How to Identify the Early Signs of Churn?

Companies that monitor early churn signals and use adequate retention tools save 20 - 40% of the revenue they would have otherwise lost to churn. Missing early churn signals costs real money, but most teams are unaware until the breakup email hits their inbox.

In this guide, we will show you which red flags matter, how to avoid panicking over normal usage dips, and how to build an early warning system that gives you a fighting chance to save the relationship. Think of this as learning to read the signs before your customer walks out the door.

Customer Churn Early Signs Timeline: The Silent Signals

Your customers are signaling their exit before it happens through dozens of tiny behavioral shifts you're probably ignoring right now.

Login Frequency Declining

The engagement fade is your earliest signal that something's breaking down in the relationship.

Watch for consistent decline patterns where login gaps keep getting wider. Someone who checked in regularly now shows up infrequently. The key is identifying when it becomes a sustained trend.

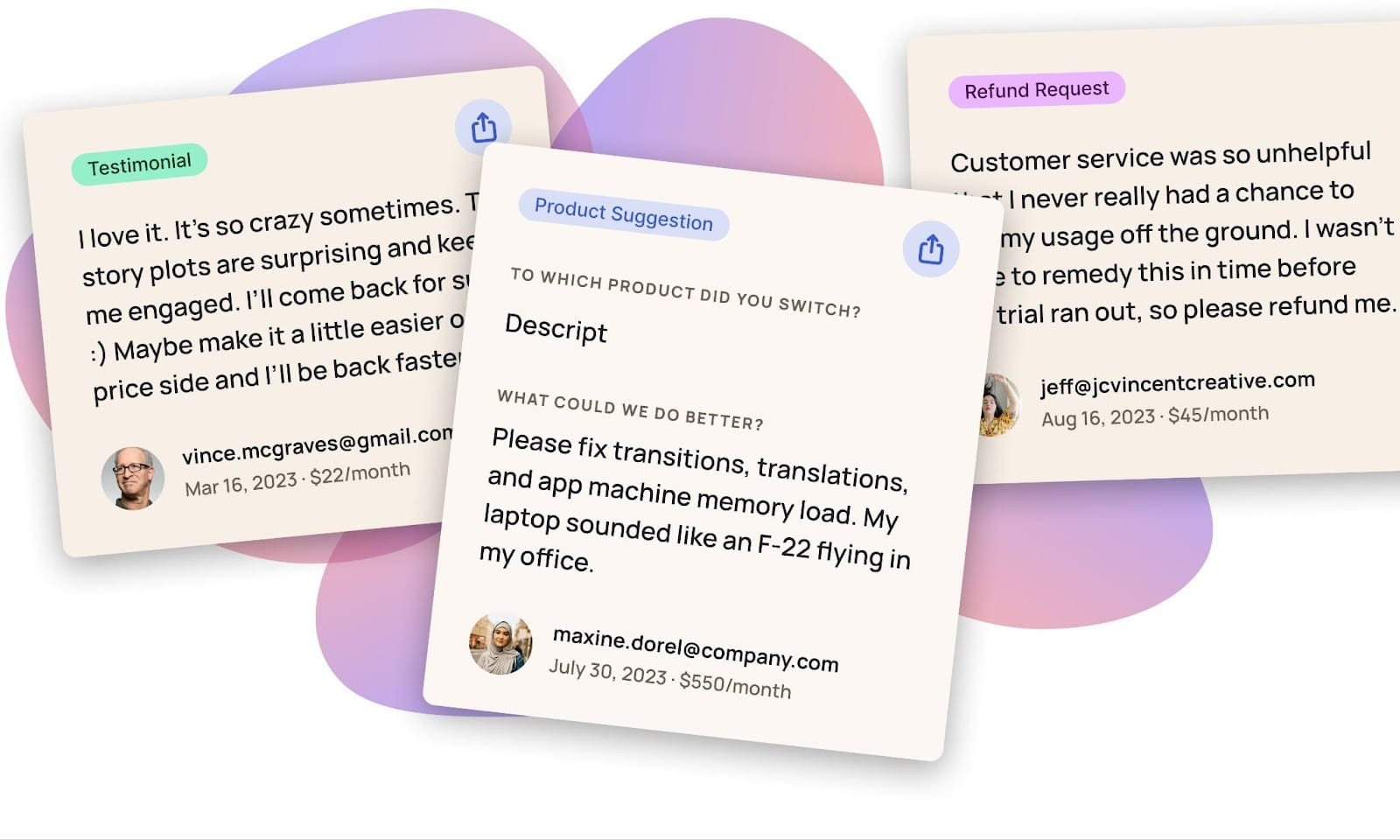

When they hit your cancel button, your exit survey will show they bailed because some feature broke or a workflow got too annoying, but they never said a word about it.

False positives to avoid: End-of-year holidays tank everyone's usage. August is a ghost month. Tax season affects login rates for half your customers if you're in finance. Someone switching from marketing to sales might stop using your tool. Daily logins make sense for Slack, but weekly is fine for expense reporting software.

The engagement pattern that signals health also varies by product type. Daily usage is critical for some B2B SaaS tools, while weekly or monthly engagement can indicate strong health for others, depending on the product's use case.

Don't panic; look for unexplained drops that are steady for weeks. Learn what healthy looks like for your type of product or your industry, then watch for deviations from that pattern.

Feature Adoption Stalling

When customers stop exploring your product and return to just the basics, you're watching them decide to cancel. Features they used every day or week go cold, the advanced capabilities you walked them through are untouched. The worst part is what we call "parking" behavior; they're doing just enough to avoid cancellation, but they've already moved on from using your tool.

Keep an eye out for workflows they got halfway through building and then ditched, or the integration features that would make their job easier but have been sitting there disconnected for months.

One thing to watch out for: don't confuse your power users with people who've checked out. Some customers do just need a handful of specific features and nail it with them. Analyze how deep they go with the features they use.

Session Duration and Depth Decreasing

Customers start treating your product like a quick check-in and not an actual work tool. Session duration and depth tell you how invested someone is in using what they're paying for.

Engaged customers dig into your product, explore features, work through full workflows, and spend meaningful time getting things done. When someone shifts to surface-level usage, either they're not finding the value anymore, they've hit too many friction points, or they're evaluating whether they need you at all.

Before you panic over a single short session, remember that "short" is relative to your product type. Some products are designed for deep, extended sessions. Others are built to be checked quickly and work in the background. The best engagement metric isn't a universal number; it's a deviation from each customer's established baseline.

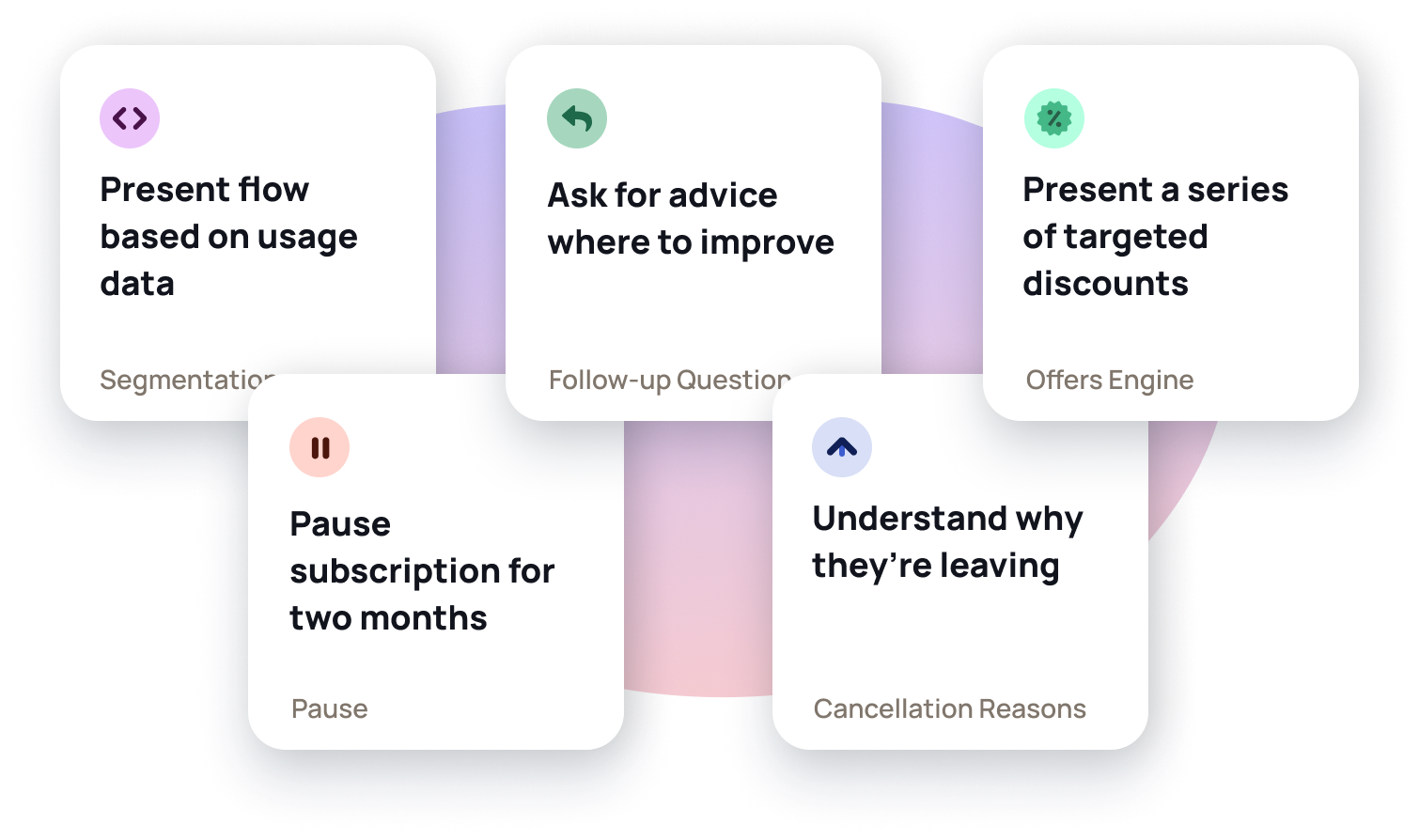

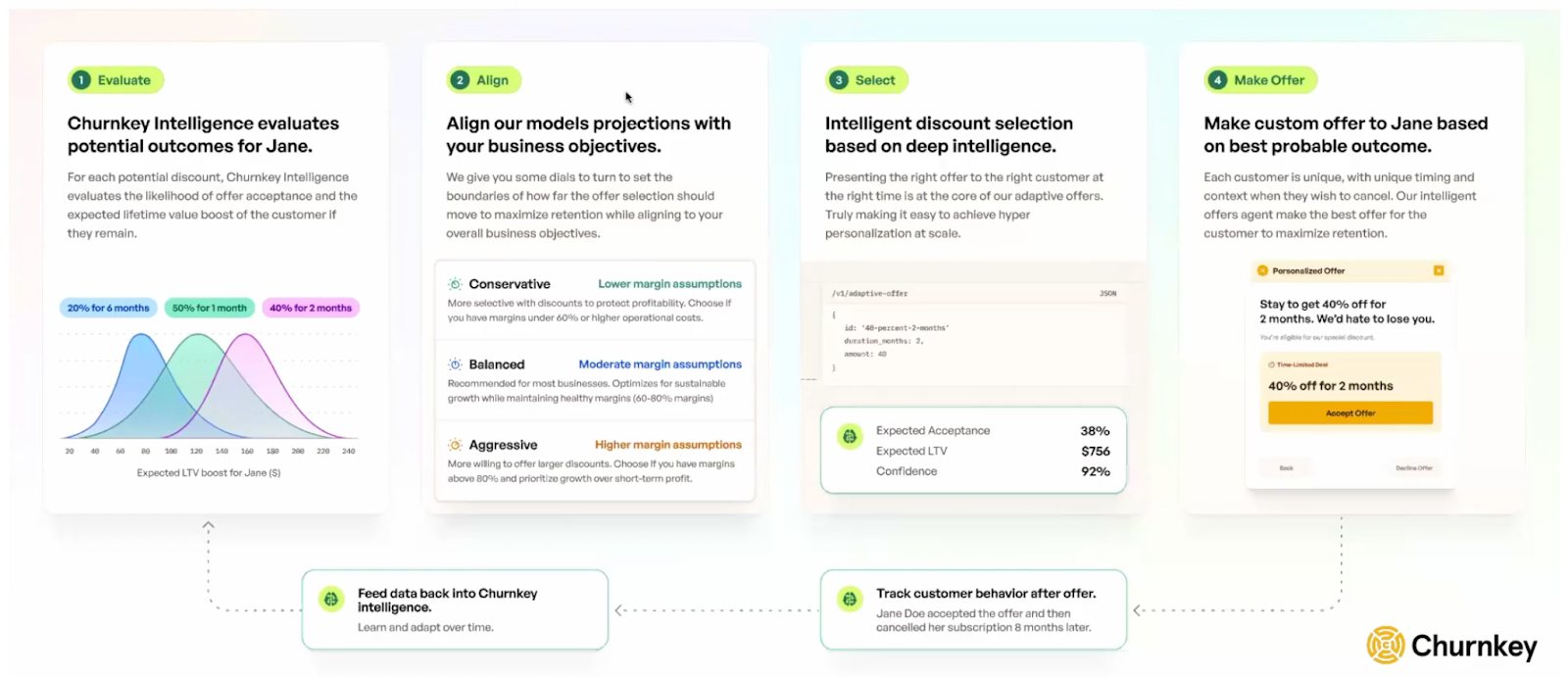

Important 💡: Churnkey's Feedback AI identifies which specific workflows canceling customers valued most, giving you the data to set thresholds around those critical actions for at-risk accounts still in your system.

Data Export Activity

When customers start downloading their data in bulk, pay attention. You'll see large CSV exports, full database downloads, or API calls that shift from creating records to just pulling everything out.

False positives to avoid: data exports aren't always bad news. Some companies run monthly backups as standard practice, others have compliance teams that require regular data audits, and plenty are just setting up new integrations that need an initial data load. A scheduled backup on the first of every month is routine.

Look at what else is happening with the account. If exports coincide with declining engagement, ghost meetings, and radio silence, you're watching an exit in progress.

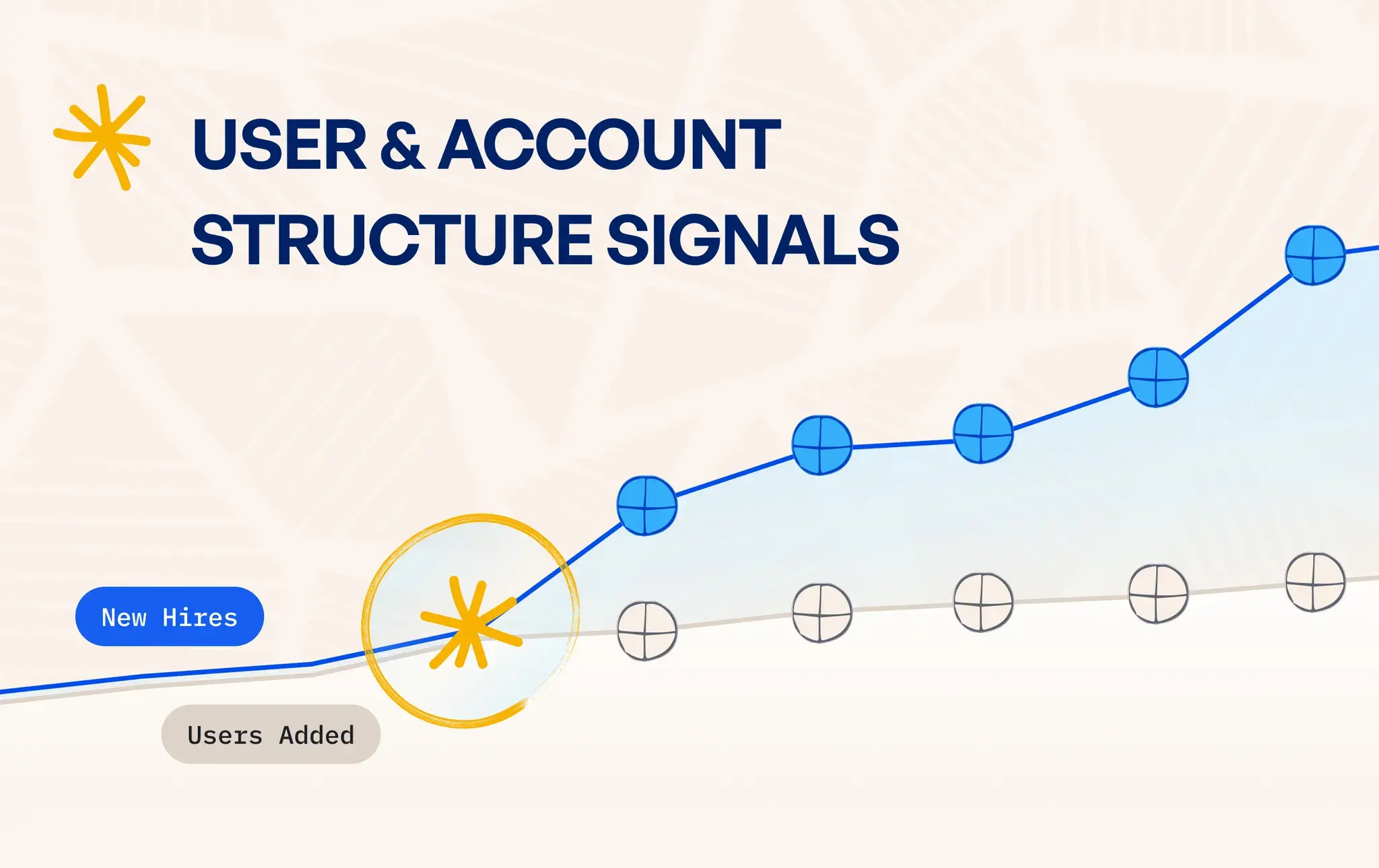

User and Account Structure Signals

The people using your product matter just as much as how they're using it, but most teams obsess over feature adoption while ignoring who's logging in. When your power user leaves the company, when seat counts start dropping (check Superhuman case study), when new hires aren't being added to the platform, these organizational shifts are some of the most reliable churn predictors you'll find.

“Churnkey helped us save more customers and learn what they actually needed from us. It changed how we approach retention entirely.” - Ben Ophoven-Baldwin, Senior Product Manager, Growth at Superhuman

The challenge is that these signals are buried in LinkedIn notifications, email bounce-backs, and CRM notes that nobody's connecting to retention risk.

Important 💡: A usage dashboard might look stable while the entire power user base rotates out, leaving you with an account full of disengaged inheritors who never chose your product in the first place.

Team Composition and Admin Changes

Your power user leaving the company is one of the most predictive churn signals you'll ever see, and it happens outside your product. When the person who bought your tool, advocated for it, and understood its value, takes a new job, you've lost your internal sales rep, and you're starting from scratch with someone who inherited a tool they didn't choose.

The new admin often sees your product as a budget they could reallocate instead of a solution they need, and unless you rebuild that relationship fast, you're looking at potential cancellation.

Set up LinkedIn alerts for your key contacts and use tools like ZoomInfo to catch job changes before customers tell you, because it is your chance to onboard their replacement and rebuild advocacy.

Seat Count Changes

Shrinking seat counts tell you how a customer feels about your product. Watch for teams cutting from several licenses down to only a couple, deactivating users, and leaving those seats empty, or dropping to whatever your minimum requirement is.

The more subtle warning sign is what doesn't happen: a company adds numerous new employees but hasn't added a single seat to your platform. That's a choice; they're deciding that new team members don't need access to your tool.

But you need to separate real warning signs from normal business changes; contractors wrapping up projects, legitimate departmental downsizing, or strategic shifts where concentrating seats among power users makes sense for how they work.

The difference is whether they're becoming more efficient or disengaging from your platform altogether. If your retention and churn data show that accounts following this contraction pattern historically churn at high rates, you've got a reliable early indicator.

New Users Onboarding

When customers stop adding new users, they're showing you that your product isn't essential to their growth. Track accounts where no one's been added for several weeks while the company is actively hiring. Their LinkedIn page and job postings will tell you if they're expanding their team.

The warning pattern looks like this: a company is actively growing its team. They hired people in departments that should be using your tool: customer success, marketing, and sales; yet none of those new hires got access.

Growing companies onboard new employees to their core tools. When your product gets skipped, you've shifted from necessary to nice-to-have. And nice-to-have tools are first on the chopping block when budgets get reviewed, or someone questions the ROI.

Customer Communication Signals

Your customers are talking to you constantly; the question is whether you're listening to what their communication patterns mean. Communication indicators are powerful because they blend direct feedback with behavioral cues: what customers say matters, but how they interact with you (or stop interacting) often tells the real story.

Track these shifts, and layer them with insights from Churnkey's Intelligence Suite to understand not just that customers are pulling away, but what's driving that disengagement while you can still address it.

Communication Dropping Off

When your main contact's response time stretches from hours to days to weeks, they start canceling your quarterly reviews, and emails go unanswered. Pay attention.

This is a problem because if you can't reach them, you can't fix whatever's going wrong. Look at how their behavior changed from the early days; they used to accept every meeting, open your emails, and engage in conversations.

One thing, though: someone can go quiet temporarily and then apologize. People get busy. The real issue is when the ghosting becomes their standard way of dealing with you.

Support Interaction Pattern Changes

Your support queue tells you who's about to leave if you're paying attention. Watch for dramatic volume shifts and tone changes. A customer who opens occasional tickets suddenly submits multiple in a short period. They start requesting manager involvement on basic issues, CC'ing their own leadership to create a paper trail, and asking for everything in writing.

Customers want commitments on roadmap items, formal documentation of issues, and explicit timelines; they're either building ammunition to leave or trying to justify staying to skeptical executives. Don't confuse this with legitimate volume spikes during product releases when everyone has questions, or when a customer onboards new team members who need help.

"I am pretty certain that [the UI update] was something we would have continued to put off again and again because we wouldn't have realized that our user interface was causing the cancellations. We've been able to gain so much insight into why users want to cancel, so we can add features or fix issues." - Davis Baer, CEO at OneUp

Competitive Mentions

When customers start bringing up your competitors, they're doing reconnaissance. The apparent signal is migration language creeping into conversations: questions about data portability, API documentation for exports, or "just curious" inquiries about contract terms and cancellation processes. These aren't theoretical; they're exploring.

How they phrase things reveals intent. Vague curiosity about "what else is out there" or "how you stack up against others" means early-stage browsing. Naming specific competitors and asking granular feature questions, like "Does your dashboard let me do X like [Company] does?", that's advanced evaluation territory.

But remember that competitive questions aren't always death knells. Engaged customers sometimes advocate for you by researching competitor claims to debunk them, or they raise features they want you to prioritize. Look for patterns; one competitor mention from an active user who responds quickly and uses your product daily is fine.

Budget and Procurement Signals

When customers start having "billing issues," you need to distinguish between innocent problems, like expired cards, accounting department delays, technical glitches, and intentional friction that signals they're mentally checking out.

The pattern that should alarm you most is the annual-to-monthly switch. Failed payments followed by plan downgrades tell you that they're evaluating whether it’s worth continuing with your subscription or not. When customers start asking about pausing subscriptions, switching to month-to-month terms, or requesting detailed contract reviews, they want to quit.

Not every billing question is a red flag; sometimes, finance just wants documentation for their audit, or they're consolidating vendors for legitimate operational reasons, but when you see multiple financial signals clustering together, treat it as a high-priority risk.

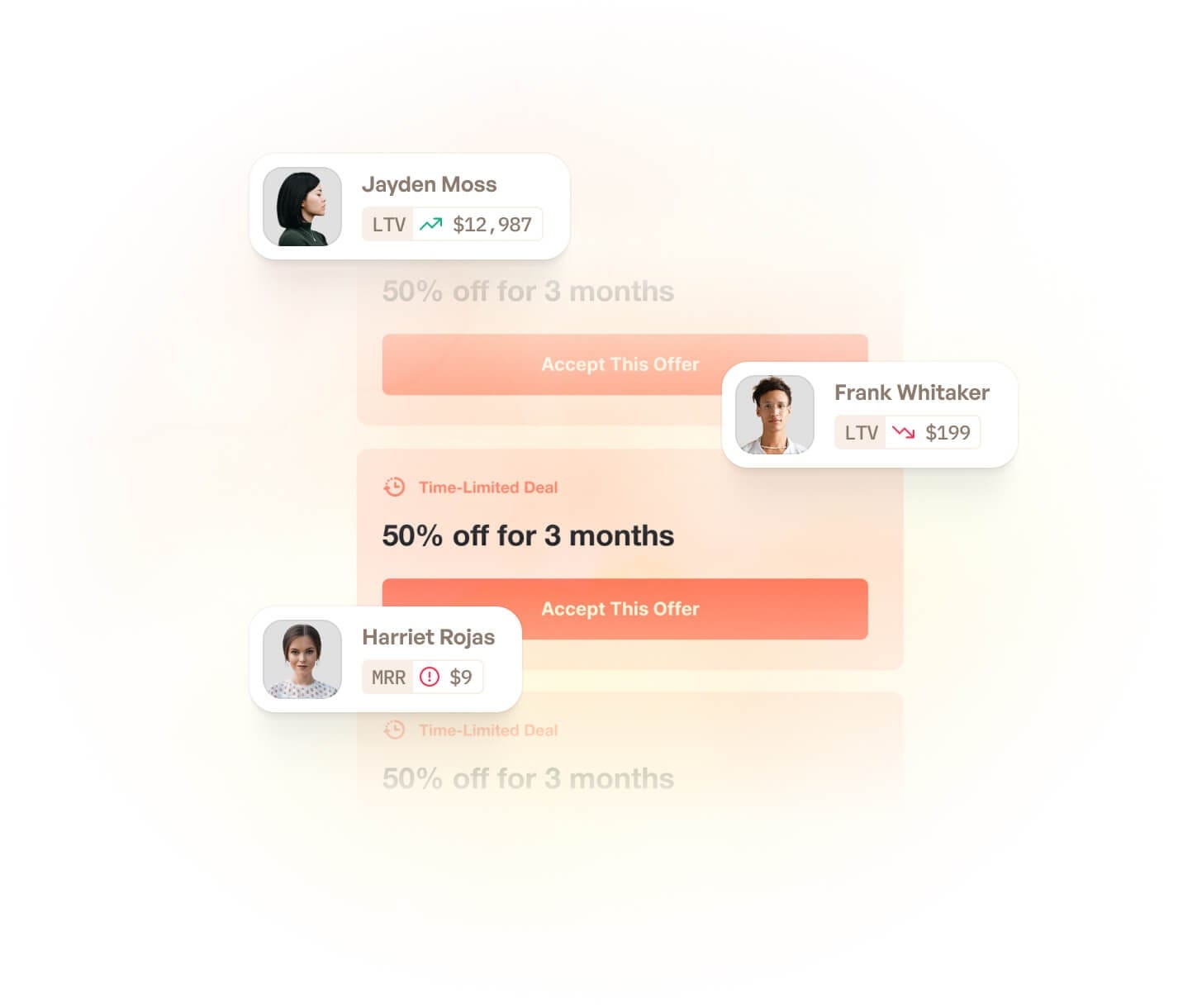

The strategic advantage lies in catching these signals early enough for an adaptive offer, before entering into reactive negotiations about price when they're already halfway out the door.

Organizational and Strategic Signals

Sometimes the biggest churn risks have nothing to do with how good your product is. Their CFO leaves. They run into money problems. They get acquired. They pivot their entire business model; what you built for them doesn't matter anymore.

The tricky part is you won't see any of this in your product analytics. You need to pay attention to what's happening at their company. Check LinkedIn when their executives change jobs. Read the press releases about layoffs or restructuring. Notice when your champion gets promoted into a different department.

Most CS teams miss this stuff because they're staring at dashboards all day. Login rates, feature adoption, and session length; none of that tells you their board just decided to cut vendor spend.

The teams that catch these signals early monitor the customer's business and their usage patterns. They see the warning signs and start the conversation before it turns into "we have to cut costs, and you're on the list."

Company and Business Model Changes

When your customer is experiencing layoffs, reorganizations, or leadership changes (a new CFO or department head), it creates churn risk that most teams catch too late. When companies face workforce reductions, mergers, acquisitions, or funding pressures, the first move is to cut vendor spend and subscriptions they're paying for.

Business model transformations hit renewal differently. Watch for ICP shifts where your customer's target audience changes, product launches that don't align with how they use your tool, or market repositioning that leaves your solution solving problems they no longer have.

The false positive trap is mistaking expansion for transformation: adding a new customer segment while keeping the core business means they still need you, but abandoning their original market means your days are numbered, regardless of product quality.

Conclusion

The churn signals are there weeks before someone cancels, you're just not looking for them yet. Start tracking usage drops, feature abandonment, support silence, team turnover, and failed payments. Build a monitoring system and check the signs weekly.

Early detection is critical, but so is what happens at the moment someone hits "cancel." That's where Churnkey helps you to understand why they're leaving and save them.