The Benefits of Dunning Offers: Improved Payment Recovery Rates & Reduced Cancellation Risk

“Churn” is an abstraction of something very real and concrete: rejection.

That's why we approach every touchpoint in your customer’s journey by remembering that there's a human behind every interaction: someone with a wakeup routine, bills to pay, who has family and friends and emotions. The net effect of this reality is that we’re always looking for more ways to empathize with your customers.

When we were looking at data across our Payment Recovery Platform, we discovered a certain segment of customers where payment recovery campaigns underperform. They’ll open the emails. Follow the “Update Card” CTA. Get to the card update form. Then...

...do nothing. Multiple times. Even with convenience-enhancing checkout options like Apple and Google Pay, even when their card details are saved in autofill.

So the net effect is that customers allow their subscriptions to lapse on purpose. And in the event that Intelligent Retries aren’t able to transition your customer’s subscription to their new card, you’ve got a customer cancelling by inaction.

Who are your "quiet cancellers?"

Anywhere from 5%-10% of involuntary cancellations can be attributed to this “Quiet Cancelling” phenomenon. From our research, we discovered some unique traits about this customer segment:

- They’re busy. Updating their payment info means tracking down their card, or authenticating with a password manager (which tends to lock you out at the worst possible time).

- They’re not superfans of your product. So they’re fine allowing their subscriptions to lapse, since the card / bank are essentially giving them permission to cancel.

- That being said, they’re still responsive to your messaging. They read your emails. Open your links. So they’re still willing to be engaged by you.

And that’s when we realized the opportunity here. Why not go above and beyond to appeal to your busy, receptive, sort-of-positive-but-not-in-love-with-you customers? Surprisingly, payment recovery campaigns can be a unique touchpoint to re-engage with them.

Enter Dunning Offers: incentives—immediate, longer-term, or both—for your customers to update their card. Partially pay an invoice, or get some relief over the next few months. By re-engaging customers like this, you’re winning time and short-term loyalty to demonstrate how valuable your product is in their lives or workflow.

Design decisions for Dunning Offers

In payment recovery, speed-to-completion is one of the key metrics for which we optimize. That means we eliminate as many unneeded steps as possible and make each, next action extremely obvious to perform.

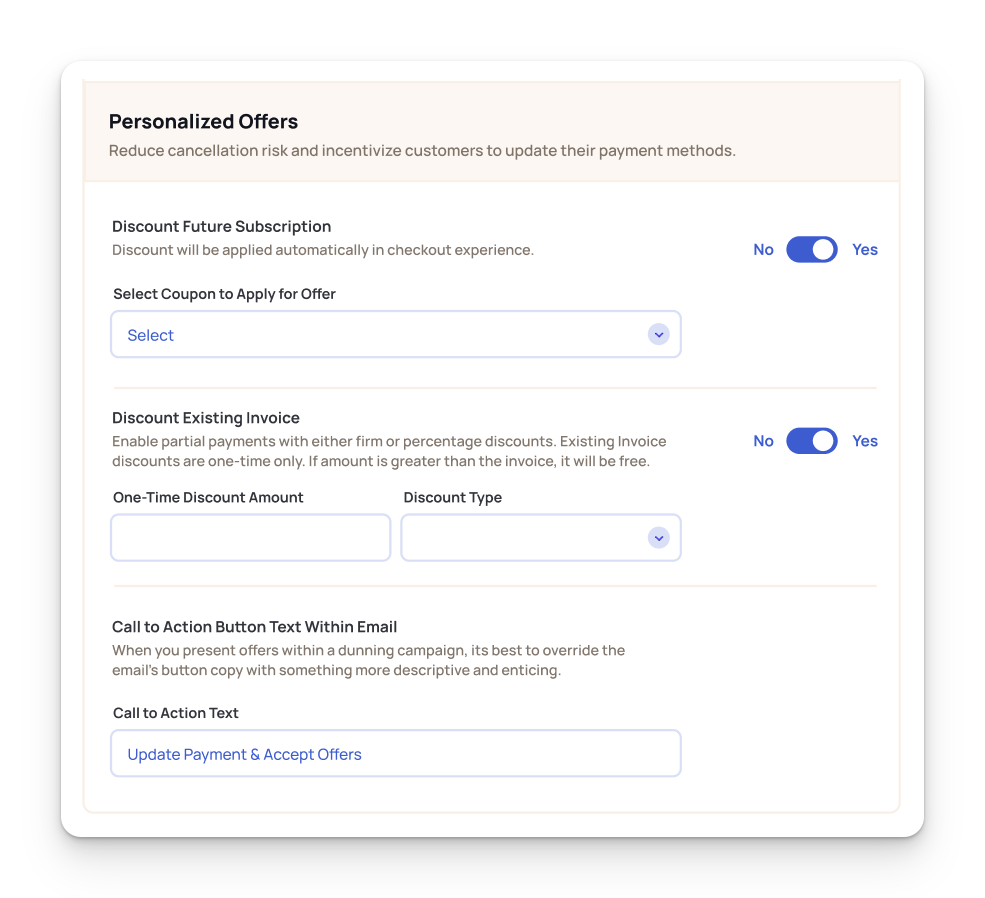

On top of that, we had to introduce a new concept to both our customers and their customers. The bare minimum requirement for this feature to succeed is insanely simple setup and deployment. Ideally, just flip a switch on part of your campaign and it goes out.

Deploying the offer

It got a little more complex, though, since our customers wanted the power to discount both current and/or future invoices:

1. Enable partial payments on past-due invoices to ease the burden for a customer in the short term.

2. Discount future payments to encourage longer-term loyalty.

That complicated the UI a bit, but I think we struck a happy balance here.

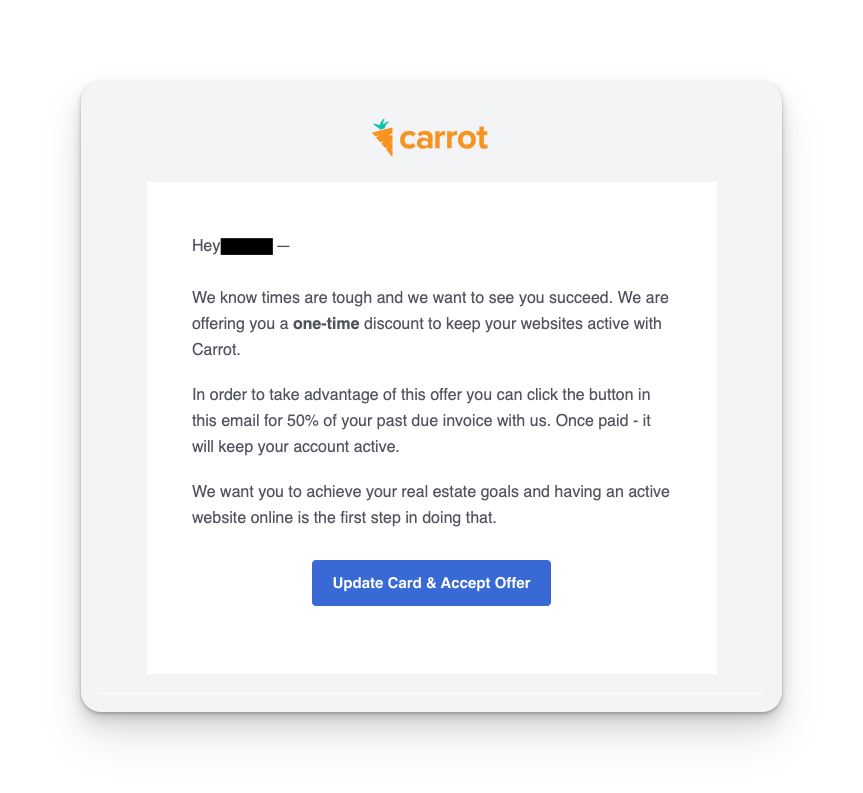

The other bit is the fact that we're dealing with written content, and can't just override the email's existing copywriting. So it's on us to educate our customers that they need to scream from the rooftops—starting with the subject line and moving to the body of the email—that there are discounts just waiting to be accepted.

One particularly fun bit is the ability to customize each email's call to action with just a simple field update. It's particularly powerful because it hammers home that their customers will be able to redeem an offer on the other side of this button.

Reinforcement through the checkout experience

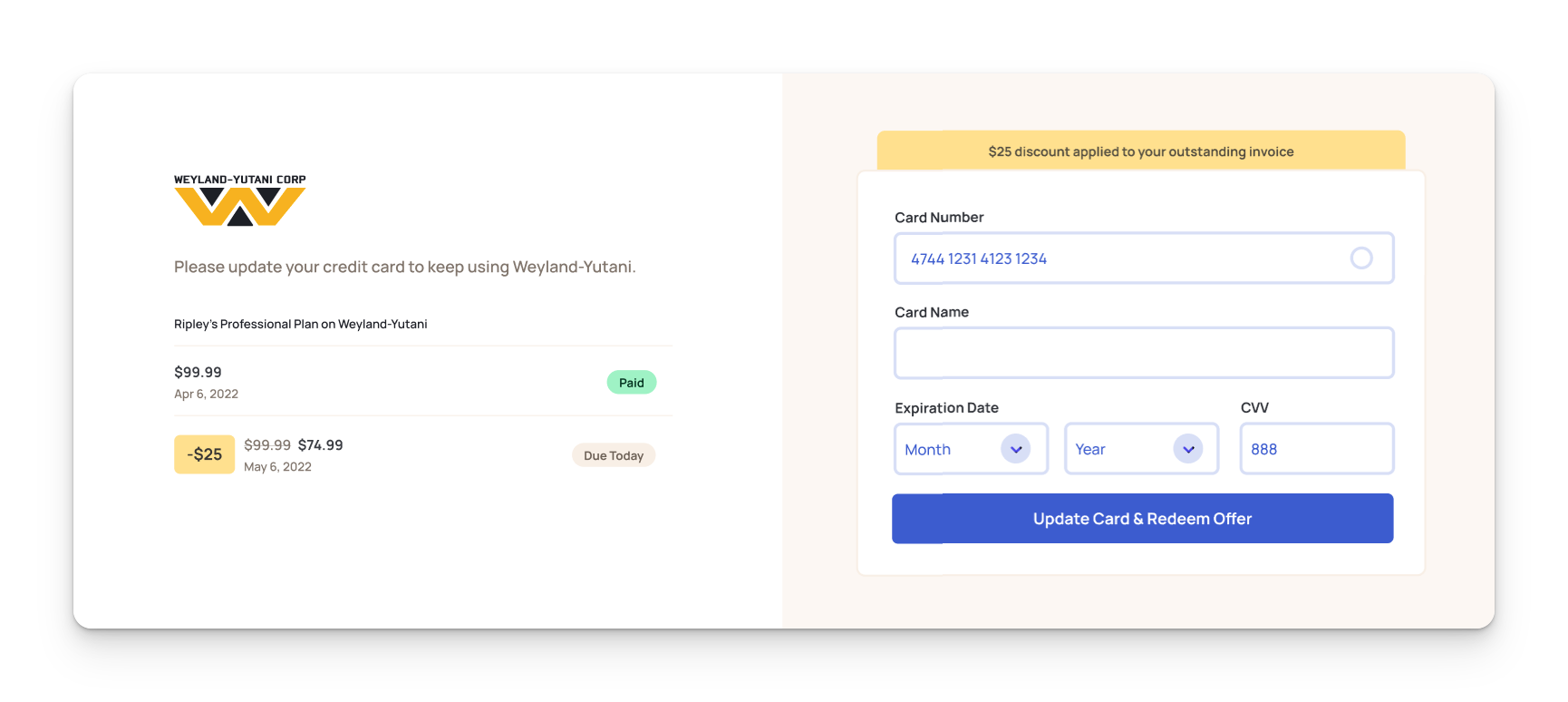

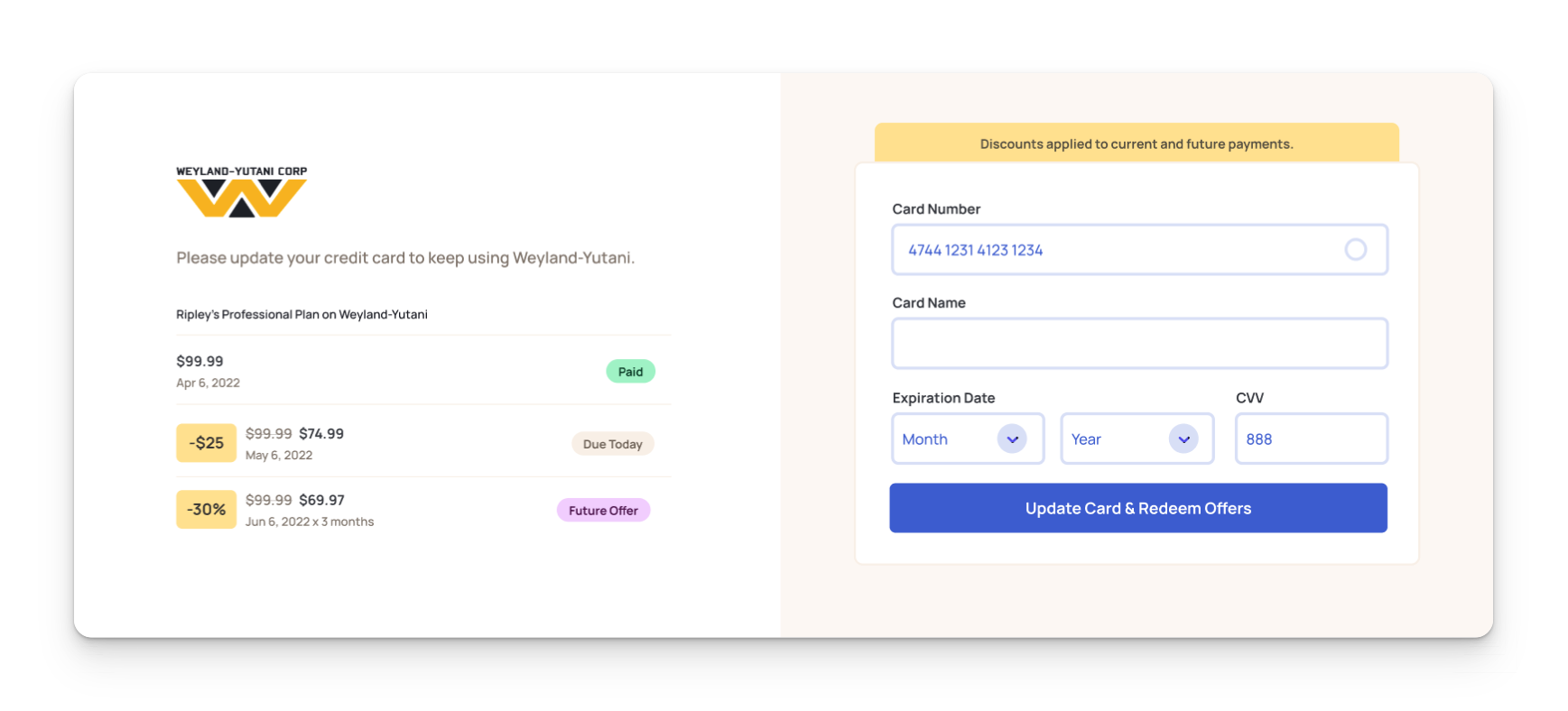

The concept of receiving a discount for updating your payment method isn't new—brick-and-mortar stores like gas stations, souveneir shops, and more will charge you less if you pay in cash or credit cards other than AMEX.

Regardless, in the context of updating one's credit card, the Dunning Offers concept needed to be reinforced.

To a customer, the fact that they're receiving a discount on their existing balance needed to be painfully obvious and reinforced with a straightforward, simple experience. There are no coupon codes to enter and no psychological games being played with countdown timers or flashing red lights. Just all tasteful upside.

In the case where an existing balance and a future invoice are going to be discounted, I realized I needed to introduce the concept of a so-called "invoice timeline" with a number of states:

- A past-due invoice

- What's due today (and how much you're saving on it)

- What you'll be charged in the future (how much you'll benefit)

Net results: more engaged customers and lower payment failures

At every billing-related touchpoint, you have a choice: introduce friction and decrease trust, or be understanding and increase empathy. We're finding that Dunning Offers extends lifetime value, causes customers to be more receptive to your communications (since you're providing value with a discount), and, ultimately, decreases your payment failure rate.

That's all for now. Stay tuned for more!