How to Reduce Payment Failures and Recover Customer Accounts

Involuntary churn–when a customer's subscription is cancelled unintentionally–is a significant problem driven by credit card failures. When you lose revenue from people who actively want to pay you, your business shrinks along with your reputation. But it's not a problem you created. Banks, credit card companies, and their opaque policies are causing up to 40% of your churn.

Let’s take a deep dive into the world of payment failures — what they are, why they happen, and how you can reduce your overall failed payments.

What are failed payments?

Payment failures, or failed payments, happen when a customer’s card transaction fails to complete because of an issue in the payment process. This failed payment then leads to the cancellation of the customer account, resulting in involuntary churn.

How significant is involuntary churn?

As a subscription business owner, involuntary churn may be taking a bigger toll than you realize. In fact, for most subscription companies, involuntary churn can account for anywhere from 20-40% of overall churn.

Then there are seasonality concerns—the summer months, when spending increases for travel; in January, after a spike in holiday-related spending; on a micro level, the time period before paychecks are deposited—that your business can plan around.

All in, that means it’s vital subscription businesses have strategies in place to track payment failures and recover customer accounts. To do that, you first need to understand why payment failures happen.

Why do payment failures happen?

Each time a payment failure occurs, you’ll receive a credit card decline code, which is a signal from the bank through your payment processor that a card transaction failed. By checking out the code for a failed payment, you can more easily understand the specific cause for a payment failure.

Credit card declined codes cover a wide range of payment failure issues. For instance:

- Code 41 indicates the the cardholder has reported their card as lost or stolen and the bank is blocking any attempted transactions.

- Code 61 indicates that the attempted amount exceeds the issuer’s withdrawal limit.

- Code 05 is a do-not-honor code that essentially means that the bank has blocked a transaction because the card cannot be honored as a form of payment.

Let's examine some of the most common reasons for card failures 👇

System-related errors

Sometimes failed payments don’t have anything to do with the customer’s card. There could be a system malfunction or error or a temporary communication error. Normally, the only fix needed for this would simply be to run the card again after it's on file.

This error can be overcome by retrying the card automatically at the right time.

Insufficient funds on prepaid or debit cards

This issue occurs whenever the customer doesn’t have sufficient funds in their account to cover the amount of the charge. Payment failures due to insufficient funds can be a huge problem for subscription companies, especially if your customer base regularly uses prepaid debit cards as a method of payment.

If a significant amount of your customers are paying with prepaid card, try retrying payments after typical paycheck deposit periods, such as the beginning or middle of the month.

Fraud mitigation

You may occasionally experience payment failures due to fraud mitigation. While fraud protection is obviously an important issue, sometimes legitimate transactions get declined in the process. In fact, research has shown that the average false decline rate is 1.16%, which results in more than $11 billion in lost sales per year.

Card expiration

Another common source of payment failures is when customers leave expired cards on their account, whether by accident or to purposefully allow their subscription to lapse. The majority of the time, it’s most likely that the customer simply forgot to update a card that was expiring.

Incorrect card information

Finally, payment failures often happen as a result of incorrect card information. If a customer inputs even one number incorrectly when they’re adding their payment information (whether it’s the card number itself, the expiration date, or the CVV), then the payment will end up being declined. That’s why it’s so important to have a card verification system in place.

How can I reduce failed payments?

Retry the card intelligently

One of the simplest methods for recovering customer accounts and reducing payments failures is to retry the failed payment method. But you have to use this method strategically, since there is a set number of retries you can run and excessive retries can cause the bank to reject your attempts and even trigger fraud detection.

This is also where credit card declined codes come into play. The reason for the failed payment will dictate whether or not a retry is prudent.

Message strategically

If retries don't work, it's time to ask the customer to update their card. Much like credit card retries, this should be done strategically. Always try to message customers at opportune times in their own time zone.

We recommend rotating your messaging through different senders and addresses within your company, as well as different subject lines to catch people's attention. Otherwise, our research indicates that customers become desensitized to your recovery attempts, not to mention that email clients like Gmail and Apple Mail roll up conversations with the same subject and sender.

Simplify the card update process

If you want to anticipate and mitigate payment failures before they happen, then it’s vital that you make it as seamless as possible for current subscribers to update their payment info before it expires.

For instance, it’s best if you can provide your customer with a way to make those updates without having to log in, call customer service, etc. Essentially, the more you reduce friction on the customer end, the more likely those customers will be to update their credit card info.

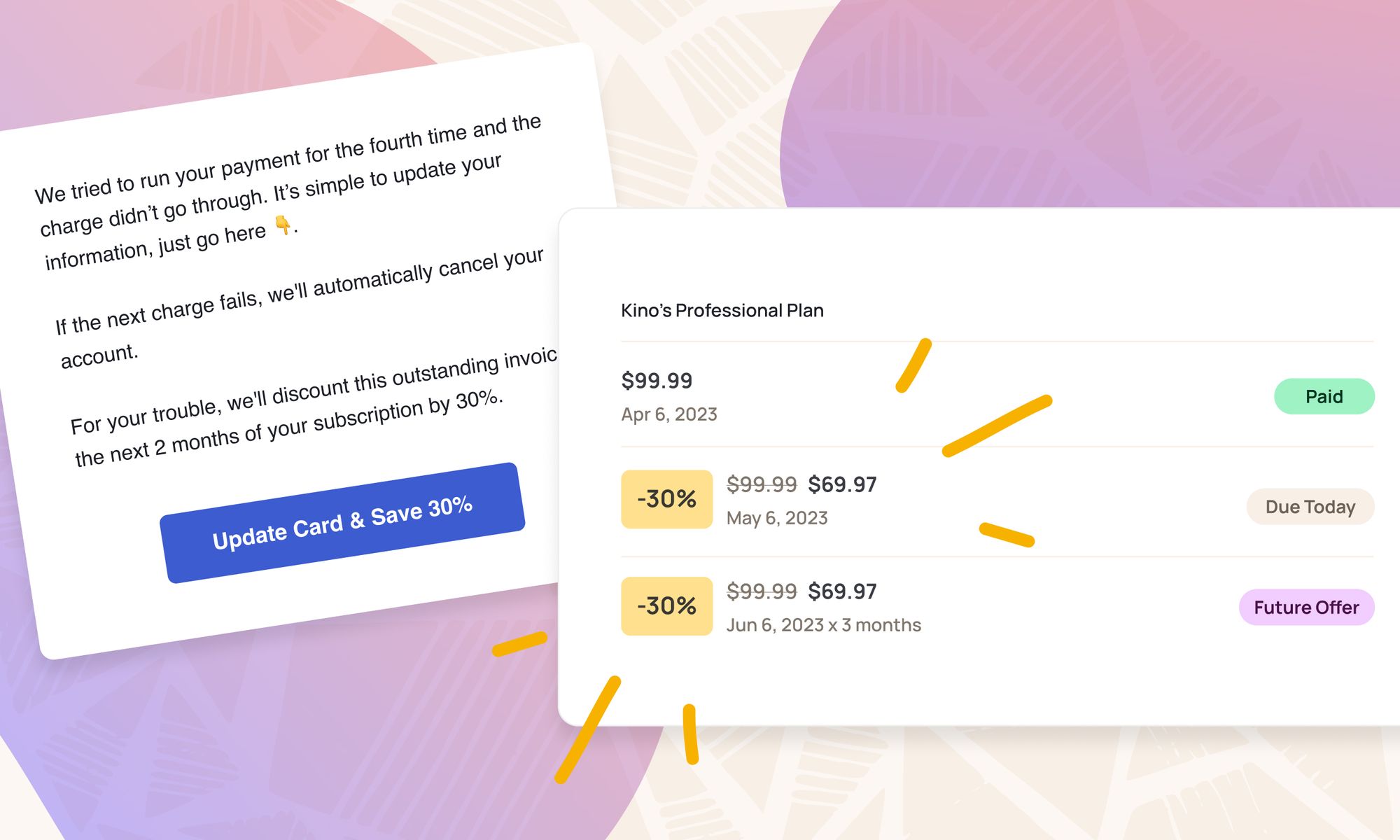

Incentivize with offers

Sometimes customers just need a little extra nudge to update their payment information. And that’s where a well-crafted incentive comes in. The right offer can help you improve your failed payment recovery rates and re-engage at-risk customers.

For instance, you could message a customer with a recent failed payment reminding them of the status of their account and offering them a percentage off the next two months of their subscription if they update their payment info.

Ask for backup payment options

Another great way to prevent payment failures before they happen? Provide customers with the option to list backup payment methods in their account. This can offer you a seamless way to proceed if the primary payment method fails without having to retry the original card or message the customer with payment failure reminders.

Handle your payment failure problem with dunning management

You already know that you can’t afford to lose customers due to payment failures. But you also have a lot of other goals to focus on. That means you likely don’t have the time or the inclination to become a payment recovery expert. And that’s why you need to right tool to help you manage and reduce payment failures.

Reduce failed payments with Churnkey

With a payment recovery and churn reduction platform like Churnkey, you won’t have to worry about handling payment failures or recovering customer accounts ever again. Build upon the latest, most modern infrastructure that’s designed to maximize deliverability, make card updates a breeze, and use AI to optimize delivery times, Churnkey can recover up to 89% of failed payments with our dunning management product.

When it comes to dunning management, Churnkey makes personalization effortless. We know that each of your customers are unique and deserve to be spoken to on an individual basis. We can make that kind of personalization happen, but at scale. Churnkey optimizes messaging on your behalf to boost failed payment recovery rates, along with your revenue.

Our Intelligent Retries feature uses machine learning and algorithmic processing on data from millions of transactions to know when, how, and why a payment will likely succeed. Plus, our dunning management is white-labeled to your brand and lives on your domain.

By simply turning on Churnkey Failed Payment Recovery, you’ll see ROI immediately. You’ll start recovering payments as soon as you go live and you’ll watch your recovery rates go up without blinking an eye. And here’s the best part… companies generating up to $25K MRR get our modern payment recovery product for free. Because getting started with the best involuntary churn solution shouldn't be a setback.

Schedule a demo or sign up for a free trial to start reducing payment failures today.

Failed payment, credit card, and recovery FAQs

Why do credit card failures happen?

Credit card failures happen for a variety of reasons, ranging from fraud mitigation and system-related errors to incorrect card information. Each of the above categories involves even more specific reasons for the payment failure, like expired card numbers, insufficient funds, etc.

How do you stop failed payments from happening?

There are several strategies you can use to stop failed payments and recover customer accounts. You can retry the failed payment, if you receive a relevant declined code. You can reach out to customers directly, letting them know about the failed payment. You can make it seamless for customers to update card info that’s about to expire. You can offer incentives for updating expired card info. And you can allow customers to provide multiple payment options, including backups.

What is a dunning campaign?

A dunning campaign is set of processes that SaaS businesses can use to manage and reduce payment failures. A dunning campaign will typically involve sending payment reminders, negotiating payment plans, issuing late payment penalties, etc.