10 Customer Retention KPIs & Metrics: With Free KPI Dashboard

Understand 10 customer retention KPIs and metrics to see how well you retain your customers. Plus, explore several ways to improve them.

According to studies, increasing customer retention rates by 5% can improve profits by 25%. It's also cheaper to retain an existing customer, than to acquire a new one. In this article, view the top 10 retention KPIs and metrics to track to reduce churn.

- Customer Churn Rate

- Revenue Churn Rate

- Net Revenue Retention

- Customer Lifetime Value (LTV)

- Monthly Recurring Revenue (MRR)

- Repeat Purchase Rate

- Customer Satisfaction Score

- Word of Mouth Coefficient

- Customer Health Scores

- Daily/Monthly Active Users (DAU/MAU)

Customer retention KPI #1: Customer Churn Rate

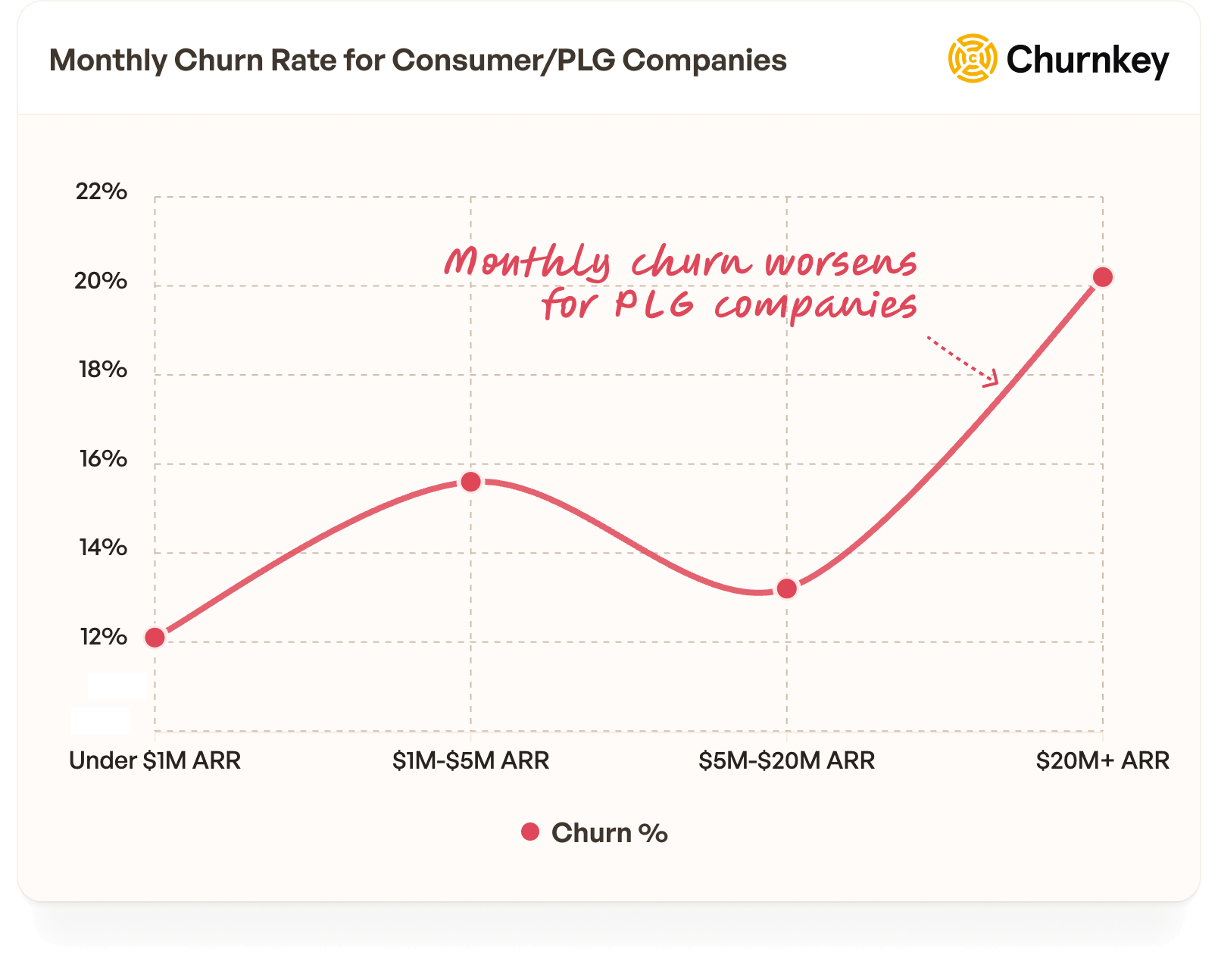

Customer churn rate measures the percentage of customers who stop using your product or service during a specific time period.

Customer churn rate formula: (Number of churned customers / Total customers at start of period) x 100 = Churn Rate %

How to improve customer churn rate

Reducing customer churn rate starts with understanding why customers leave. Here are proven strategies to lower your churn rate:

1. Implement personalized cancel flows: Create targeted offers based on cancellation reasons. By far, 50% of users leave for budget constraints according to the 2024 State of Retention report so testing with different offers for different segments can help reduce churn.

For example, if a customer selects "too expensive" as their reason for leaving, automatically offer a temporary discount or lower-tier plan. Tools like Churnkey can help automate this process and provide actionable insights.

2. Use precision retries for failed payments: Set up smart retry logic for failed payments to reduce involuntary churn. Churnkey's precision retries can recover up to 89% of failed payments automatically, without customer intervention. Typically, involuntary churn can make up between 10-30% of your customer churn and billing providers throw a host of decline codes like do not honor or insufficient funds that you can tackle with a platform like Churnkey.

3. Dunning Emails and SMS: Dunning is the process of communicating with customers and trying to collect payment when their automatic payments fail. The goal is to keep the service running and fix the payment issue without making customers feel bad.

Start with friendly reminders and gradually move to more urgent notifications. This might look like an email sequence or SMS campaign that begins with a gentle nudge and escalates to a more pressing message if the payment issue isn't resolved.

Use straightforward language to explain the problem and resolution steps. Avoid jargon that may confuse customers.

If your product supports multiple seats or roles, payment recovery campaigns can get tricky. Who's the right person to contact? Should you loop in multiple people? How does that even work? With Churnkey's Billing Contacts API, Churnkey can solve this for you.

4. Monitor customer health scores: Track usage patterns and engagement metrics to identify at-risk customers before they churn.

5. Improve customer onboarding: Create a structured onboarding process that helps customers reach their "aha moment" quickly. This includes:

- Ungated product that requires no sign in

- Onboarding profiling to customize experience

- Less friction if product is intuitive, more good friction if not

6. Offer pauses: The second biggest reason why users churn according to Churnkey's State of Retention report is 'infrequent usage'. Enable subscription pauses for up to twelve weeks with Churnkey. It works out of the box after you connect your billing provider.

Customer retention KPI #2: Revenue Churn Rate

Revenue churn is the loss of revenue from existing customers over a specific period. It includes cancellations, downgrades, or non-renewals.

There are two types of revenue churn: net revenue churn and gross revenue churn.

Gross Revenue Churn = Revenue Lost from Churned Customers

Net Revenue Churn = Revenue Lost from Churned Customers - Revenue Gained from Expansions from Existing Customers

Learn more here.

How to improve revenue churn rate

- Detect accounts who were cancelled due to overdue payments and block access using Churnkey.

- Direct these customers to update their cards inline.

Customer retention KPI #3: Net Revenue Retention

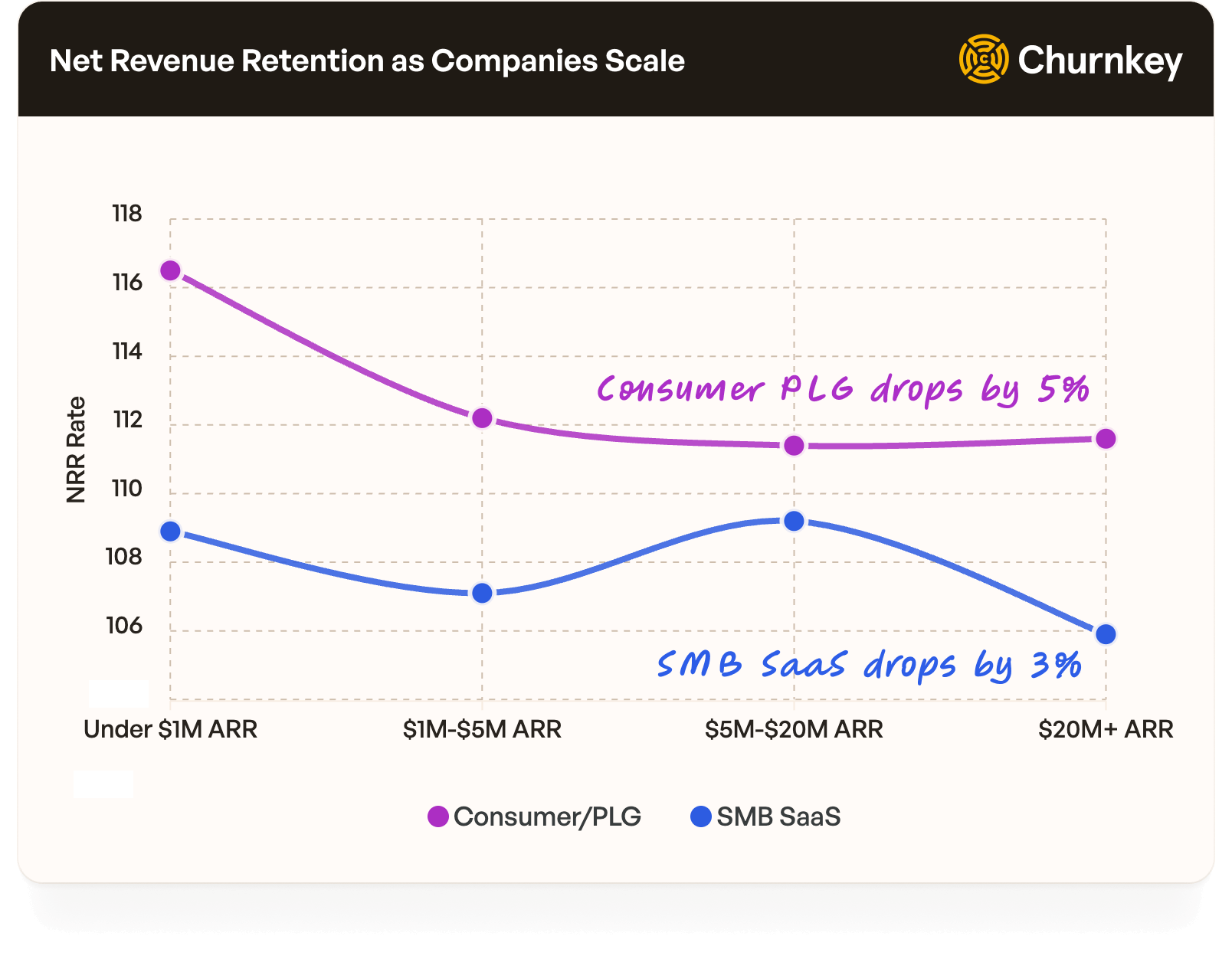

Net revenue retention measures the total change in recurring revenue from existing customers, including expansions, downgrades, and churn. It shows whether your existing customer base is growing or shrinking in terms of revenue.

Net revenue retention formula: ((End of Period Revenue - New Revenue) / Beginning of Period Revenue) x 100 = NRR %

A net revenue retention rate above 100% indicates your existing customers are spending more money over time, while below 100% means you're losing revenue from your existing base. Best-in-class SaaS companies often see NRR above 120%.

To calculate net revenue retention, take your total revenue at the end of the period, subtract any new revenue from new customers acquired during that period, and divide by the revenue at the start of the period. For example, if you started with $100k MRR, ended with $130k MRR, but $20k came from new customers, your NRR would be 110%.

How to improve revenue retention rate

1. Create clear expansion paths: Design your pricing and packaging to encourage natural account growth. You can explore tools like Pocus and Endgame to identify accounts that are hitting limits.

2. Use retention automation tools: Use tools like Churnkey to increase both gross and net revenue retention.

3. Build customer success programs: Proactively help customers achieve their goals. A newer tool on the market is Command AI.

4. Develop complementary features: Build features that naturally drive expansion. For example, Bumble for Work or Zillow Zestimate.

5. Focus on product adoption: Drive deeper usage of key features by measuring data in a product analytics tool like Posthog, Mixpanel or Amplitude.

Customer retention KPI #4: Customer Lifetime Value (LTV)

Customer lifetime value measures the total revenue you can expect from a customer over their entire relationship with your business. It's not a perfect science.

There are 4 ways to calculate LTV. One way is this: LTV = Average Revenue Per User / Churn Rate

A higher LTV indicates stronger customer relationships and better unit economics. According to industry benchmarks, a healthy LTV:CAC ratio should be at least 3:1, meaning you earn 3x what you spend to acquire a customer.

To calculate customer lifetime value, divide your average revenue per user by your churn rate. For example, if your ARPU is $100 and your monthly churn rate is 5%, your LTV would be $2,000. Alternatively, use our free LTV calculator.

How to improve customer lifetime value

Here are proven strategies to increase your customer lifetime value:

1. Increase average revenue per user: by implementing tiered pricing strategies, increase feature usage, and upsell monthly to annual users.

2. Reduce churn rate: Reducing churn by just 1% can increase LTV by 10-30%. Implement personalized cancel flows, use precision retries for failed payments, set up effective dunning campaigns, and offer subscription pauses instead of cancellations.

3. Improve customer engagement: Send personalized communications and offer loyalty programs

4. Optimize pricing strategy: Use data from Churnkey's cancel flows to understand price sensitivity and test different price points that maximize LTV. You can also run Van Westendorp / Conjoint analysis to test sensitivity.

Customer retention KPI #5: Monthly Recurring Revenue (MRR)

Monthly recurring revenue measures the amount of recurring revenue from customers in a given month.

Simple MRR Formula:

MRR = Total Number of Active Customers × Average Revenue per Customer

MRR churn formula: (MRR at start of month - MRR at end of month from existing customers) / MRR at start of month x 100 =

A growing MRR indicates business health. However, it's important to break MRR into its components:

- New MRR (from new customers)

- Expansion MRR (from existing customers upgrading)

- Contraction MRR (from downgrades)

- Churned MRR (from cancellations)

How to improve MRR

1. Upsell and Cross-sell: Introduce higher-tier plans or additional features that provide more value to your customers. Example: ChatGPT's new $200/Pro tier. or Figma's Enterprise tier with SSO.

2. Reduce Churn: Focus on understanding why customers leave and address those pain points with Churnkey. With Churnkey, companies save 20-40% of the revenue they would have otherwise lost to churn.

3. Expand Customer Base: Increase your customer acquisition efforts. This might involve refining your marketing strategies, optimizing your sales funnel, or exploring new channels to reach potential customers.

Customer retention KPI #6: Repeat Purchase Rate

Minimalist, a skincare brand, was acquired for an all-cash deal of $350 million dollars by Hindustan Unilever barely five years after its inception. The repeat purchase rate for Minimalist is a competitive industry was 60%. Subscription companies have higher repeat purchase rates built in.

Repeat purchase rate = Returning customers / All customers * 100

How to improve repeat purchase rate

1. Aim to be a sticky product: some products have a natural end use case. For example, wedding gift registry. Some products have a high repeat rate, such as an accounting software. When building new features, try to gut-check whether someone will need it once or continuously.

2. Read exit survey freeform feedback: Investigate feedback from churning customers or customers that cancel their free trial to better understand why they churn. Then, prioritize them by impact on MRR and build them out. You can use Churnkey's Feedback AI for this.

3. Offer a subscription option: If applicable, consider offering subscription options for products that customers regularly purchase. This not only secures repeat purchases but also provides predictable revenue. Many ecommerce/DTC companies will offer a discount if you subscribe.

4. Upsells/Expansion packs: Many games have expansion packs. Exploding Kittens is a card game. They created expansion packs that let fans repeat a purchase, which is traditionally not possible in card games.

5. Offer freebies post-purchase: The simplest and most cost-effective way to delight customers is by offering a freebie post-purchase. This replaces the pain of spending with a sense of joy. In South Korea, beauty shops provide numerous free samples with every purchase. When I lived in France, beauty shops not only handed out plenty of samples in person but also mailed me additional ones later which was a bit extreme. It worked. On my return, I believe I bought 20 bottles of the same product. 😅

Customer retention KPI #7: Customer Satisfaction Score

Customer satisfaction score measures how satisfied customers are with your product, service, or specific interactions. It's typically measured on a 1-5 scale where 5 means "very satisfied" and 1 means "very unsatisfied."

CSAT formula: (Number of satisfied customers / Total number of survey responses) x 100 = CSAT %

A good CSAT score varies by industry, but generally scores above 75% are considered good, while above 85% is excellent. According to industry benchmarks, SaaS companies average around 78% CSAT.

How to improve CSAT

Here are proven strategies to increase your customer satisfaction score:

1. Improve response times: Set up efficient support workflows, use automated responses for common issues, and ensure quick resolution times.

2. Gather bug reports and feedbacks easily: Make it easy for people to report bugs or share feedback by using a tool like Userback or Usersnap. It captures console data and a video recording. We use these tools at Churnkey.

Customer retention KPI #8: Word of Mouth Coefficient

Instead of the net promoter score, Word of Mouth coefficient measures actuals vs what the customer says they'd do. It's also a stable enough metric to use in forecasts.

It's calculated as New Organic Users divided by the sum of returning users plus non organic new users.

You can follow the simulator in Vexpower or the guide in Reforge. In my experience, WoM is a great metric to report to investors on.

How to improve word of mouth coefficient

Ultimately, if a customer is willing to refer organically, there is a high chance they'll retain. To improve word of mouth

1. Make an incredible offer: You can either be the cheapest or the best or both. When Apple launched, they were the first to come up with a touchscreen. When Jio launched in India with their internet cable, they were the cheapest. Twitter's team mentioned that India saw explosive growth after data was essentially free for the entire country.

2. Give people something to talk about: whether that's via a personalized campaign like Spotify Wrapped or like Lemonade's Giveback campaign which is semi-personalized.

Customer retention KPI #9: Customer Health Scores

How does your customer health translate into revenue? How much of your monthly revenue is at risk of churning? Measuring the health of your subscriber base is a great retention KPI to track.

How to improve customer health

Once you have Customer Health up and running, its effects can be felt throughout your account. Here are some immediate, practical examples:

- Cancel Flow personalization: imagine the power here. Forget about accounting for specific price points, plans, lifetime value, etc. Just use customer health to break cancel flow experiences into Low, Medium, and High Risk segments, then create offers that align to each health profile.

- Customer Success prioritization: customer success platforms have become a game of "whack-a-mole," just with less personality. You can simplify the jobs of teams whose purpose it is to stay on top of customer happiness. Now, you'll be able to sift through Low, Medium, and High Risk customer lists and let that inform everything from support to proactive engagement.

- Campaign targeting: if you want to conduct sentiment-driven marketing campaigns, you can export your Customer Health lists and target Low, Medium, and High Risk customers with different messages, offers, plans, etc

Customer retention KPI #10: Daily/Monthly Active Users (DAU/MAU)

Daily/Monthly Active Users measures the number of unique users who engage with your product on a daily or monthly basis. The DAU/MAU ratio, also known as the "stickiness ratio," indicates how frequently users return to your product.

DAU/MAU formula: (Daily Active Users / Monthly Active Users) x 100 = Stickiness Ratio %

A good DAU/MAU ratio varies by product type. Social media apps often see 50%+ while B2B SaaS might target 20%. For example, if you have 1,000 MAU and 200 DAU, your stickiness ratio is 20%, meaning one-fifth of your monthly users engage daily.

How to improve DAU/MAU

Here are proven strategies to increase your active user metrics:

1. Define clear activation metrics: Identify key actions that indicate true product engagement and build features around these core behaviors. So, a simple signup might not qualify as an active user.

2. Increase product stickiness: Create daily use cases, implement habit-forming features, and build collaborative tools that require regular engagement.

3. Drive user engagement: Send targeted notifications, create engagement loops, and gamify key product features.

4. Optimize user experience: Reduce friction in common workflows, improve load times, and make the interface intuitive.

5. Monitor usage patterns: Use analytics to identify when and why users drop off, then implement retention hooks at these points. Measure feature usage rates.

Customer retention KPIs: FAQs

What is customer retention?

Customer retention is how long your customers stay with you. It's a measure of your product's stickiness. The higher the retention rate, the better it is for your bottom line.

What are customer retention key performance indicators in SaaS?

Net dollar retention, customer and revenue churn rates, word of mouth coefficient are some of the key performance indicators when it comes to churn.

Measuring customer retention KPIs helps you keep a pulse on your business.

Why is tracking customer retention KPIs important?

For subscription businesses, retention offers a predictable and sustainable source of revenue. For non-subscription companies, it offers repeat purchase rates in a given frequency (eg, one product every X months). Retention decides whether you've found product-market-fit, have found market-channel fits, and are maximizing the revenue potential from customers.

How Churnkey can help improve your customer retention metrics and KPIs?

We're everything your customer-obsessed team needs to improve retention, automatically.

You know churn is a problem—especially in this economy—but where do you even start? Juggling product releases and growth is hard enough. And then there's retention, which requires so many different disciplines to improve, it's left as a nebulous priority with no clear owner.

What if improving retention was handled for you? With the right churn management software, you'd boost your company's profitability, keep customers around longer, and demystify the reasons why people leave your product. So if you want to run a healthier subscription business, let's begin. We're already protecting over two billion dollars in ARR.

1. Cancellation Flows:

Lower your cancellations, make customers happier, drive more revenue. Use the best cancel flow in the business and reduce active churn up to 54%.

2. Payment Retries:

Churnkey's Precision Retries recover maximum revenue from failed payments while preserving your hard-earned reputation.

3. Reactivation and Winback Campaigns:

Win back up to 34% of former customers through timed, personalized, and targeted offers. Leverage our one-click reactivation campaigns to maximize revenue potential.

4. Customer Health:

Be more strategic with your team's time: know when to engage your best customers, predict at-risk revenue, and track trends in feedback. Done for you automatically.

5. AI Feedback Analysis:

Get endless product ideas without having to hire a team of data scientists. Make our Insights AI and years of customer data analysis work for your team, saving you time and informing your product decisions.

Charts