Restricted Card Decline Code (62): Meaning, Stats, and How To Fix?

Restricted card refers to when transactions are refused because the card is reported lost or stolen. You can let the customer know and make it easy for them to enter a new card. It's a hard decline which means you cannot retry the payment.

What Does Restricted Card Decline Code Mean?

A restricted card decline in Stripe refers to a situation where a payment attempt is declined because the card was restricted either because it was lost or stolen. Virtual cards issued by companies can also be restricted.

The decline code originates from the card issuing bank and is further grouped by card networks. Stripe, Paddle, Braintree further group these codes and return a code to you.

To reduce churn, sign up for Churnkey or book a demo.

Restricted Card Decline Is Rarer

There are efforts made by Visa, Mastercard, and other card networks to encourage more specific decline codes which would help merchants and customers resolve errors faster. There's been a steady industry over the years.

These are the top 5 decline codes, broken down by region.

Read about all other decline codes here.

Recover Failed Payments With Churnkey

Churnkey is a powerful churn software. We help companies save 20-40% of the revenue that they would have otherwise lost to churn. When you lose revenue due to a failed payment, we have four products that tackle it:

- Churn Metrics (Free): Get a free, visual analysis of your churn, especially the breakdown between involuntary and voluntary churn. This will help guide your churn reduction strategy.

- Dunning Campaigns: Dunning campaigns allow for a personalized, one-click payment recovery. For example, say you want people to update their cards? If Precision Retries can't recover the payment, Dunning will pick up where it left off.

- Reactivations: Reactivations target lost customers with relevant offers.

- Precision Retries: Precision Retries intelligently retry cards well within the limits and can be layered on top of Stripe's smart retries for maximum revenue boost. You can protect any revenue lost due to soft declines like do not honor, insufficient funds, and generic declines, in as little as 15-minutes. Precision Retries integrate natively with Stripe. Implementing it requires no code.

Churnkey is also SOC-2 compliant and has robust security protocols to keep your data secured. We protect over $2B in subscription revenue across our portfolio of companies.

To get started, sign up for Churnkey or book a demo.

Types of Card Declines

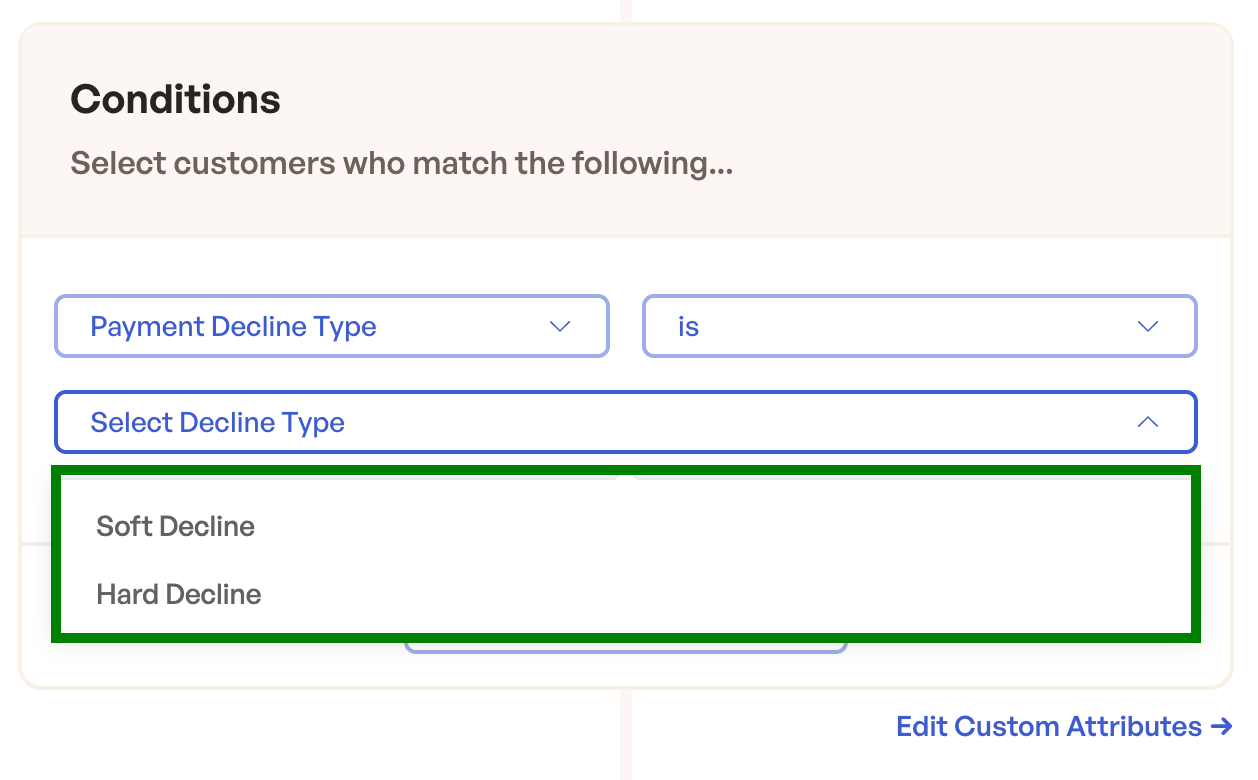

Declines can be categorized into two main types:

- Soft Declines: Soft declines are temporary errors. They can sometimes be resolved by retrying the transaction. Restricted Card is not a soft decline.

- Hard Declines: If the customer's card was restricted, it's a hard decline. You should not retry. You need to intervene via dunning campaigns, failed payment walls, and one-click recovery.

Learn more about types of declines:

How to Fix Restricted Card Declines?

There are multiple ways to manage it if you're a subscription business. Churnkey recovers up to 89% of the failed payments with its failed payment suite of products.

1. Request Card Change

Context: Address restricted, expired, or virtual cards by asking customers to enter a different card. This requires customer action but is most likely to succeed simply because a new card is added in.

Caution: Ensure the process is seamless with no logins or multi-step verifications.

Solution: Churnkey provides a frictionless dunning (email + SMS) platform that allows customers to update their cards easily, with options for advanced personalization (plan name, subscription age, trialing, etc.). You can also use Churnkey's hosted page for stronger security compliance.

Go a step further and segment based on soft and hard declines in the Churnkey platform. This allows you to send different emails to users that have different call-to-actions to make.

To get started, sign up for Churnkey or book a demo.

2. Leverage Offers and Partial Payments

Context: Sometimes customers will quietly let their cards decline on purpose. Offer discounts and partial payments that auto-apply to their account.

Caution: Manage potential system abuse when offering discounts.

Solution: Implement Churnkey's Dunning Offers to entice customers to update their cards with incentives like partial payments or automatic discount codes. Churnkey has anti-abuse built in.

3. Feature Blocking

Context: Blocked product access can prompt action. Users can escalate this issue to their billing manager.

Caution: Prevent unpaid usage when doing so. Depending on your settings, users may be prevented from accessing certain features.

Solution: With Churnkey, you can dynamically block feature access for past-due accounts. And customers can update their payment details directly inline without navigating elsewhere.

To get started, sign up for Churnkey or book a demo.

4. Monitor Metrics

Context: Since decline codes are confusing, what you can rely on are metrics. Try different offers and keep a close eye on the metrics to see what changes. Is voluntary churn higher than involuntary churn? Is there a certain decline code surfacing higher than others? Is there a certain card type that declines more than others? Use metrics to gauge the effectiveness of your retention strategies.

Solution: You don’t have time to parse overloaded charts and confusing terminology. Churnkey’s best-in-class analytics speak plainly—helping you and your team track boosted revenue, offer uptake, recovery rates, and more. You can reach out to our support team for benchmarks.

Case Studies

1. Veed.io

Veed.io successfully leveraged tailored discounts and pause options, saving nearly 5,000 canceling customers. Utilizing Churnkey's Precision Retries and Dunning Offers, they recovered over 14,000 failed payments, achieving a 35% increase in their save rate. Read Veed.io's case study.

2. Sudowrite

Sudowrite boosted revenue by over six figures within a year across various churn channels by integrating Churnkey voluntary and involuntary suite into their operations. Read Sudowrite's case study.

Common Errors and Misconceptions with Restricted Card Exceeded Decline

Common errors or misconceptions when dealing with the restricted_card code include:

- Retrying the transaction repeatedly: This can trigger alerts and further declines. It’s better to stay under the limits, contact the card issuer, or use a different payment method.

- Blaming the merchant: Customers often think the issue is with the merchant, but it's typically due to the card issuer's policies.

FAQs

What does restricted_card mean on credit card?

Restricted Card is a hard decline code used by banks to indicate a customer's card is restricted. Typically when it's lost or stolen. You cannot retry the card. Instead, use optimized dunning campaigns, layer on feature blocking, and a host of other involuntary churn reduction strategies.

What does decline code 62 mean?

Decline code 62 is associated with 'restricted card'. Typically, restricted card decline error refers to a declined transaction when the bank or the card issuing network (Visa, Mastercard) permanently rejects a payment because the customer's card was reported lost or stolen. Stripe recommends asking users to contact the bank but there are lots of ways to tackle this decline error.