Passive Churn: 9 Best Practices to Fix Passive Churn

Passive churn happens when customers are lost due to issues like failed payments or billing errors, without actively choosing to leave. Thankfully, there are ways to reduce passive churn.

What Is Churn?

Churn occurs when customers stop using your services, either voluntarily or involuntarily. For subscription businesses, this means customers don't renew their subscriptions. For non-subscription businesses, it refers to customers not making repeat purchases within the expected time frame.

For example, Netflix has a 2% churn rate while Apple TV+ has a churn rate of 8%.

The lower the churn rate, the better it is for your business and your growth ceiling.

What Is Passive Churn?

Passive churn happens when customers are lost due to issues like failed payments or billing errors, without actively choosing to leave. This includes:

- Forgetting to renew

- Payment blocked due to high-risk settings

- Difficulty in renewing due to UX complexities

- Payment decline errors like do not honor and insufficient funds.

When it comes to payment errors, insufficient funds leads the pack.

In contrast, active churn occurs when customers intentionally cancel their subscription by clicking on cancel button.

How to Reduce Passive Churn?

Fixing passive churn is crucial because it helps retain customers who didn’t intend to leave, preventing revenue loss from payment failures or billing issues. Thankfully, this is a solved problem and there are solutions out there for you to adopt.

1. Retry The Payment

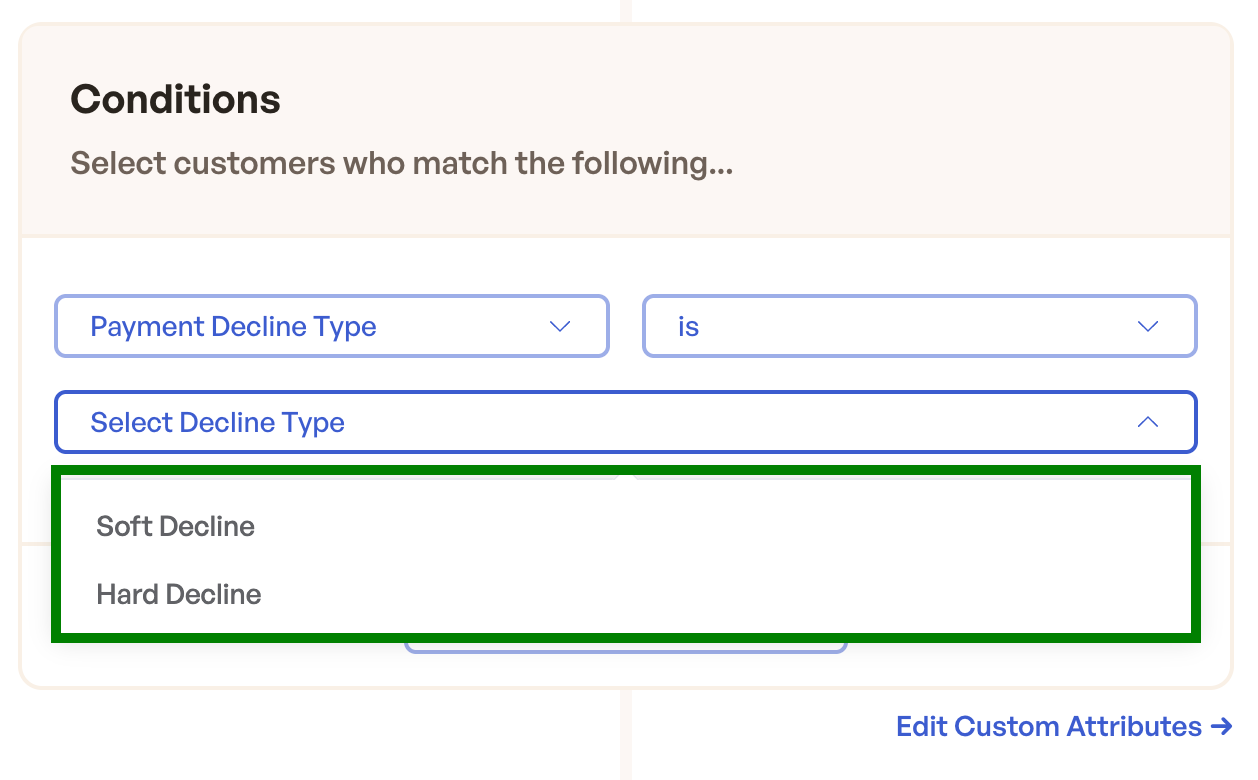

Passive churn can be due to a hard decline or a soft decline. You can retry soft decline errors as long as you're within the retry limits. Mastercard allows 35 attempts and Visa 15 within 30 days. Exceeding these limits can lead to fines as high as $15,000.

2. Dunning Emails and SMS

- Send personalized, on-brand dunning messages via different senders in the users' time zone to recover a failed payment.

- Use pre-signed URL that uses your verified subdomain. This helps increase conversion rates because users don't have to login again.

- You can take it a step further and create segments based on different users (annual vs monthly / trialing vs x plan, admin vs member).

In the screenshot below, you can see we've configured the dunning email flow based on whether the payment failed due to a hard or a soft decline.

3. Reactivate and Win Back

Not all those who churn are lost. If dunning and precision retries can't recover users, try to reactivate users who have already churned.

- Offer discounts and customize the email copy based on the exact reason they specified while cancelling.

- You can also use churn modelling to understand who are your most active users and target them.

4. Offer Customer Support

Offer dedicated support for passive churn. Have an account manager or customer support executive reach out based on the reasons you see in your churn dashboard.

5. Easy Card Updates

No passwords, no logging in: let your customer enter a new card with just one click. If you're offering a special discount, ensure that that discount auto-applies.

6. Collect Partial Invoices

Offering installment options can ease the burden on customers facing temporary payment issues, such as insufficient funds or maxed-out cards.

7. Payment Recovery Wall

Dynamically block feature access while asking your customers to update their payment details directly inline.

8. Customer Risk Modelling

Be more strategic with your team's time: know when to engage your best customers, predict at-risk revenue, and track trends in feedback. Get ahead of your passive churn with advanced churn propensity modelling.

9. Track Churn Metrics

- Track what % of churn is due to passive churn vs active churn.

- If passive churn is very low, you might be better off fixing voluntary/active churn first.

- When it comes to passive churn, know where you're losing the most. Is it due to insufficient funds or do not honor? Is a certain card failing more than the rest?

- Compare with industry benchmarks across all your churn metrics.

How Churnkey Can Help?

Churnkey is a complete churn reduction platform. Our passive churn suite of products includes:

- Churn metrics

- Omni channel dunning campaigns

- Precision retries

- Failed payment recovery wall

- Customer health

and more!

We natively integrate with most billing providers and support companies at all stages of their growth. To get started, sign up for Churnkey or book a demo.