I've seen or personally what I've done, but what it seems when most people are going to cancel something, they're not thinking; it's a gut reaction.

They see their receipt, they see the price point, and they run a little analysis in their mind. They're like - wait, I haven't watched Hulu in eight weeks, I need to go cancel this. They're not thinking about, well, what's on Hulu, is there new content coming, do I really need to cancel?

They're just like having a gut-level human reaction, like - I need, I got to cancel this as soon as possible. So a really great cancellation flow, I think, interrupts that pattern of kind of that autonomous response that the person's going through and it kind of brings the person into the moment to remind them - hey, this is what you paid for, this is what you wanted to achieve, here's how far you've made it, if you cancel, here's what's going to happen. Which makes it seem like a lot within a cancel flow, but it actually can be delivered very concisely and quickly, and effectively.

So, as I was mentioning, we have customers that will save 30 between 30 and 50% of cancelling customers when they put all this together in the right way.

Advanced Offer Strategies to Reduce Churn (Discounts, Pauses, and A/B Testing)

31:31 Brady - Yeah, and just to kind of go off on that on my experience; so when we first started doing cancel flows at the AI company, it was extremely simple to start. It was basically like someone clicks a cancel button, and we're like, are you sure?

Then, from there, of course, many people said yes, but about 10% of them were like - no, actually. I don't know if they just wanted to click the cancel button for fun and see what would happen, if we'd give them confetti or cookies, or I don't know. But, yeah, even a very simple cancel flow that was basically like: do you really want to cancel? That started having some results.

But then, Baird, everything you just said; it totally lines up with my experience. So we started with a very simple one, but over time, as we were doing A/B testing, it grew more and more sophisticated. And the kind of thing we settled on that we couldn't really start to beat that well in our A/B testing. You have sort of this initial offer somewhere along the line; you do have FOMO. We were using a credit system.

So, it would be like - hey, you're going to lose your 500 credits or 15,000 words or whatever. Like you've already paid for these, are you sure you want to cancel? Having some sort of cancel survey like you guys were talking about. Then, those customized offers, so if someone selects the budget, we might offer them a hidden plan that wasn't displayed publicly.

That was maybe half the price but a little bit worse of a deal, so stuff like that. So, when you guys are thinking of these offers, and this is the roadblock I ran into, was like, at some point I'm like - okay, I don't know what else to do at a high-level overview. What are some of the best practices as far as offers? What should every business consider using at some point? And what do you see usually being more and less effective than other things, if there is really any difference?

33:13 Nick - Yeah, that is a great question. We're getting into the deep tactical cuts now. I would say one of the things that's most valuable is running an A/B test if you're able to A/B test, something like a discount. So let's say it's somebody, at their core, it's a price sensitivity issue. They know that they've got a limited budget, they need to start cost-cutting on things that they may not need right now, based on the cost. So, what are you going to do as a business? Well, you have a few options:

- You could just let them leave because you don't want to give any discounts at all. But that's a loss for both of you.

- Option number two is to offer them a discount of some kind: it could be a short duration, it could be long. When you're thinking about that, it's like you kind of have to know your customers, and you know that's why you want to A/B test, so you know well how much of a discount do we need, the minimal discount to offer them enough to stay.

How do you arrive at that figure? Well, you run an A/B test, and you look at acceptance rates, and you could do

- One where you're offering 50% off for three months.

- You could do another where you're offering 30% off for a year.

It's better off financially to do the 50% off short-term discount if you look at it over a long enough time. But you can make these really intelligent decisions as a business: we're going to retain a customer, we're going to increase our LTV, and this is how we're going to do it. So that's just one example using a discount - the most obvious type of offer to keep somebody.

But then it applies to other things too; you can A/B test trial extensions. How long do you need to extend a trial in order for somebody to come back and recognize the value to stay and convert from that paid trial to a paid full subscription? Pause is also similar, based on what you know about your customers. It may be one month, maybe three months. We generally don't recommend more than three months because then people forget that they were supposed to be paused in the first place.

35:07 Brady - Yeah, that was totally my experience as well. So we were doing three-month pauses, and we found disproportionately. When people were doing chargebacks or disputes, it was people who' paused for three months, they contact support sometimes, and they're like, who the heck are you guys? Totally forgot. So sorry to interrupt, but yeah. I found that my experience for one to two months was perfect.

35:26 Nick - It really does vary. It varies based on the type of business you have. If it's a B2B business, we find that longer pauses are fine, you know you're not going to get the chargebacks because you're dealing with a business that is like - okay, we'll have this again. And then if it's more of a casual consumer, they're going to forget, or they're gonna be like - oh I got charged, I'm not going to use it, and they cancel.

That's why you A/B test, though, and monitor the financials to make sure that each offer is well-tailored to maximize your revenue and increase the chances that the customer is going to stay longer, boost your LTV. One final thing that comes up a lot, Baird, you get this on every single sales call, I think businesses worry about gamification.

Like - oh, I'm going to come back every month and just keep taking discounts or keep pausing indefinitely forever. And you know we've addressed this. This is something that is built into our platform, where you can have cool-down periods, you can have anti-gamification tools, so that only certain segments receive that sort of offer.

And that's the full power of not building yourself and trying to chase every edge case, but having a fully featured platform that manages this for you. You can solve all the problems that you're worried about with individual gaming discounts, pauses, or offers, and make it so that it's not possible to get one over this time period. You can only get up to this many discounts.

36:48 Brady - Yeah, and this is something that I believe we actually ended up. So we started using this, and then I think we turned it off because I think from a psychological perspective, there's something where, like, some people just like to get deals, and they will pay for something if they feel like they're getting a deal.

Like, I always go back to thinking about Black Friday. Before it was like Black Friday week, like when it was actual Black Friday and people would go out and wait like six to eight hours outside a store like Camp, outside of Walmart, to get a TV for like 30% off, save, like 200 bucks.

37:17 Nick - I'm so glad you brought up that example because a lot of businesses will do annual plans at like a 50% off discount because they're like, oh, you know, our customers stay with us for about six to seven months, let's just get that money forward, bring it forward. You know the time value of that money is more valuable to get it now, and we're going to discount it because those customers have a high chance of turning anyway.

But that same customer, you could offer, turn off anti-gamification, they can come back every month and get the one-month 30% off. They're going to stay with you, and it's going to be less than what you're giving away on an annual plan. We see that a lot with customers who used to have really aggressive annual plans, and then they found that with Churnkey, you can actually mitigate some of that risk and actually have a better LTV for monthly customers than you do on this discounted annual plan.

38:04 Baird - Yeah, we have a hard time explaining, well, I should say SaaS operators have a hard time understanding that monthly customers are way easier to save than annual because when you buy an annual subscription, the feedback loops can be 12 months between when a customer has thought about you, or you know it can definitely be multiple months.

So, one other really important thing that takes me to another point about reactivations, I think one of the best things a company can do is understand their organic reactivation rate. So that means if you're not doing anything, how many of your customers cancel and actually come back? If you see that number over 10, 15, or sometimes 20 percent or more, that is a really big indicator that you could be using offers to smooth out that cancellation, those churn numbers, because people are cancelling. But then they're coming back voluntarily, so you can use offers to keep them around and give them what they actually want, which is more flexibility.

But then, you also have opportunities to be more strategic around who you contact to try to reactivate them after they've canceled. So I think that's kind of a really hidden metric when it comes to churn, that people don't really think about, but can be really telling and help you to make decisions on how you should be trying to attack churn.

The Hidden Risk of Annual Plans (and Why Monthly Customers Are Underrated)

39:29 Brady - Yeah, and kind of going back on what you're talking about, the things that we don't think about, when it's related to churn. Baird, you actually taught me this when I first started thinking about churn. When it first became a real full-time job, I had the assumption that annual customers were so much more valuable than monthly customers.

I remember being on a call with you, and you're like, well, it's actually really hard to get, or it's not really hard, but it's harder to get annual customers to stay compared to monthly customers, it's harder to negotiate with them. I don't know if that's because they have more, that they're going to pay upfront, or you know what, if they've really decided to leave.

I don't know what the cause is there, but I totally agree that monthly customers are probably undervalued by a lot of people who are looking at growth, looking at retention, because, like, honestly, you can just do a lot more when you're negotiating or making these offers to monthly customers.

40:24 Nick - There's another level to this, too, that when you go to sell a business, and the annual plans often could be discounted because it's like, you've already received the cash for these customers. There's a higher propensity that annual customers will not renew, or they will leave. So, in some situations, depending on your business, you may actually see that acquirers do not value the annual plan as much as this steadier recurring monthly customer base. So that's another good point to kind of keep in mind.

40:54 Baird - Yeah, I remember a potential acquirer, can't remember the exact churn, they used, but I remember we were kind of negotiating price, and they said we're just nervous about the future churn event that's about to happen. Meaning all these annual plans that are going to come up for renewal, and they're, like, you know, we can't pay full price for these annual plans because we don't know how many of them are actually going to renew next year. I think they called it like falling off a churn, a churn wall, or something.

41:13 Nick - It was, I think it was around the November-December time frame when we were fielding that offer, and we'd had a big Black Friday deal. It was like an end-of-year Black Friday thing, so maybe it was November. And it was like they sent us the offer letter, and we got on a call, and we're like, what the heck happened, and he's like, well, you know, a lot of these are coming up for new, we need to see how these go.

41:45 Brady - Wow, that must have been pretty scary.

41:49 Nick - Yeah, we were already nervous about it, and then we were more nervous because it's like, oh man, this could hurt.

How to Build a Legally Compliant and User-Friendly Cancel Flow?

41:56 Brady - Yeah, well, speaking of things people are nervous about. So, as we're talking about these cancellation surveys, all these offers, it all sounds, I think, complex. Are there any legal ramifications or things people need to really be looking out for when they're making their cancellation process?

And I think Nick, you have a legal background, so you're probably good to start on this one.

42:12 Nick - Yeah, I'm an attorney, but this is not legal advice. I have to throw that disclaimer out there, but yeah, it's an interesting area to me. You know, if you look back over time, and you think about the best example, the gym. So if anybody who's listening has ever tried to cancel a gym membership, you can't do it online. You've got to go in person, and then you've got to fax something to the owner of the gym, and the owner of the gym has to sign off.

You might as well send it by carrier or pigeon; it's so complicated. The FTC recently has said, hey, there are a lot of problems out here with bad patterns and practices that are not consumer-friendly, even predatory in some cases. They've tried to address that with a ruling. Now, we will see if this ruling actually goes into effect as scheduled in June; with an administration change, it may not happen at all.

But it's out there in the zeitgeist now. It's important to be aware that states could still start to pass some of this legislation; California has some that's not going away. So what do you do as a business to just make sure that you're compliant?

- Well, number one, if you don't have a self-serve cancellation portal of some kind, you absolutely have to have that. And a lot of companies are scrambling right now to do that.

- There's other language within the FTC, guidelines, and the new regulation around symmetry with the cancellation process. It needs to be as easy to cancel as it is to sign up.

The way that we've gotten our own FTC expert, legal counsel to come in and really walk us through this. This guy's up in DC. He spends all day, every day, nerding out on FTC rulings. And he was saying the symmetry thing, it's not a perfect measurement that they're looking for, but it's like you know, they know it when they see it. If it's a three-minute sign-up, it shouldn't take 10 to 15 minutes to cancel, right? Like you shouldn't have to create a support ticket or an email, even if it's online. You shouldn't have to go through all this hassle to do it.

But if you've got a self-serve cancellation process, they're not going to be looking at it. Saying it took one minute to sign up, it took three minutes to cancel, that's not what you need to be looking out for here. It's really about delivering a good user experience.

If you're actually dedicated to delivering a good user experience, you're not using dark patterns, you're not hiding cancel buttons, you're collecting feedback, doing all these things in the best interest of your customers and attempting to offer them something to stay, then you're going to be perfectly within the realm of compliance according to the construction of that statue.

44:51 Baird - I'm glad you brought up dark patterns. It's kind of like, well, it's not like the annual plans, but it's similar, where if you know we've had some customers that we've talked to. They're like, well, if I put a cancel button in my back in the app, my churn's going to spike. It's like, yeah, it is, but your reactivation rate is going to be better because people aren't going to be furious when they're trying to cancel their account.

So I think it's worth noting that a lot of this legislation probably shouldn't be scary to business owners, because it's really just reflecting what the market wants. Like we've been seeing this for a decade, consumers want control over their subscriptions. They want to be able to cancel online, and if you don't offer it, they're probably going to go complain on Facebook and tell all their friends about it, which is going to hurt your business even worse.

I think it's worth mentioning that everything that we've read about this legislation matches up with what we're seeing in the market, of what consumers want. So it shouldn't be a scary thing wanting to provide a good user experience, like Nick said to subscribers, the way they want it.

45:55 Nick - Yeah, like one thing that we did that we found was really helpful for some businesses is email-based cancel flows. So, like somebody doesn't remember their login, or they don't have a user portal. Well, businesses are able to have an email-based flow, so they just enter the email, and then they get a link to a cancel flow.

It's about thinking through all those different cases for your customers, knowing what you know about them, and doing right by them; otherwise, you're going to have what Baird said. Those customers are going to give you bad word of mouth, bad reviews, unlikely to reactivate, and chargebacks, a higher dispute rate, and a likelihood of getting the platform from your payment provider if that rate goes too high.

46:34 Baird - Yeah, chargebacks are probably the single most increasing aspect of all of them when it comes to subscription payment providers. I think it's another thing that's becoming normal for consumers to think about or see subscriptions like I'm just going to go through my bank and cancel it. You know, to make sure that it gets done because they don't trust the user experiences out there, which you know is something that all of us, operators, need to do a better job of providing, so that people don't do that.

47:04 Nick - Yeah, that's a really great point too, around the difficulty of cancellation versus chargebacks. It shouldn't be easier to file a chargeback with your bank than it is to cancel the subscription. Some companies have made it easy, like Apple Card. I had to file a chargeback on that recently, and I hate chargebacks, so I felt like guilty doing it, but it was a service that I had actually canceled. And it was a service that I had to send an email support ticket to actually cancel, and it still didn't fall off, so I filed a chargeback. It was so easy, like it probably took me 10 or 15 minutes. But that's better than waiting around for emails with Apple's chat support, and I think that's also why chargebacks are increasing. It's getting easier to file these.

47:47 Brady - Yeah, and just to clarify for anyone who isn't sure. So if someone has sort of this offboarding procedure you guys are talking about, where someone clicks a cancel button, they get surveys, offers, you know, everything that can be done within like a minute, two minutes max. They're still the person who's running the business that's still on the right side of the law; they don't have anything to worry about.

48:10 Nick - Yeah, not legal advice, but yeah, they don't have anything to worry about. And also, like we track time spent on cancel flows, we have session recordings and things like that. Customers, like the businesses we serve, can actually go back, and they can see if there are dark patterns or issues with the cancel flow.

I think 48 seconds was the average time spent, which is, you know, less than a minute. That's pretty fast. If you really want to cancel for sessions, if somebody really wants to cancel, it's just - no, no cancel 15 seconds. Then there are other ones where it does go a little longer. It's when they're really deliberating, and you can actually watch the session and say - oh, they're considering this. They're waiting, they're wondering, you know, is it worth pausing and retaining the subscription, so that's another important thing when you're looking to be compliant.

Just making sure you understand, like what's the feedback we're getting around our cancel flow? Are people upset about it? Do we need to change things with a product like Churnkey? You can do this really simply on the fly and like push changes live immediately, so that like you've made it easier within five minutes of editing a cancel flow.

How to Reduce Involuntary Churn

49:20 Brady - Okay, well, that's really cool, and I'm sure that puts a lot of hearts at ease because no one wants to be on the wrong side of the law, especially someone who has no legal background. They just want to run their business, they just want to make some money, do good for their customers, and so on. So, I think, we've pretty much talked a lot about voluntary churn. Let's go to involuntary churn in our last few minutes here.

So first, could one of you go ahead and let's define that again, because it's been a few minutes since we've talked about it. And then maybe talk about some best practices that you're seeing businesses do that are really lowering their involuntary churn.

49:53 Nick - Well, involuntary, it's like it sounds, not intentional churn. Some people call this accidental churn, some people just call it failed payments, but that's essentially what's happening - somebody has agreed to use the subscription, they're going along, they're happy, they're using the product. And then something happens outside of everybody's control on the bank side and the payment side that the card fails, and it's declined. We're seeing, over the last three years, since we've been working in this space of failed payment recovery, an increase in this due to more sensitive fraud alerts.

I mentioned earlier that some of this is also due to cards that have a virtual debit card or virtual limit. There are a number of things that have influenced this and caused it to spike over time, so that's a quick overview. What's happening here is that payments are just failing a lot of times, customers don't want to leave, they don't want to be canceled, but the business logic automatically cancels the subscriptions when a payment is declined for a certain period of time.

50:58 Baird - We've been working with customers to really help them understand the difference between hard and soft declines, too. So a hard decline means that that card's never going to work; maybe the card was stolen or doesn't exist any longer, versus soft declines, where maybe it's just insufficient funds or there was a bank. Some of these bank codes are not very clear, and you run the card again, and it actually works. So, when there's a hard decline, it doesn't matter how many times you retry the payment; it's never going to work.

Then it comes down to communicating with the customer, notifying them, letting them know that they need to update their payment information. What we see is that you're fighting procrastination; these customers generally want to stay subscribed, but it becomes a to-do list that has to be checked off. They're like - oh, I got to go log in, update my payment information. So I think communicating very timely, sending great emails, writing a great copy, making sure that emails don't go to spam, and then providing a really clear experience to update credit card information is important.

Something else that works really well is including offers in the email. And again, you're fighting procrastination with these people. So if you put a 50% off coupon for this specific invoice that needs to be paid, you're going to get a lot of people moving it up the to-do list and actually update their credit card information.

So those have been some strategies that have worked really well. The latest has been SMS, if you collect phone numbers from customers. Nick, what was the latest reading like, 3x recovery rates with SMS?

52:41 Nick - Our customers see a 3X recovery rate when they're using SMS compared to email. That just goes down to how convenient it is to update something from your phone. Somebody's more likely to just tap an SMS that comes in and update a mobile-friendly web page with a card. So, back to procrastination, that's the biggest issue we see with involuntary churn.

Customers don't want to cancel the subscription. They put it on their to-do list, and they wait too long until the subscription is automatically canceled.

53:10 Brady - You guys were mentioning three times a response rate with SMS versus emails. Do you have any numbers so far? Roughly how much someone should expect to recover when they're sending an email?

53:20 Nick - You know, it's hard to compare when you're doing both. We have a few customers where we can compare it because we've had enough time to assess it. One customer I'll use as an example: they were getting 45 to 55%. It varied by month with just emails, and they've boosted it into the high 50s consistently, like 58 to 62% last I checked, on a monthly basis by adding SMS.

Another thing, in addition to SMS, that can increase this is, let's say, you're a company and you serve other businesses. You have seats at that company, and the person who is the primary record holder who would typically receive that email is gone (they're on holiday, on maternity leave) or they've left the company. What do you do then? There's no way to reach them. You can retry it, but if it's a hard decline, what are you going to do? Well, now we offer the ability to send to multiple contacts. So if you have people with multiple seats on an account, then you can reach out to those different seat holders with an email saying - hey, you're about to lose access, please update your information.

54:27 Baird - Yeah, the most common example is the CFO or someone in finance buys the subscription. And that's what you know in Stripe or your payment provider: that's the email that's listed, but that person never uses the product. Emailing that person over and over again might not do any good when you know the person who really needs it is somebody in marketing or in sales.

So being able to communicate with the right person is really important. I'm surprised that we built that feature for one of our largest customers, and I'm surprised it took that long for it to come up as a feature request; it seems so obvious, but now it's been really incredibly effective.

Automation vs Manual Recovery: Why Automation Wins

55:10 Brady - Well, I can tell you why it took so long for that feature request to come up. This is my scenario: I was using our payment provider to do this, and I thought it was fine, like I didn't know what to expect. We were having sort of mid-five figures in churned revenue every month. They were recovering a couple of hundred bucks, so I was like, I don't know, I don't spend any time on it. So it seemed better than nothing.

Then I started using a solution that worked. I'm gonna throw away, my kind of riding the fence here; I was using Churnkey and our recovery rate, like depending on the month, literally like 10 to 20x. It was such a difference, and what was really cool about payment recovery as well, is that this was something that we just spent no time on. We set it up, and it's just stinking run. I mean, it was getting just incredible numbers as far as how much we were losing and how much we were recovering.

I don't remember the exact percentages, but it was something mind-boggling, and when you count like our return on time investment that we had invested in, like do we put an hour into payment recovery, maybe, and we're making five figures a month from it. It doesn't get better than that

56:20 Nick - I think in some situations, Brady, the time recovery is potentially more valuable than even the revenue. Now the revenue recovery is going to be amazing, but if you've got somebody who's a customer success agent, and they have to track down, fill payments, and they're spending 5 to 10 hours a week, that's taking time away from other accounts they need to be focused on. They're on the payroll; that's a very tangible cost.

The other thing we've seen is that the automations that platforms like Churnkey has, will actually beat and outperform a CS agent or a dedicated person who tracks these down because that is the only job of the platform: in a machine-like customized fashion, recover these. Whereas a person is going to get distracted trying to chase payments down. They're not going to be as consistent; there's that human error element, so I think that's an important thing to point out. Because a lot of companies just throw a person on it and say - hey, go fix this, go chase all these down.

57:18 Baird - I think it goes back to what consumers or what the market expects. I think automation is what consumers expect; they don't want to talk to somebody. You know, you get an email from some random person that's telling you to update your payment information. Even though you know it is maybe personalized, but wait, who is this person? Am I being fished? It's like what's going on versus something from the business that's very transactional and seems fast and automated. It is going to be something that I would personally much rather interact with. Then the feeling like - I have to have a conversation with somebody. So you're again going back to some of these legislations, and what people and what the market expect. I think this fits in line with that as well.

Final Words

58:07 Brady - Yeah, you're totally right, having actual conversations is the worst, except for this one. This was really great, thank you guys both for your time. I think we've covered a huge chunk of churn. Of course, there are still a million things that people can still do to lower their churn. So, anything you guys want to wrap up with as far as what people should be doing, and then where can they find you guys?

58:25 Nick - Well, I mean, you can find both of us, our names are Nick and Baird, at Churnkey.co. We're both on X (Twitter) with our first and last names, too. Not as active on there as we used to be. I guess that's a good sign that the business is busy, and we don't have as much time for distractions.

And, you know, it's a New Year; it tends to be our busiest time of year when everybody is like - oh, wow, New Year, we got to do a churn resolution. There's really no better time to start recovering than now. Stop procrastinating on your churn problems and do something about them.

We're happy to meet and talk. You know, we're not going to do a high-pressure sales pitch or anything, but this is what we do, it's all we do. We love talking to businesses about churn because we've been there, we know the psychological impact that churn has, and it's negative. Sometimes we see ourselves as a churn therapist. We love to talk about business, and talk through problems, and if we can help with the platform, we'd love to do that.

59:20 Brady - Cool. Baird, any closing thoughts?

59:23 Baird - I think, to just wrap up, if I had to just give one sentence summary on churn, it's this:

Don't avoid the churn, don't hide from it. You might as well just face it. Good operators don't look at problems as painful, but look at problems as opportunities to grow, and that's what churn is. You get closer to your customers, you'd better understand what they're really looking for based on what they didn't receive or didn't think they received. It doesn't seem fun, but there's just nothing but good things that come from tackling churn head-on.

Similar to any New Year's resolution that everybody's trying to do right now, the best way to do it is just to get started. So that's my wise words of the day.

Find us on X (Twitter), LinkedIn. I think I'm still the only Baird Hall in LinkedIn, so you can find me there pretty easily. We'd love to chat with anybody who wants to talk churn or retention.