What Is Involuntary Churn, How To Reduce It, Benchmarks

All involuntary churn issues like payment processing errors, logging out, switching emails, expired credit cards, limit reached, address change and how to solve them.

Maybe involuntary churn is harmless.

And maybe there's nothing you can do about it.

Not to mention, it can feel like a chore to tackle.

The most frustrating part? Working on involuntary churn might not change anything.

But you also know that churn is a silent killer. It's capping your growth ceiling.

Sure, you can choose to focus on voluntary churn.

The consequences of involuntary churn

But if involuntary churn makes up 20-40% of your overall churn, is ignoring it really the right move? And that's the reality for most businesses. 20-40% of their overall churn is involuntary.

How much is involuntary churn costing you?

Get a free, visual analysis of your churn metrics and understand how your retention compares to other companies. Churnkey's free churn product offers visibility on your:

- Gross and new churn rates by date.

- Involuntary and voluntary churn rates.

- Revenue vs logo churn.

- Retention cohort analysis.

- New vs. old churn.

- Churn cake charts.

Voluntary churn vs involuntary churn

Involuntary churn occurs when customers unintentionally stop using a service due to reasons beyond their control, such as payment failures, technical issues, or changes in service policies. It comprises of hard and soft declines.

Voluntary churn on the other hand is when they physically click on that cancel button.

And here's the big question: who should own involuntary churn?

Who's it going to be? Finance, customer support, product, marketing, or growth?

One thing's for sure. It's not something people 'volunteer' to work on. 🤓

It's a real team effort.

Usually, a few teams shoulder the responsibility together.

- Product focuses on minimizing friction related to technical issues, such as bugs, login problems, or email changes.

- Finance handles payment-related issues, such as expired credit cards, credit card limits, or address changes.

- Customer support addresses both product and payment issues to return users to a healthy state.

- Growth team personalizes resurrection campaigns based on customer data and reduces friction so that it's easier for users to fix their problems.

It's possible to reduce involuntary churn

What if I told you that there's a better way? And that involuntary churn can be mitigated and reactivated.

In this article, we'll classify the types of involuntary churn, show examples, and share ways to mitigate it.

Involuntary churn benchmarks

Here are some metrics from our retention report.

The large number of “Insufficient Funds” failures in 2024 could be attributed to virtual cards since these cards come with hard spending limits.

This decline reason, combined with the nebulous “Do Not Honor” code, can help us visualize the scale of virtual cards for businesses.

B2C companies are more likely to accept debit cards which is why you see a steeper increase in 'Insufficient Funds'.

Making sense of your data

Churnkey has a native integration with Stripe. You can see an overview of the reasons why your payments fail, the recovery rate based on any campaign you run, and how it has trended over time. You should also be able to segment it, e.g., for active subscribers vs. trialing customers.

An alternative way to estimate is to look for 'past-due' in your billing provider. If you use Stripe Connect, you can see all your past-due subscriptions by clicking here and exporting the data.

"Most businesses are surprised to find that involuntary cancels can represent between 25% to 50% of their total cancels. At any point, roughly 5% of your paying subscribers may be “past due” — they’re going through the credit card retry process after a payment failure and are at risk of canceling."

Source

How to reduce every type of involuntary churn

There are a few major causes of involuntary churn. Let’s go through some of the most common and look at examples for each.

Payment processing errors

There are lots of ways to lose a customer. One way is to simply never charge them. Involuntarily, of course.

Back in 2018, Spotify migrated payment providers. If bugs creep up in your payment processor, people aren't going to be able to pay or use your service.

Spotify fixed it quickly, but here are a couple of things you can do to prevent a similar issue:

- Monitor failed payment errors for anomalies and spikes. Dropbox's monetization team has a technical article on how Dropbox manages payment failures.

- Setting up a failed payment help article so people can report or self-help like this one from Netflix

Users getting logged out

Logging in is generally a high-friction activity. If they aren't able to log in to update their payment cards, that might be revenue that's lost forever.

While Instagram isn't your traditional SaaS company, their entire business model revolves around MAUs. So, it's a good example to look at.

- Instagram developed a "Save your login info" feature. This allowed users to log back in quickly on shared devices or when managing multiple accounts—one personal and one for a brand.

- They also added support for the auto-fill feature for passwords.

- Instagram could auto-detect when users struggle to log in. And they promptly sent an email to validate the login quickly.

In a podcast with Adam Mosseri (CEO of Instagram) or Mark Zuckerberg, they explain how critical this simple feature was for driving growth.

Switching emails

People may switch emails for various reasons with no intent to discontinue their subscription.

- It might be a team member that leaves the company but the rest of the team still uses the product.

- It could be that the company's domain address changes.

- It could be that the company gets acquired by a new company and emails change.

- For a more B2C use case, people change their email addresses or lose passwords.

Expired credit card

Expired credit cards are considered a hard decline. To manage hard declines, there are some ideas:

- Optimize the payment methods: Can you switch to ACH or Paypal?

- Offer backup payment methods: People might want to add a backup card if your service is critical to their business (eg, Google Collab). GPUs for AI training are billed based on how many machines are available. If your card declines, you might not get a machine. That's why many developers add backup payment methods.

- Remind users prior: People are busy, and tracking expiring credit cards can be hard to manage. You can reach out via in-product notifications, emails, or via your payment provider.

- Account updater: Stripe and Braintree have features that let you automatically update payment information for a user as they switch out credit cards. You can supplement it with retention automation tools like Churnkey.

Limit reached

Cards can come with transaction limits, either on volume or total transactions. The good thing is that this is a soft decline.

If it's a company card via Ramp or Mercury, it might come with a spending cap. Individual users can also use virtual credit cards using a native bank software like Netsafe or a 3rd party solution like Privacy.

Some companies break down charges into smaller chunks to recoup a payment. For example, if the payment is $50, they might charge $10 after the first soft decline. If you choose to do this, try to be mindful and empathetic.

Some companies will block or limit access to the account as a way to nudge people to update their cards. However, it's usually best to step into the customer's shoes.

For example, Figma will block edit access but allow view-only access.

On the other hand, Gmail / Google Photos will completely block access if a payment fails.

The downside of blocking account access is that workflow might be disturbed.

Convert Calculator, on the other hand,

- will give customers a final warning (+2 days grace period) to enter a card,

- remind them that their data won’t be deleted if they input their payment info during that grace period.

- offer a trial extension within the email. Trial extensions are possible to do automatically with Churnkey.

Compare that to Keywords Insights that promises to delete the data if payment is not made. They are up-front about it and say that data storage costs them money and they can't do it on a free tier.

The kind of blocker you add into the product via in-product notifications, emails, etc might depend on your cost to serve and goals.

Address change

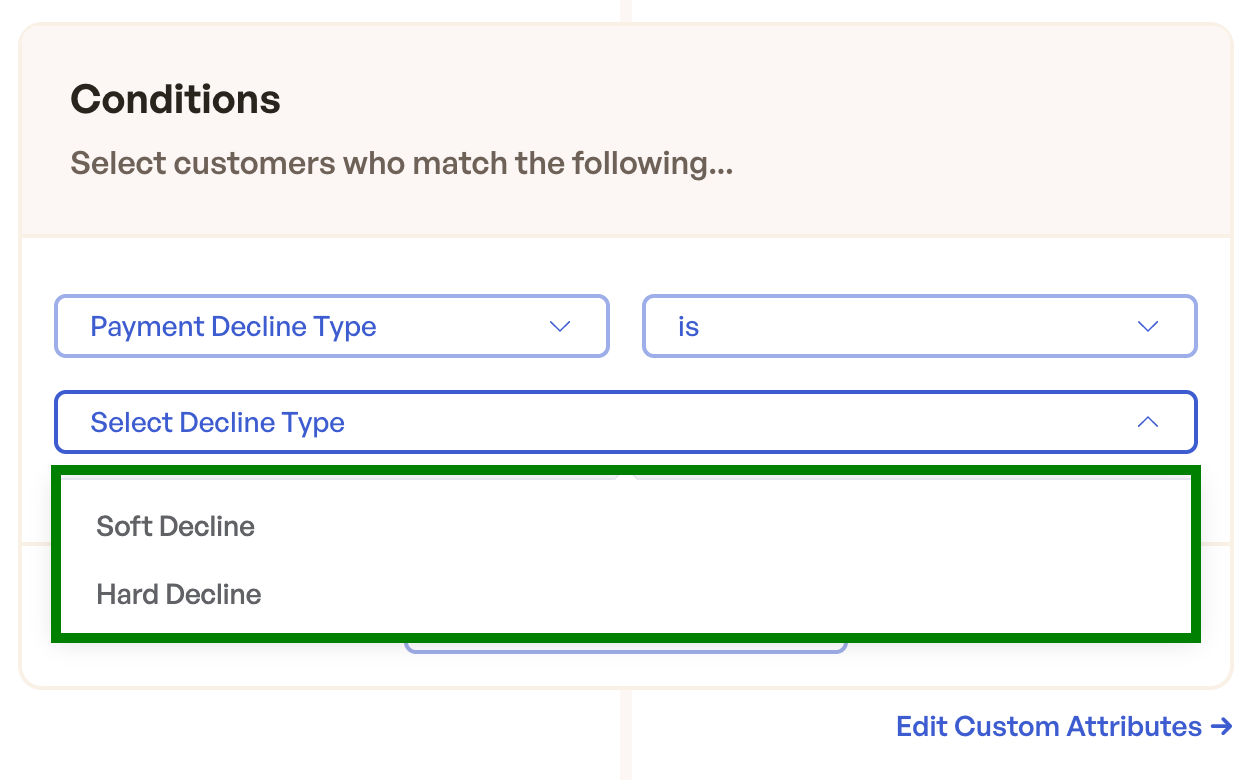

When customer's billing addresses change, banks might decline the card to prevent fraudulent transactions. In Churnkey, you can segment on the basis of the decline code type.

How to stop involuntary churn with Churnkey?

Clearly, there are a lot of ways to lose customers to involuntary churn.

But with Churnkey’s involuntary churn solutions like precision retries, recovery offers, and in-app payment recovery wall, you could recover up to 89% of failed payments.

Churnkey's reactivation feature helps you send one-off or recurring emails to users that have already churned. It offers a one-click reactivation process, unlike what your lifecycle marketing tools can offer. The email copy is also customizable, unlike the built-in failed payment recovery tool that Stripe offers. It'll help you resurrect churned users without investing too many internal resources.